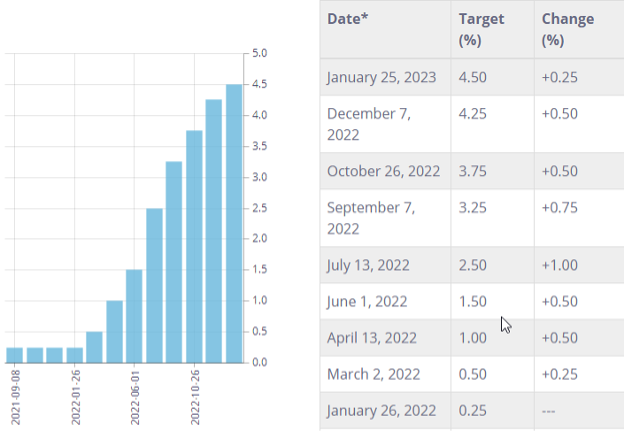

The market conditions experienced in 2022 were far from perfect for bond investors. Rising interest rates put pressure on the returns of fixed-income investments, and this trend has continued into 2023 with the Bank of Canada announcing its 8th consecutive interest rate hike on January 25. This most recent hike pins the targeted overnight rate at 4.5%, a level not seen since before the 2008 Global Financial Crisis.

Bank of Canada Policy Interest Rate History

Source: Bank of Canada

Rate conditions have been reflected in almost all bond investments. Take for instance, the largest bond ETF (by AUM) in Canada—the BMO (TSX:BMO) Aggregate Bond Index ETF (ZAG). Since the start of 2022, ZAG has returned -12%; which is a painful return for one of the “safest” asset classes.

However, as highlighted in a recent article by NEO writer, Tony Dong, some active ETFs have been able to outperform in these uncertain conditions.

Active bond investing explained

Active investing means taking an “active” view that differs from a benchmark index. If a benchmark holds bonds A, B and C at 33% each, an active investor could hold A, B and C at differing weights in an attempt to outperform the benchmark.

While this results in higher fees, more rapid turnover and greater transaction costs due to the hiring of a fund manager and investment team to manage the portfolio; theoretically, active bond ETFs could provide excess returns. This isn’t always the case, especially in a low-rate environment where most bond investments perform well. However, market conditions have been tightening for more than a year, opening the door for active bond investors to find increasingly attractive investment opportunities.

Why is active bond investing looking attractive

When market conditions are all well and good, passive investing can truck along and provide comfortable returns for investors. But in times of uncertainty and heightened volatility active investors are often more appreciated.

Passive bond ETFs (like ZAG) hold a range of bonds with different characteristics (e.g., differing coupon rates and a range of maturity dates). However, an active bond ETF can position its portfolio holdings into bonds that maintain characteristics that would outperform in a rising rate environment.

The bottom line is that by using their skill and insights, active bond investors have the potential to outperform their passive counterparts. And as 2023 looks set for more uncertainty - with the threat of a potential recession looming over the Canadian economy – the increased flexibility of active bond ETFs is ever more attractive.

Active bond ETF examples

Examples of active bond ETFs that Canadians can utilize in 2023 are as follows:

CI First Asset High Interest Savings ETF (CSAV)

An active ETF for those on the lower side of risk tolerance, CSAV is an ETF by CI Financial (TSX:CIX) which seeks higher yields on cash balances by actively managing a portfolio of short-term government bonds. This ETF is suitable for low-risk investors who want to preserve capital and receive monthly income. Since its inception in 2019, the bond ETF has returned around 5%, and gained value throughout the painful period of 2022 which hurt most bond investors.

- AUM: $5.8 billion

- Expense Ratio: 0.15%

- 1mo Performance: +0.4%

Horizons Active Ultra-Short Term Investment Grade Bond ETF (HFR)

On the corporate bond side of things, HFR is a high-grade corporate bond ETF by Horizons which is designed to pay a higher yield as interest rates rise. The aim of this ETF is to be insulated from interest rate fluctuations, making it an ideal candidate for investors expecting interest rate volatility to continue. While this ETF is less liquid than other options, it does provide a higher return potential.

- AUM: $426 million

- Expense Ratio: 0.47%

- 1mo Performance: +0.5%

NBI High Yield Bond ETF (NHYB)

At the highest end of the risk spectrum, we have NHYB, an ETF by National Bank which actively invests in high-yield debt securities. This ETF is focused on identifying and holding U.S. high-yield bonds (98.6% of holdings) which are expected to outperform. While not the greatest of track records, having been launched in March 2020 at the start of the Covid-19 pandemic, NHYB provides greater upside potential, while still maintaining a steady stream of income.

- AUM: $1.05 billion

- Expense Ratio: 0.69%

- 1mo Performance: +1.4%

Data as of January 25, 2023

This content was originally published by our partners at the Canadian ETF Marketplace.