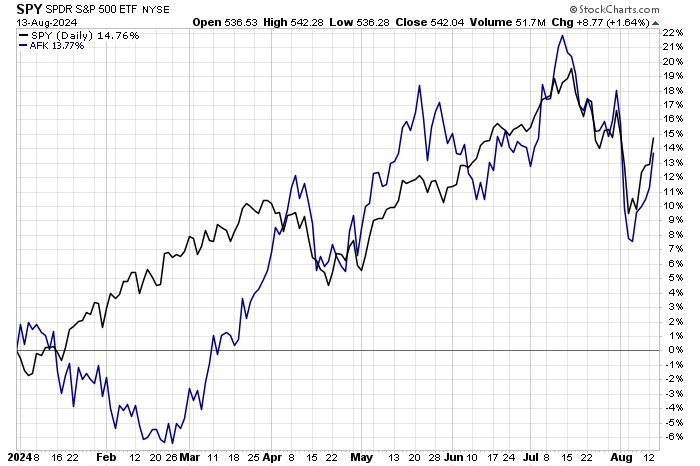

Betting against the US stock market has been a losing trade in relative terms in recent years and from a top-down down perspective it’s not obvious that’s about to change. But carving up the global market into regional slices highlights a rally in African stocks that may be set to give US shares a run for their money, based on a set of ETFs.

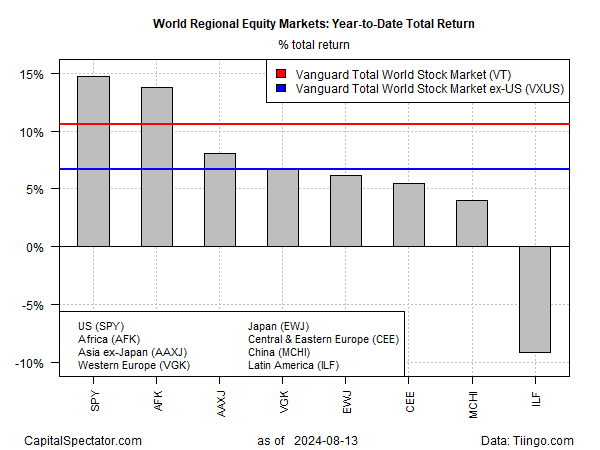

American stocks are still the year-to-date leader so far in 2024 via S&P 500 (NYSE:SPY), but VanEck Africa (NYSE:AFK) is nipping at its heels. SPY closed on Tuesday (Aug. 13) with a 14.8% gain so far this year, which is only modestly ahead of AFK’s 13.8% rally. On both counts, the gains are comfortably ahead of a global equities benchmark, based on Vanguard Total World Stock Index Fund (NYSE:VT), which is up 10.6%.

AFK’s effort to grab the performance crown this year marks a stunning recovery for the formerly sinking fund. In 2023, AFK lost more than 12%, which translates to a steep run of underperformance vs. SPY’s stellar 26% rally last year.

AFK, despite its pan-African mandate, is heavily weighted in South African stocks, which comprise roughly 40% of assets, according to Van Eck. From a sector allocation perspective, financials and materials dominate with a roughly 60% weight. The fund, in short, offers a particular bet on the continent’s shares. But so far this year, that bet is paying off, fueled by the recent tailwind in South Africa stocks.

What accounts for the change in sentiment? A weaker US dollar helps. All else equal, a softer greenback supports prices for offshore assets generally after translating foreign currencies into dollars. Although the US Dollar Index is up about 1.4% this year, it’s well below its 2024 and roughly 10% below its 2022 peak.

Another positive factor is the return of relative political stability in South Africa after elections six weeks ago. JPMorgan (NYSE:JPM) recently upgraded South Africa to “overweight”, predicting that investment will increase now that a degree of political calm has arrived.

Bloomberg reports: “South Africa’s new business-friendly coalition government signaled that its foreign policy will be focused on furthering the nation’s economic interests, a shift that could help mend rifts with Western countries that rank among its largest trading partners.”

The revival of leadership of foreign stocks over American shares has been a hardy perennial for some strategists in recent years, but so far the forecast has fallen flat. But if a regime shift is brewing, perhaps it will begin with leadership in Africa.