Robust Q315 results despite weaker APT

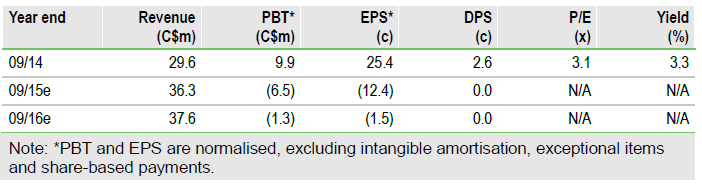

Almonty Industries Inc (TO:AII) reported solid Q315 financial results, with an adjusted EBITDA loss narrowing to C$0.9m compared to C$1.0m in Q215 and C$1.5m in Q115, against the backdrop of a falling APT price. The results were supported by the continuing strong performance from Los Santos, which benefited from improved plant recovery and higher processed grade. Having incorporated Sangdong, the reported results and updated tungsten price assumptions into our model, we revise our valuation of Almonty from C$1.00/share to C$1.26/share.

Reassuring Q315 financial results

Almonty reported a 15% q-o-q reduction in total revenue to C$8.7m, on the back of lower WO3 sales (down 1.6% q-o-q to 34.5kmtu) as well as falling tungsten prices. Headline EBITDA improved from C$0.2m in Q215 to C$1.8m in Q315 due to a 34% q-o-q decline in cash production costs and a further 21% q-o-q reduction in G&A. Taking into account production costs allocated to tailings inventory and capitalised waste mining, we calculate an adjusted EBITDA loss of C$0.88m compared to losses of C$1.0m in Q215 and C$1.5m in Q115.

Los Santos continues to perform well

Despite a 14% q-o-q reduction in the realised tungsten price, Los Santos generated a 6% increase in revenue to C$7.1m, driven by a 23% growth in production. This was due to the plant recovery improving to 61.2% in Q315 vs 58.7% in Q215 and the higher estimated processed grade. The improved operating performance has helped Los Santos’ production costs to reduce further, with the reported cash operating cost falling 9% q-o-q to US$79/mtu (excluding waste mining) and the all-in unit cash cost dropping 11% to US$143/mtu (including capitalised stripping and costs allocated to tailings inventory).

To Read the Entire Report Please Click on the pdf File Below