News broke last week that Apollo Global Management will be added to the S&P 500 by December 23rd. The event marks a momentous occasion for Apollo Global, placing the asset manager in the upper echelon of U.S. businesses, which might provide the company's stock with valuable marketability and tradability advantages.

Although a sizable enterprise, Apollo Global operates a niche business model focusing on alternative investments. Therefore, an analytical opportunity arose to disseminate valuable information to the public.

Considering the above, here's what you should know about Apollo Global and its interim prospects.

What Is Apollo Global Management?

Apollo Asset Management is an alternative asset management company providing expertise in credit, equity, and real assets. Moreover, the company participates in the retirement management space by delivering annuities and general asset management services to corporates, families, and institutions.What differentiates Apollo Global from traditional asset managers? Unlike most fund managers, Apollo Global specializes in alternative asset classes, allowing investors to partake in diversified returns with alpha generation attributes. Additionally, Apollo Global flanks its asset management endeavors with retirement offerings, providing noteworthy cross-sales synergies.

Joining The S&P 500

S&P Global released a statement on December 6th, stating that "Apollo Global Management Inc. and Workday Inc (NASDAQ:WDAY). will replace Qorvo Inc (NASDAQ:QRVO). and Amentum Holdings Inc. in the S&P 500, respectively."Apollo Global's stock reacted positively, surging by over 5% on December 9th's pre-market, suggesting investors have a favorable view of the company's inclusion in the S&P 500.

Aside from its enhanced marketability and tradability, Apollo Global's inclusion provides peripheral benefits such as inclusion in S & P 500 tracking funds, cost of capital flexibility, and credibility.

Segmental Analysis

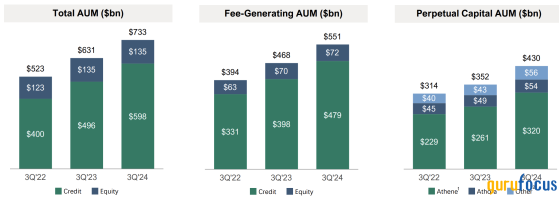

Asset BaseAs illustrated in the following diagram, about $598 billion of Apollo Global Management's assets span credit investments, whereby the firm provides an umbrella of portfolios, including direct lending, opportunistic credit, and multi-credit. In addition, Apollo Global's equity portfolio reached $135 billion in 2024 as its presence in private equity, the secondary market, and hybrid solutions continues to grow.Source: Apollo Global Management (Asset Class Exposure)

Apollo Global's latest inflows provide a better understanding of its enterprise-level strategy.

The company's fourth-quarter data conveys that Apollo Global's retirement segment experienced $77 billion in quarterly inflows compared to its asset management segment's $72 billion.

While the company's primary segments are distinct, both silo funds into the firm's broad-based business model instead of acting as standalone entities. The approach allows Apollo Global to address multiple markets without rebasing its core investment strategies.

Source: Apollo Global Management (Asset Management Vs. Retirement Inflows)

Revenue GenerationA segmental view of Apollo Global's earnings mix illustrates that it earns from fee-based management and spreads, where the latter relates to retirement products that include payouts such as annuity benefits.

Source: Apollo Global Management (Revenue Streams)

The asset management firm expects its fee-based revenue to grow by 20% per annum until 2029 and its spread-based earnings by 10%.

Scaling fee-based revenue can be straightforward for companies with substantial market shares. However, scaling spread-based earnings can be more challenging due to factors such as cyclical annuity sales and lumpy claims. Nonetheless, the two segments seem in good health and possess diversification benefits.

The following diagram provides a more granular understanding of Apollo Global Management's fee-related earnings. The segment's mix is multifaceted, including organic inflows, originations, and bespoke capital solutions. Although bespoke solutions and originations can be cyclical, organic inflows are generally steady, providing a countercyclical balance.

Source: Apollo Global Management (A Granular View Of Fee-Based Earnings)

As for Apollo Global's retirement segment, Athene, a company acquired in 2022, plays a key role. Athene's gross invested assets are expected to grow by 15% annually until 2029, while its spread-related earnings will likely increase by 10% annually.

Athene and Apollo Global's broad-based retirement solutions provide perpetual assets through annuities. Although product-linked annuity payouts can be lumpy, immediate and deferred annuities are usually non-cyclical, providing Apollo Global with sustainable asset growth and predictable cash outflows.

Source: Apollo Global Management (Granular View Of Spread-Based Earnings)

Latest Earnings Report & Outlook

HeadlineApollo Global released its third-quarter results in the first week of November, revealing net income per share of $1.85, 13 cents higher than expected.The key driver behind Apollo Global's quarter was its fee-based revenue, which reached a recorded $516 million. Moreover, the firm's spread-based revenue followed suit, tallying $856 million, its second-best quarter-to-date.

An additional landmark was Apollo Global's $42 billion in quarterly inflows, a 16% year-over-year increase, which places Apollo Global's total assets under management at an astounding $733 billion.

Collectively, Apollo Global's sustained asset growth, resilient fee structures, and coherent cost management led to a spike in quarterly results. However, the question beckons: Will Apollo Global's performance be sustained in 2025 when changing market conditions occur? An analysis of Apollo Global's key value drivers can address the central question.

Key DriversThe global interest rate environment is changing, which will most likely lead to an alternative landscape for most asset classes in 2025.

As visible in the next graphic, the G20 Leading Economic Indices are robust, conveying an enhanced outlook for consumer sentiment, industrial production, manufacturing orders, and unemployment. Risky assets such as alternative investment might prosper in an improved economic outlook, leading to higher organic asset growth for Apollo Global and its peers.

Source: Trading Economics (G20 LEI Indices)

Isolating Apollo Global's fee-based earnings provides an informative vantage point. For example, Apollo Global's credit offerings experienced solid growth in the firm's third quarter and year-to-date. However, lower interest rates and tighter credit spreads might slow demand for alternative fixed-income products due to compressed yields.

In contrast, Apollo Global's equity offerings might experience upside next year. The segment's management fees softened by 11% year-over-year in Apollo's third quarter. However, lower interest rates might spark private equity activity through leveraged buyouts, while an enhanced economic outlook might draw investors into riskier equity investments.

Source: Apollo Global Management (Asset Management Segment Results)

The firm's retirement segment experienced a strong third quarter as its fee-based earnings rose across the board and its operating costs tapered to $112 million, down by 7.2% from a year earlier.

A large portion of the segment is annuity-driven, meaning fixed-income investments dominate the segment's portfolio. Unlike its asset management segment, fixed-income headwinds are unlikely to impact Apollo Global's retirement segment, as the division's product demand is bound to annuity offerings instead of its investment themes.

Lower interest rates may decrease asset-level income. However, such an event may reduce the segment's interest expenses, which grew by 11.3% year-over-year to $118 million in Apollo's third quarter.

Source: Apollo Global Management (Perpetual AUM driven by annuity business)

Consolidating the section is a view of Apollo Global's dry powder. The firm recorded $64 billion in dry powder during its third quarter, which it could allocate toward new assets in late 2024 and early 2025. Some might disagree, but the interest rate environment might result in asset class rotation, allowing Apollo Global to partake in tactical opportunities with its dry powder.

Source: Apollo Global Management (Dry Powder/Cash)

Valuation Metrics and Dividends

How is Apollo Global Management's stock valued?Apollo Global Global's value derives from fees and spreads, suggesting an overview of its price-to-sales and price-to-earnings multiples is prudent. Other valuation metrics can be considered; however, a relative view of Apollo's price-to-sales and price-to-earnings ratios sets a comprehensive framework.

A peer-based analysis of Apollo Global's price-to-sales and price-to-earnings ratios illustrate potential relative value. For example, the asset manager's price-to-sales and price-to-earnings ratios both rank second among their selected peer sets.

Source: Yahoo Finance

Furthermore, Apollo Global's stock provides a dividend with a forward yield of approximately 1.06%. Unlike Patria Investments, Apollo Global's dividend yield aligns with most of its peers.

Some might consider Apollo's dividend tame. However, it has a dividend payout ratio of merely 19.33%, the lowest among its selected peers, suggesting its dividend capacity is commendable.

Source: Yahoo Finance

Apollo Global's stock might not be a deep value investment. However, it shows relative value and exponential fundamental growth, raising the possibility of being a steady value stock.

Risk Factors

The economic cycle and peripherals, such as the credit cycle and asset class rotation, should be noteworthy considerations when assessing an investment company's prospects.Despite lower interest rates and an improved LEI index, the possibility of an economic backdrop remains. Factors such as a hard pivot in U.S. politics, extended stimulus in China, and rising geopolitical threats introduce structural risks that could swing the pendulum, subsequently damaging the capital markets.

The above-mentioned situation could lead to secondary risks for Apollo Global. For example, Apollo recorded $108 million in clawbacks during its third quarter, which could increase during an economic downturn.

Lastly, Apollo Global is very credit-centric, leaving it open to concentration risk in an asset-class-specific downturn.

Final Word

Apollo Global's inclusion in the S&P 500 provides an array of tailwinds, including enhanced marketability, tradability, credibility, and S&P 500 index fund eligibility.In addition to the above, the company is in good shape and experiencing solid asset growth. Moreover, Apollo Global's segmental split is alluring, providing a split between niche asset growth and perpetual inflows through annuities.

The firm's stock holds relative value, and although risks are evident, Apollo Global Management seems primed for steady value accumulation in 2025 and beyond.

This content was originally published on Gurufocus.com