Amazon.com Inc. (NASDAQ:AMZN) has delivered exceptional results for long-term shareholders. The stock delivered a total return of roughly 993% over the past 10 years, while the S&P 500 has delivered a total return of roughly 231% over the same period. However, the e-commerce giant's shares have underperformed the benchmark index over the past five years, delivering a total return of roughly 84% while the S&P 500 has delivered a total return of around 97%.

The stock has underperformed as the company has continued to prioritize deploying capital into long-term growth opportunities as opposed to focusing on returning capital to shareholders. Moreover, it has encountered challenges related to increasing competition in both its online retail and Amazon Web Services business segments. China-based Temu and Shein have emerged as key competitors in the online retail business, while Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOGL)'s (NASDAQ:GOOG) Google have strengthened their cloud offerings to become more competitive with AWS.

Despite these challenges, Amazon has continued to deliver solid growth and margin improvement. While the stock trades at an above-market forward price-earnings ratio of 35 based on consensus full-year 2024 earnings, I believe the stock is undervalued given the company's significant earnings growth potential.

Growth story despite massive sizeWith a market cap nearly $ 2 trillion, Amazon is currently the fifth-largest company by market cap in the U.S., trailing only Microsoft, Apple (NASDAQ:AAPL), Nvidia (NASDAQ:NVDA) and Alphabet.

In terms of revenue for U.S.-based companies, Amazon's nearly $600 billion in annual revenue for 2023 trails only Walmart (NYSE:NYSE:WMT). However, despite the company's massive size, it remains a growth story. In particular, the company has substantial earnings growth potential as margins are likely to significantly improve as its business mix continues to shift toward AWS.

As of the second quarter, AWS accounted for roughly 18% of total sales and 64% of operating profit. This is due to the fact that AWS, which has operating margins of about 35%, is a much higher-margin business than the retail division. During the second quarter, AWS sales increased 19% on a year-over-year basis, while the company's North America and International segments' sales increased by 9% and 7%. Thus, over time Amazon is likely to experience significant margin expansion simply due to a more favorable business mix. While the AWS business is already generating more than $100 billion in annual revenue, it has a very long runway as an estimated 85% of global IT spending remains on-premises. Furthermore, artificial intelligence has emerged as a key tailwind for the cloud business and revenue growth has started to accelerate. On the second-quarter call, CEO Andy Jassy discussed the impact the company is already starting to see from AI:

"Our AI business continues to grow dramatically with a multi-billion dollar revenue run rate despite it being such early days, but we can see in our results and conversations with customers that our unique approach and offerings are resonating with customers."Another key element to Amazon's growth story is its advertising business. Advertising revenue for 2023 came in at around $47 billion, up from $12.50 billion in 2019. During the second quarter of 2024, advertising revenue increased 20% on a year-over-year basis and accounted for approximately $12.80 billion in total revenue.

The company lumps advertising revenue into its North America and International segments. However, to get a sense of how important advertising revenue is to these segments, it is important to note that quarterly advertising revenue of $12.80 billion significantly exceeded total operating profit of $5.30 billion for Amazon's North America and International segments combined.

While Amazon does not provide an operating margin breakout for its advertising business, it is safe to say this is a very high-margin business as competitors such as Google and Meta (NASDAQ:META) have operating margins of around 30% and 38% respectively. As advertising revenue growth continues to outpace growth in Amazon's retail business, I expect further margin expansion in both the North America and International business segments.

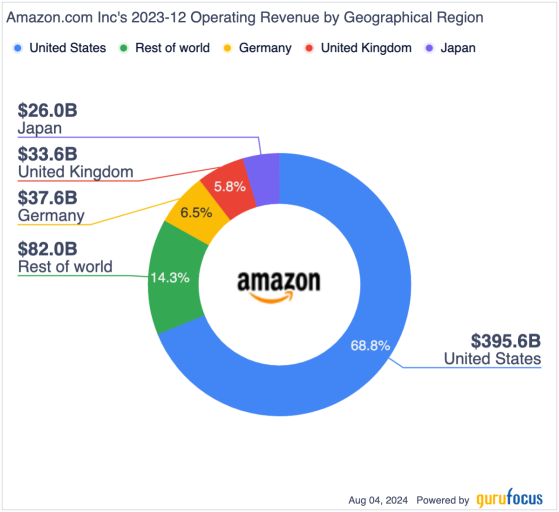

Finally, other key drivers for Amazon include continued international expansion and margin improvement in its core retail business. Currently, the company derives nearly 70% of total revenue from the U.S., which suggests it has a significant international growth runway. Additionally, Amazon likely has significant margin expansion opportunity in its core retail business as much of the operating profit in both the North American and International segments is currently coming from advertising, suggesting there is significant room for margin expansion in the core business over time as sales grow while much of the fixed investment needed to support the business has already been made.

Valuation is attractiveAmazon currently trades near 35 times 2024 consensus earnings per share and 29 times fiscal 2025 consensus earnings per share. Comparably, the S&P 500 is trading at 22.20 times 2024 consensus earnings. While Amazon is trading at a significant premium to the broader market, the company has much better growth prospects.

Currently, consensus estimates call for Amazon to report earnings per share growth of 62% for 2024, 24% for 2025, 29% for 2026 and 20% for 2027. Comparably, the S&P 500 is expected to grow 2024 and 2025 earnings by 11% and 14.70%. Moreover, in addition to growing earnings rapidly over the next few years, Amazon also has strong long-term growth potential due to increasing global adoption of cloud computing, a secular shift toward online retail and international expansion opportunities.

Thus, on a relative basis, I view Amazon as a more attractive investment than the broader market as I believe the stock is likely to be driven higher by strong earnings growth. Moreover, the stock is attractive relative to its own historical valuation norms. Despite a number of recent positive developments, including accelerating AWS growth and overall margin improvement for the company, the stock is trading toward the low end of its recent historical valuation range based on both a price-earnings ratio and price-to-cash from operations basis.

Key risks to the bull caseIn my view, the key risk to the Amazon bull case is regulatory risk. In September 2023, the U.S. government and 17 states filed a landmark lawsuit claiming that Amazon is an illegal monopoly. The company tried to get the case dismissed, but a U.S. judge recently set a trial date for October 2026. While the outcome is uncertain, I do not believe the government is likely to succeed as Amazon faces significant competition across all of its key businesses. The AWS business competes with stalwarts such as Microsoft and Google, while the company's retail business competes with players such as Walmart, Costco (NASDAQ:COST), Target (NYSE:NYSE:TGT), Temu, Shein and many others.

Another key risk is increasing competition. In particular, the threat posed to AWS by Microsoft's Azure is something that Amazon bulls should monitor closely. While Azure has been gaining market share, AWS market share losses appear limited as it is estimated to have 31% market share, down from 32% a year ago. Azure's market share is estimated to have grown to roughly 26%, up from an estimated 14% in 2017. Thus, Azure appears to be gaining market share from smaller players, which suggests AWS remains a highly competitive offering. I would view any significant decline in AWS market share along with slowing revenue growth to be a cause for concern. However, this is not currently the case as AWS market share appears stable and revenue growth is accelerating.

Another competitive threat which has weighted on Amazon shares is the rise of Temu and Shien, which offer lower prices in exchange for longer delivery times. In response, Amazon recently announced plans to launch a new discount service which will offer goods directly from China warehouses. Overall, I view the threat from Temu and Shien as only a marginal concern given Amazon's massive scale advantage.

ConclusionAmazon shares have delivered exceptional results for long-term shareholders. However, the stock has underperformed the broader market over the past five years. Despite its massive size, the company is likely to grow earnings per share at a rate well above the broader market over the next few years.

Despite the company's strong near-term and long-term growth prospects, driven by increased demand for cloud computing and growing advertising revenue, the stock trades at just 29 times full-year 2025 earnings.

I believe the stock is attractively valued at current levels and represents a solid growth at a reasonable price investment opportunity.

This content was originally published on Gurufocus.com