Analog Devices (NASDAQ:ADI) is one of the world's largest analog and power semiconductor chip manufacturers. The company holds the top spot in the analog and the radio frequency market, as well as the second spot in the power management market. Analog Devices had a tough FY 2024 as the industry faced excess inventory challenges amid weak demand and over-capacity. There are clear signs that the worst is over for Analog Devices, and the company is well-positioned to return to growth in FY 2025. However, Analog Devices' valuation level suggests that the market has at least partially priced in a potential recovery. At the current price, Analog Devices is not cheap enough for serious value investors.

Business description and competitive landscape

Analog Devices have existed for almost six decades. The company was founded in 1965 by two MIT graduates, Ray Stata and Matthew Lorber. Its initial products were high-performance operational amplifiers. Through both organic growth and acquisitions, Analog Devices has grown into a global leader in analog and power management chips. The company's most important acquisitions include Linear Technology (NASDAQ:LLTC) and Maxim (NASDAQ:MXIM) Integrated, both of which expanded its product portfolio and technological capabilities.Analog Devices offers a wide range of products. The company is best known for its high-precision data converters, amplifiers and RF ICs (Radio Frequency Integrated Circuits). Analog Devices products are predominantly used in four end markets: industrial, automotive, communications and consumer electronics. Historically, the industrial end market segment has been the most important market for Analog Devices, consistently contributing to 40-50% of the company's overall revenue. Recently, Analog devices have also been very successful in the highly competitive automotive semiconductor market, driven by the rapid electrification of vehicles.

Texas Instruments (NASDAQ:TXN) (TI) is Analog Devices' largest competitor, especially in the industrial end market in areas like power management and data conversion chips. Texas Instrument has the most comprehensive product portfolio with more than 80,000 products, which enables Texas Instruments to be the one-stop shop for its customers. Another big competitor for Analog Devices is Infineon Technologies, which is very strong in certain niche markets in the automotive and industrial segments. Infineon is the most dominant force in advanced semiconductor solutions for automotive electronics, particularly in the electrification and safety systems. In addition, Ananlog Devices also competes with Nexperia (NXPI), OnSemi(ON), and STMicroelectronics(STM) in the automotive markets.

Compared to its competitors, Analog Devices has always had a dominant position in analog-to-digital conversion products. The company's data converters are renowned for their exceptional precision and speed. This competitive advantage is further strengthened after acquiring Linear and Maxim.

Financial and valuation analysis

For FY2024, Analog Devices generated revenue of roughly $9.4 billion. The gross margin declined to 67.9% due to lower utilization rate and products mix shift. However, through efficient improvement measures, Analog Devices is able to maintain its operating margins at an impressive level of 40.9%.For the most recent quarter, Analog Devices experienced revenue decline of 10% year-over-year. On a sequential basis, revenue grew 6% quarter-over-quarter.The company's largest end market is the Industrial end market, which accounted for 44% of the consolidated revenue. For FY2024, the industrial end market declined 35% on a year-over-year basis due to weak demand.

Analog Devices' second largest end market is the automotive end market, representing 29% of the consolidated revenue. For FY2024, the automotive end market only declined 2% from the record level achieved in FY2023.

The company's third-largest end market is the consumer market, which represents 16% of the consolidated revenue. For the year, the consumer end market is the best-performing end market for Analog Devices, declining only 1%. For the fourth quarter, the consumer end market finished up very strong, with a growth rate of 31% year-over-year, driven by higher demand for consumer wearables, premium handsets, and gaming applications.

Last but not least, the communications end market represented 11% of the consolidated revenue. This end market declined 33% for the full year.

Over the past 5 years, the company's revenue has grown at an annual rate of 7.4%. The company's gross margin has oscillated between 57% and 68% during the past decade, while its net margin remained between 15% and 24% during the same period. Both gross margin and net margin declined in FY2024. However, as the end market recovers in 2025, I expect the company's gross margin and net margin to improve over the next 2-3 years.

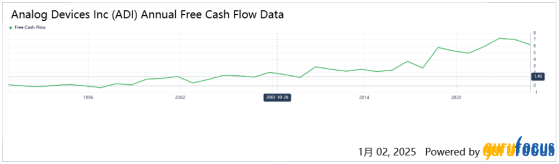

Analog Devices' free cash flow has been consistently growing for many years. Therefore, the DCF valuation method seems appropriate for the stock.

If we use a 10% discount rate and optimistically assume that Analog Devices can grow its free cash flow at 12.5% over the next 10 years and 4% afterwards, the implied current intrinsic value per share is $129. At the current price of $212, Analog Devices' stock price has no margin of safety at all.

Using the reverse DCF tool, Analog Devices would need to grow its FCF per share at almost 20% a year to justify today's valuation. Given the size of the company and the competitive landscape, I think this is almost impossible.

Risk analysis

Regarding risks, I am mostly concerned with three risks for Analog Devices. The first is competitive risk, particularly from emerging Chinese players in the automotive semiconductor market. China is the leader in electric vehicles, and the Chinese government is pushing for self-sufficiency in all semiconductor products.The second risk is macro economic uncertainty. All of Analog Devices' end markets are very vulnerable to macro economic conditions, especially the industrial end market, which is Analog Devices' largest end market. Historically, the company's customers have significantly reduced investments and postponed capex projects during economic downturns, which always led to reduced demand for Analog Devices' products.

Lastly, foreign currency fluctuation can negatively impact the company's profitability, as a significant portion of its revenue comes from the non-U.S. markets.

Conclusion

In conclusion, Analog Devices has seen early signs of recovery in its end markets. The company is still the dominant force in the analog and mixed signal semiconductor space, with one of the most comprehensive products offering in the industry. After a challenging FY2024, Analog Devices is well-positioned for growth during the next 2-3 years. However, at the current market valuation, the stock is trading at a substantial premium to its DCF-based instrinsic value. I believe the stock offers no margin of safety and suggest value investors to wait for a much better price.This content was originally published on Gurufocus.com