It has been over a year since the generative artificial intelligence craze took off, triggering a spike in the share prices of semiconductor companies whose GPUs feed into that market. The most prominent players have been Advanced Micro Devices Inc. (NASDAQ:AMD) and Nvidia Corp. (NASDAQ:NVDA), with the former being my focus in this analysis.

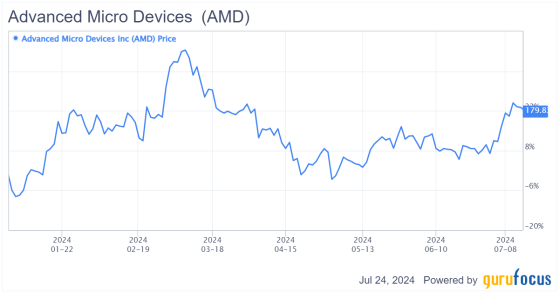

While both stocks initially surged, the first half of 2024 has not been as favorable to AMD. Nevertheless, the company's shares have risen more than 20% year to date at the time of writing, though they still trailed significantly behind Nvidia (up roughly 168%), which has surpassed expectations.

AMD's stock has surged due to anticipated growth in the AI industry. However, research and development costs have been eating away at operational profits as the company strives to keep pace with Nvidia in the AI chipset space. AMD faces strong competition from Nvidia and Intel (NASDAQ:INTC), but is positioning itself as a formidable contender in this market. Despite lagging behind Nvidia in its GPU offerings, I believe AMD is now set for another period of growth. With the stock price dipping below fair value, it deserves an upgrade to strong buy once again.

AMD Data by GuruFocus

The company manufactures a suite of semiconductor products, including GPUs and data center chips with AI applications. Bulls argue this positioning should drive strong growth fueled by generative AI demand, leading to improved results and higher earnings per share in the future. AMD is accelerating its GPU roadmap and plans to launch new Instinct chips in the fourth quarter of 2024 and fiscal 2025. Recently, the company revealed two new processors: the Ryzen AI 300 Series processors built on its XDNA 2 architecture and the Ryzen 9000 Series processors for desktops built on the Zen 5 architecture. Additionally, AMD is intensifying efforts to expand its Instinct accelerator lineup, which could significantly boost the top line and free cash flow, helping narrow the valuation gap between AMD and Nvidia.

As such, AMD appears well-positioned to capture some AI chip demand as its products continue to improve, though it will be challenging to catch up with competitors. The company is positioning itself to challenge Nvidia's dominance in the space, but will have immense obstacles to overcome in doing so.

Nvidia has a first-mover advantage and stronger financials overall. While AMD aims to gain market share from Nvidia, it could face pricing pressure as the dominant player has more runway to compete. Even with intense competition, I believe the industry's growth will allow both players to achieve significant growth in the coming years as AI continues to transform the world. By capturing AI chip demand and expanding its product offerings, AMD is poised for substantial growth. The company's strategic initiatives and new product launches suggest a bright future despite the competitive landscape. The AI revolution presents opportunities for both AMD and Nvidia, making the former a compelling investment option at its current valuation.

Source: AMD Investor Relations

Upcoming processor launches and accelerated pipelineAs mentioned previously, AMD is poised for rapid growth with its upcoming product rollouts. The company is set to launch two processors soon: the AI 300 Series for laptops in July and the Ryzen 9000 Series for desktops, with shipments starting in August. The AI 300 Series targets content creators handling demanding AI workloads. Both chips are expected to provide significant tailwinds for its core processor business.

AMD is also accelerating its GPU product pipeline to compete more effectively with Nvidia's H100. Earlier this year, the company launched the Instinct MI300X accelerator, aiming to challenge Nvidia's dominance in the data center GPU market. With strong endorsements from industry players like Lenovo (HKSE:00992) and Microsoft (NASDAQ:MSFT), the current Instinct MI300X accelerators have shown promise. The company plans to release the AMD Instinct MI325X accelerator in the fourth quarter and the AMD Instinct MI350 Series in 2025. The MI350 Series boasts up to a 35 times increase in AI inference performance compared to the MI300 Series, making AMD's chips a compelling alternative to Nvidia's high-priced H100 chips. The MI400 series is expected in 2026, signaling AMD's move toward an annual GPU release cycle.

Source: AMD Investor Relations

Expanding AI server partnershipsAMD is quietly expanding its partnership network in the AI server chip space. One of its largest partners is Microsoft, which has shown significant optimism about its AI products. Microsoft CEO Satya Nadella highlighted the MI300X for its price-to-performance ratio on GPT-4. Further, Microsoft's Azure cloud now offers AMD-based virtual machines optimized across the hardware and software stack, integral to the AI infrastructure running GPT-4 Turbo and Microsoft's Copilot. As Copilot technology gains traction among over 340 million users, demand for AMD's chips is likely to rise.

The company's partnership network also includes other blue-chip tech companies like Lenovo, Dell (NYSE:DELL), Hewlett Packard (NYSE:HPE), Super Micro (NASDAQ:SMCI) and Oracle (NYSE:NYSE:ORCL), which use AMD accelerators in its offerings. As these partners' revenues grow, driven by AI demand, AMD stands to profit significantly, even with a modest share of the market.

Financial performance and outlookOver the past several years, AMD has consistently met or exceeded analyst expectations, with the exception of the third quater of 2022, a challenging period for many companies across the market. This solid track record highlights the company's ability to outperform market "base" expectations. However, achieving nominal top and bottom-line growth has proven more challenging.

In the most recent quarter, AMD reported 80% year-over-year revenue growth in its data center segment, driven by strong shipments of the AMD Instinct MI300X GPU and double-digit growth in server CPU sales. Despite this, overall revenue growth was significantly impacted by sharp declines in the Gaming and Embedded segments. From my perspective, the future trajectory of AMD's business, particularly its Data Center segment, is more critical and will likely become the core of its operations.

Source: AMD Investor Relations

AMD's revenue growth was a modest 2% year over year in the last quarter, compared to Nvidia's staggering 262% increase. However, as the company accelerated its Instinct MI300 shipments in the second quarter, the company is poised for stronger revenue and free cash flow tailwinds.

While AMD may not overtake Nvidia in the data center GPU market in the near term, its free cash flow growth potential is likely underrated. The company generated $379 million in free cash flow in the last quarter, equating to a 7% FCF margin, compared to Nvidia's $14.90 billion in FCF and a 57% margin. Nevertheless, AMD's free cash flow margin has improved from 4% in the fourth quarter of 2023, partly due to the high-margin Instinct MI300 processor shipments.

Source: AMD Investor Relations

With GPU-related revenue potentially doubling to $8 billion next year (my estimate, given the current supply-demand imbalance in the GPU market), AMD is set to see a significant improvement in free cash flow. Consensus forecasts suggest 28% revenue growth for AMD next year, reaching $33 billion. A moderate increase in the free cash flow margin to around 15% could imply a total free cash flow potential of close to $5 billion in 2025. Given that AMD achieved about $1.10 billion in free cash flow in 2023, the company could potentially quadruple its free cash flow by then as well. This growth may be underrated as the market's focus often remains on Nvidia's leading top-line growth rates and FCF margins.

Margin resilience and strategic investmentsAMD's gross margin has shown resilience, with strong expansion in the last quarter. The company expects further expansion in the second quarter, guiding a 53% gross margin outlook. This strength is largely due to robust growth in the Data Center and Client segments, which have offset margin headwinds in the Gaming and Embedded segments.

However, the company's operating margin remained flat year over year. The 150 basis point improvement in gross margin was offset by a 23% year-over-year increase in selling, general and adminstrative expenses in the last quarter. Management has explained the company is investing aggressively in research and development and marketing to capitalize on significant AI growth opportunities. These investments are crucial, as they indicate the company is focusing on the right areas to power future success. R&D is critical for staying competitive in the tech-heavy semiconductor design and manufacturing industry. By continuing to invest in R&D, AMD is taking the necessary steps to catch up to Nvidia or at least reduce its significant market share.

Underdog valuation potential I favor AMD primarily due to its underdog status and its relatively lower valuation compared to Nvidia. Over the long term, the company is expected to grow its earnings per share faster than Nvidia, largely because its GPU development pipeline has been lagging. This gap presents considerable "catch-up" and revaluation potential for AMD. Intel, which recently introduced its own AI chips (the Gaudi 3 AI accelerator for the enterprise market), also has significant potential. However, the market remains overly bearish on Intel, which is reflected in its low forward price-earnings ratio.

Currently, AMD shares are valued at a forward price-earnings ratio of 24.80 compared to Nvidia's ratio of 30.70. Intel is the most affordable among the three with an earnings multiple of 13, though it has faced challenges such as delayed processor launches. While Nvidia has outpaced both AMD and Intel in growing its Data Center and consolidated revenues in recent quarters, AMD is making significant strides. With the promising Instinct MI accelerator pipeline, AMD has an attractive risk-reward setup.

If AMD can execute well with its Instinct chip releases, maintain high demand for GPUs and achieve significant free cash flow margin improvements, it could potentially trade at a price-earnings ratio similar to Nvidia's, around 30 to 32 times. This would imply a fair value range of $200 for AMD, offering about a 10% safety margin from current levels, even on a relative valuation basis.

Source: Alpha Spread

AMD's stock price has recently dipped below its fair value, providing a margin of safety for investors. My discounted cash flow analysis forecasts a 33% revenue CAGR over the next five years (growth stage) and anticipates operating margins to grow to 34% by the end of this period, aligning with Wall Street estimates.

Source: Alpha Spread

Given the AI accelerator business is likely a high-margin sector, further improvements in operating margins are plausible. The DCF model uses a discount rate of 9.70% and a terminal growth rate of 2%. Based on these conservative estimates, AMD's current fair price is approximately $232, indicating a safety margin of about 22%. This current consolidation period presents a strategic opportunity to invest with a built-in margin of safety, supported by conservative valuation metrics. By leveraging its growth potential, solidifying its market position and executing its product strategy effectively, AMD is well-positioned to capitalize on the expanding AI and semiconductor markets, promising substantial returns for long-term investors.

Final thoughtsAMD has positioned itself as a formidable contender in the semiconductor market, leveraging its strong product pipeline, strategic partnerships and underdog status to capitalize on the AI revolution. While facing stiff competition from Nvidia and Intel, AMD's aggressive R&D investments and upcoming product launches indicate a promising trajectory. With its current valuation offering a margin of safety, AMD presents a compelling investment opportunity for those looking to benefit from the rapidly expanding AI and semiconductor markets.

This content was originally published on Gurufocus.com