What are the odds of a Bitcoin exchange traded fund (ETF) gaining Securities and Exchange Commission (SEC) approval to trade on one of the US's major exchanges in 2018? Last October we asked a similar question regarding whether the SEC would approve a Bitcoin ETF in 2017. At that time the prospects for such an instrument becoming available in 2017 didn't look very likely. And indeed that proved to be true.

To be sure, currently—and similar to the situation last fall—investors interested in exposure to Bitcoin via a fund specifically focused on the most popular cryptocurrency had access to Grayscale's Bitcoin Investment Trust (OTC:GBTC), but that's traded over the counter, meaning off traditional exchanges. Real legitimacy, as well as more robust investor trust in the asset class, would only come from a vehicle traded on a major US exchange. But are investors any closer to seeing an exchange traded Bitcoin ETF launch this year?

One development that's occurred since our previous article, which has been a positive for the prospect of a major exchange traded ETF gaining regulatory approval, has been the launch, this past December, of Bitcoin futures trading via both the CBOE's XBT and CME's BTC. As many had said before Bitcoin futures trading became a reality, it could be a game-changer for the cryptocurrency sector overall and was often cited as a key step toward eventual regulatory approval of an exchange traded fund.

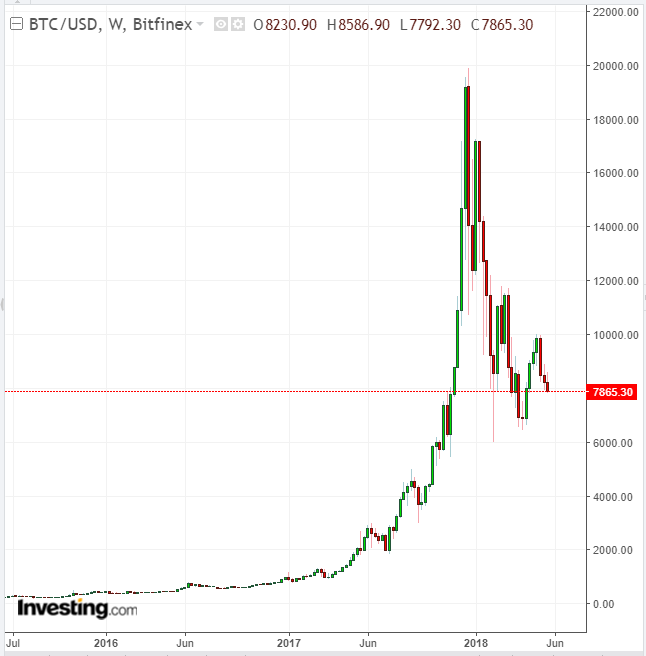

There's no doubt the launch of a Bitcoin ETF would add additional liquidity to this particular market. As well, it would enable institutional and retail investors to more safely bet on this extremely volatile asset. But as of this writing, interested investors continue to wait.

The good news is there has been some progress on the regulatory front since we last covered the rejection of ETF applications by the SEC, or the withdrawal of requests by prospective fund providers ahead of any SEC rejections. In early April, CNN reported that the regulatory commission had quietly begun considering a rule change that would enable ProShares to list two Bticoin ETFs on the NYSE Arca exchange.

CBOE, others encourage Bitcoin ETFs

CBOE, which is behind the launch of one Bitcoin futures exchange, is also actively encouraging the SEC to authorize cryptocurrency ETFs.

”Cboe encourages the Commission to approach Cryptocurrency ETPs [exchange-traded products] holistically and from the same perspective that it has historically approached commodity-related ETPs … The Commission should not stand in the way of such ETPs coming to market"

There are, however, a number of factors weighing on the launch of crypto ETFs says Rafael Delfin, head of research at Brave New Coin, an industry focused news and insight provider. "Most notable are increasing regulations, custodianship and liquidity." Nevertheless, he believes "the relevant stakeholders in each of these fields are setting up the groundwork toward an upcoming expansion of offerings."

For example, Delfin notes that US regulators are working to provide a clearer legal framework for liquidity, in both the spot and derivatives markets, as well as for custody providers. On the liquidity side he highlights recent examples of industry consolidation, with the goal of future expansion, include Goldman Sachs (NYSE:GS) working with JP Morgan (NYSE:JPM) to actively trade Bitcoin. In addition he says other large institutions that are rumored to be starting cryptographic asset operations of their own.

As well, there's the heavily chronicled fact of increasing record volumes of Bitcoin futures trading on both the CME and CBOE. Finally, on the custodianship end, large industry players such as Coinbase, Ledger and BitGo, are launching custody products for institutional customers.

But for every step forward in this environment, there are also what appear to be some missteps.

ARK Trims Bitcoin Exposure

For those investors who may have wanted access to Bitcoin via an exchange traded fund, there was, until recently the option of investing in ARK's Innovation ETF (ARKK) or its Web X.0 ETF (NYSE:ARKW) both of which offered limited exposure to Bitcoin within what ARK called a 'wrapper,' meaning Bitcoin exposure came from shares of GBTC, which the fund manager bought in 2015 when Bitcoin was trading below $250 per coin.

Until recently the ARK Bitcoin allocation ranged from 6% to 10%. However, that exposure was recently trimmed. According to CNBC the fund provider "divested much of its Bitcoin holdings, citing regulatory and tax concerns."

ETF.com reported that ARK trimmed its exposure to Bitcoin in both funds during mid January 2018, in conjunction with the rapid slide in the price of the token.

Today Bitcoin represents only 0.5 percent and 0.6 percent in ARKK and ARKW respectively. ETF.com says that the cryptocurrency is almost a negligible allocation in both of these portfolios now and according to ARK, the "complicated decision" to dramatically trim Bitcoin exposure had little to do with the "merits" of Bitcoin itself. An ARK spokesperson was unavailable for comment further on the matter.

Addressing the cuts, Brave New Coin's Delfin sees nothing crypto negative in the move. He points out that since ARK first ventured into the crypto space, Bitcoin had risen nearly 90 times, so it would be expected that ARK would take profit from those gains by reducing their exposure and their risk while looking for other opportunities with more attractive risk/reward ratios.

Fundamentals Not Yet In Place

Do crypto industry players believe ARK's move portends negatively for the launch of a Bitcoin ETF? Rohit Kulkarni, managing director, private investment research at SharesPost, a provider of liquidity solutions and private capital market research to late-stage private companies and investors, focuses on the fact that ARK's ETFs did not directly own Bitcoin, but rather simply owned shares of Grayscale's GBTC.

“This is a privately offered trust, managed by Grayscale investments, and is available exclusively to accredited investors. Also, Bitcoin Investment Trust is not registered with the Securities and Exchange Commission and is not subject to disclosure and certain other requirements mandated by US securities laws.”

In other words it likely has no bearing whatsoever on the whether an exchange traded ETF is ever authorized by the SEC.

Gabriele Giancola, co-founder and CEO of blockchain-powered loyalty ecosystem qiibee, agrees with Delfin's assessment. It's reasonable to assume that ARK’s decision to reduce its exposure to Bitcoin was simply the company taking profits. It decreased its position in the digital currency as Bitcoin prices dropped.

Giancola says it remains to be seen whether the SEC will approve a Bitcoin ETF in the near future. In his view, "the fundamentals that are still causes for concern haven’t yet been addressed, including extreme cryptocurrency price volatility and liquidity in related funds." He believes the SEC wants more time to ensure the Bitcoin futures market is efficient enough to weather turbulent market conditions. And he adds:

“However, given that the public’s appetite for cryptocurrencies is bound to grow as blockchain technology sees increased mainstream adoption, we can expect more fund structures such as the Bitcoin Investment Trust (GBTC) — which buys and holds bitcoin on behalf of its clients — to be introduced to the market.”