Barrick Gold (NYSE: NYSE:GOLD) reported third-quarter earnings on November 7, 2024. This article provides an update on my Gurufocus article dated March 21, 2024, in which I analyzed the fourth quarter and full-year results for 2023.

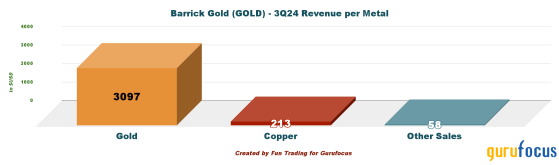

In the third quarter of 2024, Barrick's primary revenue source was gold, accounting for 92.0% of total revenue, an increase from 90.7% in the second quarter of 2024.

The remaining revenue came from selling copper, silver, lead, and zinc. Copper production was notable, contributing 6.3% to the total income, while the other metals (silver, lead, zinc, etc.) accounted for 1.7%.

This metal revenue ratio is similar to that of the Newmont Corporation (NYSE:NEM). Please read my recent article on NEM by clicking here.

Newmont's revenue per metal is shown below for comparison purposes. Newmont's gold production accounts for 85.7% of its total revenue.

Gold production is slowly bottoming out, with 943K Au Troy ounces produced this quarter. The chart below compares 3Q23 to 3Q24 for each producing mine.

Copper production is expected to increase significantly by 2030 as the Lumwana pit expands and production at Reko Diq is added. For the moment, Barrick mines copper from three locations. The historical detail output is shown below:

Note: The company has indicated copper production in million tons starting in 2024.

1: A risk profile elevatedBarrick Gold distinguishes itself from its competitors (especially Newmont and Agnico Eagle) by relying heavily on production from less desirable and risky jurisdictions.

Barrick has too many mines in Africa, especially since Randgold (LON:RRS)'s acquisition, significantly increasing overall risk.

Furthermore, the company is investing in Pakistan, Balochistan (Reko Diq Gold and Copper Project), and Papua New Guinea (Porgera), which may cause problems in the future.

Gold investors should carefully analyze where gold is produced and apply an honest discount related to the country of origin, with 1 for safe jurisdictions such as the USA, Canada, and Australia all the way down to 0.25 for unsafe jurisdictions such as Africa (Mali for one) and Papua New Guinea.

I'll give you a few examples to illustrate my comment above.

- Barrick Gold owns the North Mara and now Bunyanhulu in Tanzania, and we all know how much trouble they have had with the Tanzanian government. The contract (for the acacia mine) was renegotiated, the mine was closed for an extended period of time, and Barrick was required to pay the government a larger share before reopening the mine.

- With Randgold, Barrick expanded into three gold mines: Loulo-Gounkoto, Tongon, and Kibali. In 3Q24, the Mali Loulo-Gounkoto mine complex produced 144,000 ounces of gold, or 15.3% of the company's total gold production. After months of bad blood, Barrick and Mali's government reached a final agreement in October 2024, following extensive negotiations. This article states that:

The resolution between Barrick Gold and Mali shows some of the challenges mining companies face when operating in resource-rich yet politically volatile countries.

- Barrick Gold appears unaware of the risks associated with investing in large projects in dangerous jurisdictions, such as the Reko Diq gold and copper project in Chagai district, Balochistan, a poor region of Pakistan bordering Iran and Afghanistan. The company anticipates the project will require more than $7 billion in investment. Barrick owns 50% of the project.

This specificity, mainly attached to Barrick, pushes me to be more cautious about my investment in the company than Newmont Corporation or Agnico Eagle, which have their issues but present a better risk profile. The following chart shows Barrick Gold's gold production per mine.

Note: Randgold represents three mines: Loulo-Gounkoto (80%), Kibali in DRC (45%), and Tongon in Cote d'Ivoire (89.7%).

2: Trading StrategyInvesting in gold mining is difficult, but it can be extremely profitable for those who know how to trade in this sector. Analyst recommendations and detailed comments about fundamentals are frequently useless to investors who are attempting to develop a winning trading strategy. The game is all about strategy.

What I wrote about strategy in my recent NEM article still applies to GOLD.

To avoid becoming victims of what I call the financial mind game, we must develop a strong personal strategy that provides a consistent income while maintaining our long-term position and paying regular dividends. Of course, this strategy has tax implications, but it is not a problem.

My winning strategy is known as LIFO trading, which enables you to sell your most recent purchases for a profit of between 3% and 5% or more, depending on the situation. Do not forget to set you broker account to LIFO instead of FIFO.

Then you can hold onto your older, higher-cost purchases until the stock price rises to a point where you can sell them for a profit. It may take days, weeks, months, or years. Short-term transactions rely heavily on technical analysis.

As a result, knowledge of technical analysis, patience, and methodical stock trading are all required.

The task is easier for solid companies like GOLD, which pays a 2.3% dividend. Above all, never sell at a loss to satisfy your emotions; instead, choose solid companies with a proven track record and strong fundamentals.

3: What insights can we gather about the third quarter?Barrick Gold's third-quarter earnings per share fell short of consensus estimates, even though revenue increased by 17.7% compared to the previous year. The profit margin rose 14% from 13% in the same period.

It's fascinating to witness how analysts' reactions can shape market sentiment. While I don't argue that GOLD presents a strong fundamental outlook, portraying it negatively is unjustified. Revenues met expectations, but earnings per share were slightly lower than expected. Revenues were $3,368 million in 3Q24.

Understanding how these analysts' estimates are calculated reveals how imprecise they are in fundamental terms despite having a significant, albeit voluntary impact on market sentiment.

Yahoo, for example, reports that 14 analysts cover Barrick, with earnings predictions ranging from $1.15 to $1.32 per share for 2024. Calculating the average from such a small sample with a large deviation and declaring a'miss' or a 'beat' based on only a few cents is statistically incorrect.

Nonetheless, the market frequently bases its assessment of the stock on these minor differences. As investors, we must navigate this reality in order to succeed in the market, even if we know deep inside it is clear manipulation

The market had anticipated a stronger quarter, especially given the substantial rise in gold prices over the past few months. Barrick sold its gold at an average price of $2,494 per Troy ounce, compared to $2,075 in the previous year and $2,344 in the preceding quarter.

It reflects a 20.2% year-over-year increase in gold, while overall revenue increased by 17.7%, which is positive. Better yet, the 4Q24 gold average price could be above $2,600 per ounce, representing another 5% increase quarter over quarter. Today, gold ended at $2,658.

However, it is worth noting that Barrick Gold's free cash flow increased slowly in the third quarter, totaling $444 million.

Analyzing free cash flow (FCF) is essential for comprehensively understanding a company's financial health. A low FCF suggests high capital expenditures (CapEx) and weak cash flow from operations.

In Barrick's case, the high CapEx is due to several ongoing costly projects. These projects raise CapEx without generating any corresponding revenue to offset the increase. This situation is only temporary and should not be a major concern.

If we compare Barrick to Newmont and Agnico Eagle, the ratio of free cash flow per revenue is the lowest for GOLD at 0.132, while NEM is 0.167 (revenue of 4,605 million and FCF of $771 million) and AEM is 0.286 (revenue of 2,156 million and FCF of $616 million). Below is GOLD's FCF history:

The main issue is the costs, which consume a large portion of the profits. Costs are increasing at a record pace. We can see this through the AISC, now $1.507 per ounce, compared to $1,286 for AEM. NEM is also struggling with costs and has an AISC of $1,611.

4: Dividend and buyback ProgramBarrick repurchased an additional 4.725 million shares during the third quarter as part of the $1 billion share buyback program announced in February 2024. This brings the total number of shares repurchased to 7.675 million. Additionally, the company is paying a quarterly dividend of $0.10 per share, which equates to a yield of 2.3%.

5: Net DebtFinally, the debt profile remains stable, even though I would have preferred the company to pay off some of its debt instead of spending a large amount to buy back its shares.

The company's net debt is now $0.5 billion, which is excellent and has established solid fundamental support.

6: Gold and Copper production in charts

Technical Analysis

Note that the chart has been adjusted to reflect dividends.

Barrick forms a descending triangle, with resistance at $18.35 and support at $16.50. The relative strength index (RSI) is now at 40, recovering from yesterday's oversold position. GOLD has returned to its 200 MA level and closed slightly higher, indicating strength. However, the market is now unpredictable, and large swings may occur.A descending triangle is generally perceived as bearish in the short-term trend. However, this pattern often ends in a bullish breakout. The stock has established a new support, around $16.50. However, depending on the gold price, GOLD could drop below $16 if the metal price starts to decline again from its highs. The gold price has been bullish for months, and it is difficult to imagine a following bull run now.It is safe to consider buying back GOLD between $16.75 and $16, with short-term profits on any rally above $18. Please look at my chart above for more information.

Taking partial short-term LIFO profits is critical. As I previously stated, the short-term trading strategy is to trade LIFO for approximately 40% of your position while maintaining a core long-term position for a potential significant recovery. In the meantime, you can expect a 2.3% dividend yield. Above all, be patient and avoid selling for a loss!

Warning: To remain relevant, the TA chart must be updated often.

This content was originally published on Gurufocus.com