Warren Buffett (Trades, Portfolio) (Trades, Portfolio)'s moves are always emblematic and attract attention. In the Q3 of Berkshire Hathaway Inc. (NYSE:BRKa) (NYSE:BRK.B) one of the notable factors was the continued sale of shares of Apple Inc. (NASDAQ:AAPL), which amounted to around 100 million shares, making it still an important position for the holding company, which still owns around 300 million shares of Apple.

Even so, this move intrigues investors who are looking for an answer as to whether this was just a tactical move to reinforce cash and eventually apply it to new opportunities (when they arise), whether the big investor is seeing some structural problem in the market, or whether Apple shares (NASDAQ:AAPL) alone have lost some of their attractiveness.

It's not possible to know exactly what justified this, and it may have to do with various factors, but it's interesting to note how these sales occur when Apple has already become an expensive company and now offers low value for shareholders when we consider earnings yield, as well as having a low-risk premium.

I understand that even though it is still one of the best companies in the world and has good prospects, this low-risk premium, together with possible slower revenue growth, doesn't justify the current valuation, even though there is rationality and the stock still makes sense in some portfolios.

Apple Had Strong Q4 Earnings

Overall, Apple delivered a solid fiscal Q4 and better than expected by the market. iPhone revenues reached $46.2 billion, while the market estimated something close to $45 billion, while services revenues were slightly below expectations.

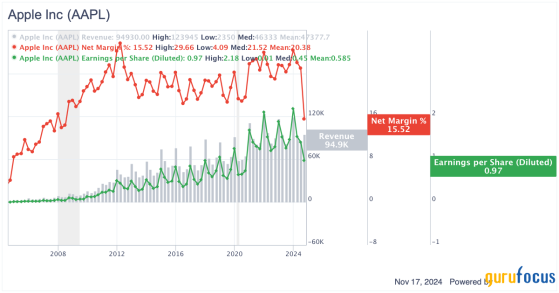

In the quarter, the company also reported an EPS of only $0.97, but that was impacted by a non-recurring effect related to the European General Court's decision to pay taxes, while removing this effect, EPS would have been $1.64. This effect causes a distortion in the graph, showing a dip in EPS and net margin, but removing it gives a net margin of ~26.3%, which is quite healthy and higher than in Q4 fiscal 2023. Analyzing decades, it is also clear that financials (especially EPS), although cyclical and with a high seasonality between quarters, are advancing consistently.

Source: GuruFocus

In the fiscal year as a whole, revenue showed an advance of just 2%, sustained by stable iPhone revenue, a slight recovery in Mac, and a 13% advance in services, which is by far the most bullish segment today.

Source: Apple's IR

One factor that adds a sparkle to the fiscal year is the gross margin. Total (EPA:TTEF) gross profit went from $169.1 bn to $180.6 bn, the result of a timid growth in revenue, but a large expansion in margin, which went from 44.1% to 46.2% in the consolidated. In addition to the small gain of 0.7 percentage points in products, which is relevant, Apple achieved an advance of more than 3 percentage points in services, showing why this is the segment that supports a good part of Apple's bullish thesis.

Apple's Future

As I've mentioned in other Apple articles, it's virtually undeniable that Apple is a high-quality company. Its business model is very solid, having built a strong brand power, which together with other barriers to entry such as high technology and a complete ecosystem that already has very consolidated customers, makes Apple one of the companies with the widest moat in the world.

In turn, these competitive advantages are reflected in its financials, with a very high gross margin that reinforces the high demand and perception of value for its products, a net margin that is also at a high level and capable of generating shareholder value, as well as high return indicators, such as an ROE of over 90% and an ROIC that is still close to 30%. Not only that, but cash generation is massive, allowing for things like the $100 bn buyback announced a few quarters ago.

The problem is when we combine the ~30x earnings valuation with the sustainability or pace of Apple's growth.There are trends such as premiumization, which together with the innovation of Apple's products, new features of the ecosystem, can make the company continue to advance in market share gradually, in addition to its power to raise prices constantly. Still, the consolidation is already very large, its market share is already large, and the price of its products is already expensive, so it is difficult to think of an accelerated advance in any of these strategies.

We can extrapolate and think of some optionalities, such as the creation of new products, but this is not only difficult to measure, but there aren't many things on the radar. The Apple Car has been discontinued, the Apple Vision Pro is rumored to be discontinued, and it's challenging to think of any other new product (such as the 'Apple Home Hub') that will grow in revenue to the point of being relevant in the midst of iPhones and Services revenue.

In other words, Apple is a company that we can project will show gradual and sustainable growth. But where there is doubt is whether this level close to high-single digit is sustainable. In my opinion, something closer to mid-single digit or low-single digit for more difficult years (iPhone cyclical and macroeconomic) is more credible and conservative for the models.

A margin expansion is also reasonable to consider, since even if it's very efficient, there's always something gradual to adjust to, and with services gaining representation in the mix, among other AI trends and the like, it's possible to believe that Apple will gradually advance its net income margin.

While services support the bull thesis, relying so heavily on it can also be seen as a weakness. The App store's high fees are often a point of discussion in a regulatory sense, as well as facing some resistance from large apps, although there's not much choice for them, since everyone wants and needs to be on Apple products. In other words, this segment is very resilient and has good prospects of maintaining this higher CAGR, but still, it's making a relevant part of the thesis depend on not coming up with some alternative (possibly created by some regulation) to the App store, as well as believing that new entrants will continue to subscribe to Apple services and accept the price increases.

Apple's Valuation Is Reasonable

In the last 5 years, there have been some slightly bearish moments in the market, but overall, between 2020 and 2021 there was a moment of high valuation in the stock market due to low interest rates and also euphoria in the market. And even taking this window where the market was more optimistic than pessimistic most of the time, the mean of Apple's forward price-to-earnings was 26.8x. The current multiple is 30.4x, slightly higher than this average, which is already slightly higher than in other periods.

Source: GuruFocus

What needs to be asked is whether there are plausible reasons for this higher premium. Apple benefits from the AI trend, has strong prospects because of its services revenue, and should also achieve margin expansion in the coming years. But this shouldn't result in high growth on a sustainable basis, as the company is already very mature and is unlikely to maintain net income growth above double digit for many consecutive years, although this is possible at EPS due to the high buybacks.

As the forward multiple doesn't say much on its own, trying to forecast the next few years realistically is ideal. Using the market's consensus estimates for 2025, and from then on a 7% growth in revenue every year and a gradually increasing net income margin until it reaches 28.3%, we find a net income of $164 bn in 2030. This huge net income means a price-to-earnings ratio of 20.7x in 2030, an earnings yield of just under 5%.

Source: Author (Kenio Fontes); GuruFocus

In a slightly more optimistic scenario, with revenue growth of 9% and a net income margin of 30% in 2030, we find a net income of $191.3 bn, equivalent to a price-to-earnings of 17.8x and an earnings yield of 5.6%.

Source: Author (Kenio Fontes); GuruFocus

In other words, there is a certain rationality to Apple's valuation. It's not a bubble, but it is a premium valuation for a premium company. For some investors it may make sense to expose themselves to such a solid company in order to have an earnings yield of 4% in a few years' time, since there is the possibility of positive surprises and the prospect that this will increase consistently every year, even if slowly. Despite this, I still think it's a low-risk premium since there's a possibility that instead of a revenue CAGR of 7%9%, this will be maintained in the mid-single digits. For margin expansion, I see it as a more predictable trend, since the revenue mix tending towards services seems almost certain to occur.

The Bottom LineIn view of the information above, Apple continues to prove to be a robust company, with the right tendencies to generate shareholder value, through margin expansion and a continued (albeit slow) evolution of revenue. The question is the generation of value in relation to its high price, which in some more conservative scenarios, ends up sounding low and revealing a low-risk premium.

This content was originally published on Gurufocus.com

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.