I recently started tracking Airbnb (NASDAQ:ABNB) and noticed its stock price is currently $122.86, ~14% below its listing price. Since its listing in 2021, the company has generated a good amount of free cash flow, improved its operating margins by controlling its general and administrative costs, and increased its topline. This drew my attention to further analyze the company and dig deeper into its nooks and crannies.

So, what exactly does Airbnb do, and how does it generate revenue?Airbnb is a global technological platform that connects travelers seeking unique accommodations with hosts offering their properties for rent. Airbnb facilitates short-term stays (1 to 5 days) and extended stays (over a month) through its website and app. The company also offers Experiences, which are local activities that host or community members lead. Since its inception, the platform has over 8 million active listings and has served more than 2 billion guests. Airbnb has a very resilient business model as it does not own any property listed on the platform (asset-light) and has a presence in different geographies worldwide.

Airbnb generates revenue by charging both hosts and guests, reducing its reliance on a single revenue stream. Guests are charged a service fee ranging from 6% to 12% of the booking subtotal, based on the length of the stay and location. Hosts are charged a service fee of around 3% of the booking subtotal. The company also charges a percentage for experiences hosted by locals.

How was the recent quarter performance?

Airbnb's revenue in Q4 2024 increased by 12% year over year to $2.5 billion, driven by the growth in nights and experiences booked and a modest increase in Average Daily Rate (ADR). Furthermore, Airbnb's monetization efforts, such as expanded guest travel insurance and additional service fees for cross-currency bookings, benefited the topline. ADR in Q4 was $158, up 1% year over year, driven by price appreciation. Total nights booked through app bookings increased to 60% in Q4 compared to 55% in the same quarter of the previous year. Despite the top-line growth, the EBITDA margins declined by 200 bps year over year to 31% due to investments in sales and marketing and product development. The nights and experiences booked increased by 12% year over year to 111 million, with December showing the highest booking in 2024. The Gross Booking (NASDAQ:BKNG) Value (GBV) increased by 13% yoy to $17.6 billion. Airbnb generated $458 million of free cash flow in Q4 and $4.5 billion for the full year, a 40% free cash flow margin. The company had $10.6 billion in corporate cash and investments at the end of the year.

Airbnb's Financial performance

Created by Warp Analysis using data from Airbnb

Created by Warp Analysis using data from Airbnb

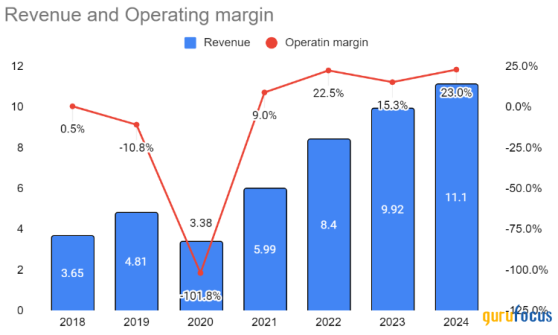

Airbnb's topline has grown at a CAGR of 18% over the last five years, whereas its margins have improved from negative to 23% as of 2024. The company's Gross Booking Value (GBV) grew at a CAGR of 16.6% from $37.96 billion to $81.78 billion, the Average Daily Rate (ADR) grew from $116.1 to $166, and the take rate increased by 90 bps from 12.7% to 13.6% during the same period. The growth was driven by continuous product innovation, expansion of host communities and listings, entering into new geographies, and an additional fee for cross-currency transactions. In 2021 alone, the company released over 150 upgrades, including streamlined onboarding processes, flexible-date search tools for guests, AirCover for enhanced protection, and dedicated SuperHost support. By the end of 2024, Airbnb's host community had active listings exceeding 8 million. In April 2024, Airbnb implemented an additional fee for cross-currency transactions. This surcharge of up to 2% applies when guests pay in a different currency than that of the listing, potentially increasing the guest service fee to as much as 16.5% of the booking total, excluding taxes. This further lifted the take rate by 20 bps.

Growing Through Investments

With over $10 billion in cash, Airbnb is well-positioned to reinvest in its business, explore mergers and acquisitions, and return capital to shareholders. In 2025, the company plans to allocate $200 million to $250 million to launch and scale new businesses, set to be introduced in May. The revenue benefits from these investments are expected to materialize towards the end of Q4. CEO Brian Chesky is steering Airbnb beyond just being a travel company. This transformation began with a major tech replatforming that enabled rapid product launches. Airbnb continues to address key customer concerns, ensuring a seamless experience.

Affordability: Implemented pricing tools to help hosts set competitive rates, introduced "Rooms" to support budget travelers, enabled total price filtering (including cleaning fees), and reduced fees on long-term stays.

Consistency & Quality: Rolled out "Guest Favorites," ensuring a higher and more predictable guest experience. Enhanced host quality systems have led to the removal of 400,000 listings that didn't meet standards.

Product Optimizations: Features like improved search, better merchandising (suggested destinations, detailed maps, welcome guides), flexible payment options, and a redesigned checkout process have boosted conversion rates. These strategic improvements have already contributed to an increase in Airbnb's Q4 2024 growth rate by a few hundred basis points, with continued momentum expected in 2025.

2025: The Next ChapterAirbnb's multi-year growth strategy for 2025 and beyond focuses on three pillars:

Perfecting the Core Service: Over 535 feature upgrades have been introduced based on guest and host feedback, including the expansion of the Co-Host Network, which reached nearly 100,000 listings in just four months. Listings managed by co-hosts generate about twice as much revenue due to higher quality standards.

Accelerating Global Growth: Airbnb is increasing investments in expansion markets while maintaining disciplined marketing spending in core regions.

Scaling New Offerings: Experiences Relaunch: Addressing integration issues, weak merchandising, limited social media presence, and lack of compelling supply with a more aggressive marketing approach.

Concierge Services: Exploring additional travel and living services, such as grocery shopping and access to local amenities.

Partnership Expansion: Moving toward an open ecosystem, Airbnb plans to collaborate with cleaning companies, key exchange services, grocery providers, and local businesses.

Despite increased investments, Airbnb expects a full-year adjusted EBITDA margin of at least 34.5%, with the most pronounced quarterly impact in the first nine months of 2025. The company will continue driving efficiencies in variable costs (payment processing, customer service) while maintaining discipline in general and administrative expenses (G&A) and headcount growth. AI-driven internal efficiencies should enhance engineering productivity and optimize customer service operations.

Valuation & My View on Airbnb

Based on my DCF analysis, Airbnb's intrinsic value is approximately $170, representing a 38% upside from its recent trading price of $122.86. I have assumed a topline growth rate of 11.5%, driven by the expansion of its core business and new offerings, which will take a few more years to fully materialize. With a strong cash position, strategic investments, and a commitment to innovation, Airbnb is entering a new growth phase. I have assumed a discount rate of 10%. Furthermore, I am assuming Airbnb can expand its margins from the current 23% to close to Booking.com's 30% by driving efficiencies in payments, support, and infrastructure, along with declining R&D as a revenue percentage. Growth in its core platform and high-margin adjacencies will further enhance scale and monetization, driving long-term margin expansion. I believe Airbnb has a strong business model, an experienced leadership team, and a valuable brand. Current valuations indicate upside potential, making it a stock worth keeping on my watchlist.

This content was originally published on Gurufocus.com