Alphabet (NASDAQ:GOOGL) just reported an exceptionally strong quarter, albeit its shares were only up by around 3% following their earnings release on October 29th, which not only beat analyst expectations but also reinforced a positive outlook for Google's long-term prospects. Beyond its core operations, Google's secondary ventures in AI, Full Self-Driving (FSD), and other areas continued to grow, especially with notable progress in its Waymo robotaxi initiative.

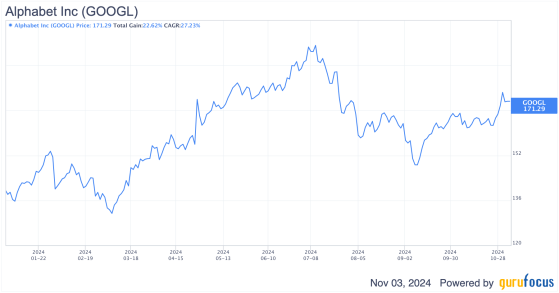

GOOGL Data by GuruFocus

Alphabet recently went through a market correction, which has positioned it attractively for potential gains heading into the year-end. The stock dropped from a peak of approximately $193 in early-July to a low of about $148 by early-September. This significant sell-off represents a 23% decline, which has essentially created a buying opportunity in the $150-160 range. Looking forward, the strong growth and profitability of Alphabet's Cloud segment signal promising potential for catching up with larger competitors. Combined with its dominant position in search, the company stands well-positioned to leverage its significant investments in generative AI developments. With these strengths in mind, I maintain that Alphabet still remains a solid buy. This quarter, in particular, validated this thesis.

Cloud Business: A Long-Term Growth DriverGoogle's recent earnings showcased particularly strong growth in its cloud segment. Cloud revenue grew 35% YoY, reaching $11.4 billion, solidifying its status as a $10 billion+ business. Google Cloud's operating margin also improved by six percentage points from the previous quarter, landing at 17% in Q3 FY24, driven by an increasing contribution from AI-related revenue. Although the majority of Alphabet's revenue still comes from advertising, the growth of its cloud business is adding crucial diversity to its overall revenue mix.

While Google Cloud has shown consistent revenue and profit growth (with a CAGR of 41.9% from 2017 to 2023) and achieved profitability in 2023 with a 5.2% operating margin (rising to 17% in Q3 FY24), it still trails behind major rivals like Amazon (NASDAQ:AMZN)'s AWS (26% margin) and Microsoft (NASDAQ:MSFT) Azure (44% margin). However, the segment's rapid growth and improving profitability shows strong potential for further margin expansion over time. So, I expect Alphabet to continue investing heavily in cloud infrastructure and AI to capture more of the expanding market for cloud solutions. Google Cloud's strategic push towards enterprise cloud spending optimization and multi-cloud adoption positions it as a strong competitor against Azure and AWS. This approach, which also appeals to smaller enterprises, is likely to drive more businesses to migrate to Google Cloud. As this trend continues, I expect Google Cloud to close the revenue and margin gap with its peers, supported by the general industry growth in cloud-based solutions. While I believe that Amazon, Microsoft, and Alphabet all stand to benefit from this growing market, I see Alphabet gaining ground faster as it scales its cloud operations.

[Synergy Research Group]

Notably, Google Cloud increased its market share by 2 percentage points from 10% in Q2 FY24 to 12% in Q3 FY24. In my view, Google Cloud is on the right path, and with ample room for expansion and investment, I'm confident it will narrow the gap with the leading players sooner rather than later.

Waymo: A Long-Term Growth DriverAlphabet's autonomous vehicle (AV) division, Waymo (part of its Other Bets segment), has made significant progress recently, as the division now completes more than a million fully autonomous miles and conducts over 150,000 paid rides each week. Furthermore, Waymo's recent valuation reached over $45B in a funding round that aimed to expand its operations across the US, with backing from Alphabet and major investors like Fidelity and Tiger Global. However, many believe Waymo's true worth could be far higher. Morgan Stanley (NYSE:MS), for example, has valued Waymo at $175B, a significant jump from most other estimates.

The market for full self-driving (FSD) technology may be considerably undervalued, presenting a big opportunity for Alphabet. The FSD market is expected to grow rapidly, potentially reaching $200B annually by 2030 and expanding to between $300-400B by 2035. Based on recent updates and additional funding, Waymo seems well-positioned to gain a strong foothold in the AV space. While Waymo's current contribution to Alphabet's overall revenue is relatively small, I see it as a potential major growth engine over the long term. With the rapid developments in this sector, Waymo could become a significant driver of future earnings for Alphabet.

Impressive Q3 Earnings And Solid FundamentalsAlphabet's Q3 FY24 results were very strong. The company reported $88.3 billion in revenue, surpassing estimates by more than $2 billion and reflecting a robust 15% YoY growth. Earnings per share (EPS) were $2.12, notably higher than the $1.85 consensus estimate, marking a 37% YoY increase and a 15% outperformance over expectations.

GOOGL Data by GuruFocus

This solid result was mainly driven by the strong advertising growth in its core Search and YouTube platforms, alongside significant contributions from AI-driven revenues in Google Cloud. In the Search & Other category, Q3 revenue rose by 12.2% YoY, from $44.03 billion to $49.39 billion. YouTube's ad revenue also increased by 12.2%, climbing from $7.95 billion to $8.92 billion. Meanwhile, revenue from Google's subscriptions, platforms, and devices surged by 27.8%, reaching $10.66 billion, up from $8.34 billion. The highlight of Alphabet's performance continues to be its Cloud segment. The latest quarter's cloud revenue hit $11.35 billion, which represents a 35% YoY increase from the $8.41 billion reported in the same period last year. This strong growth came from increased investments by Alphabet's clients in AI, driving demand within the cloud computing industry. This momentum is shifting investor sentiment, as Alphabet's focused spending on AI infrastructure is proving beneficial, reflected in the stock's rebound post-earnings.

Alphabet's growth in revenue has fueled a significant rise in profitability. The company reported net profits of $26.30 billion, up 33.6% from $19.69 billion a year ago. As mentioned before, EPS also jumped from $1.55 to $2.12, showing these profit gains.

GOOGL Data by GuruFocus

Despite considerable capital expenditure, Alphabet's operating margin stood at 32%, reflecting a YoY expansion of 450 basis points. This improvement is mainly due to the increased revenue mix from Google Cloud, driven by AI, which supports sustained margin expansion over the long term. While Google Cloud's operating margins still lag behind the broader Google Services segment, its rapid scale-up, fueled by the ongoing AI trend, sets the stage for long-term profitable growth. The sequential increase in Cloud's operating margin during Q3 highlights this potential, even as the unit remains in the early stages of monetizing AI. Alphabet's new CFO emphasized the company's commitment to enhancing the efficiency of its technical infrastructure and leveraging AI to streamline operations. There was also mention of "optimizing headcount growth," suggesting the possibility of ongoing workforce adjustments to maintain operational efficiency.

Other profit metrics also improved, though operating cash flow rose only slightly from $30.66 billion to $30.70 billion. Free cash flow for the quarter came in at $17.6 billion, boosting the trailing 12-month figure to $55.8 billion.

Another great thing about the enterprise is that it has a fortress balance sheet, which holds $93.2 billion in cash and equivalents against only $12.3 billion in debt, resulting in a net cash position of $80.9 billion. This figure excludes an additional $36.2 billion in long-term investment securities. Remarkably, these cash reserves are maintained even after substantial share repurchases. In Q3 alone, Alphabet spent $15.3 billion on stock buybacks and paid $2.5 billion in dividends. Year-to-date, share buybacks have totaled $46.7 billion, with dividends amounting to $4.9 billion.

Valuation and Upside PotentialI believe Alphabet's sales and EPS growth should continue on an upward trajectory as both its core business and secondary segments are well-positioned for future growth. A more favorable monetary environment, combined with stronger global economic growth, could further boost Alphabet's stock value. Alphabet's current forward P/E of approximately 19x makes it a no-brainer for value investors to invest at current levels, particularly when compared to its peers in the Sensational Six (Alphabet, Meta (NASDAQ:META), Amazon, Microsoft, Apple (NASDAQ:AAPL), and Nvidia (NASDAQ:NVDA)). This is also below Alphabet's own 5-year historical average forward P/E of 24x and significantly lower than the group's average of around 30x (excluding Alphabet). While I don't expect Alphabet trading at 30x or higher in the near future, I do believe it warrants a higher multiple than its current valuation.

GOOGL Data by GuruFocus

In my analysis, I use a forward P/E of 23x, slightly below its 5-year mean to remain conservative. Pairing this multiple with a projected FY25 EPS of $11.11 leads to a price target of $255, suggesting an upside potential of about 48% from current levels. This upside offers a comfortable margin for value investors to consider entering the stock now.

I also looked at Alphabet's value using a base-case discounted cash flow (DCF) model, incorporating a conservative approach. The DCF uses an 11% WACC as the discount rate and a 1.5% perpetual growth rate for terminal cash flows, reflecting Alphabet's stable growth outlook and risk profile. This model assumes an achievable EPS growth rate of 16.34%, which is considerably lower than the company's historical 10-year EPS growth rate (excluding non-recurring items) of 21.80%. Given the growth drivers like Google Cloud and Waymo, these estimates seem very conservative, and still the model estimates a fair value of $218 per share, implying a 21.5% safety margin from current levels.

Wall Street shares this bullish outlook as well. Following Alphabet's recent earnings release, Needham reiterated its buy rating with a $210 price target, while Citi reaffirmed its buy rating with a $216 target. Other firms like Evercore ISI and Morgan Stanley have buy ratings and $205 targets, Wedbush raised its target to $210, and Jefferies reiterated a buy rating with a street-high target of $235. This positive analyst sentiment reinforces the idea that downside risks are limited, creating a compelling risk/reward profile for investors.

Wrapping-upNo matter how you look at it, Q3 FY24 was a great quarter for Alphabet and its investors. The company is performing exceptionally well, more or less across the board, and where it matters most. The continued growth in the cloud business and the improvement in profits associated with it are encouraging signs. Google Cloud took a significant step forward as a formidable challenger to AWS and Azure, showing strong revenue growth and improving margins during the quarter. This comes at an opportune time, given signs of slowing growth in the Search and YouTube businesses.

With Alphabet's current attractive stock price and AI investments starting to pay off, as evidenced by the growth in Google Cloud, I find it difficult not to justify a "buy" rating. This combination of strong core business performance, strategic growth in emerging areas like cloud and AI, and a valuation that still provides a margin of safety makes Alphabet an appealing opportunity for long-term investors.

This content was originally published on Gurufocus.com