Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway (NYSE:BRKa) (NYSE:BRK.A)(NYSE:BRK.B) recently cut its stake in tech giant Apple Inc. (NASDAQ:AAPL) by nearly 50%, reducing its holdings from 790 million shares to 400 million shares according to the company's second-quarter earnings report. This move is quite unusual for Buffett, who is known for holding stocks for the long term, signaling that he may perceive a disconnect between Apple's valuation and its future growth potential.

In my view, while Apple remains a high-quality company, it currently faces several challenges. The lack of meaningful innovation, coupled with inconsistent profitability and cash flow growth, raises concerns about its future prospects. Although the tech company's recent artificial intelligence announcements were well-received by Wall Street, driving the stock price higher as if a "supercycle" had already begun, I believe the financial impact of these new offerings will be limited.

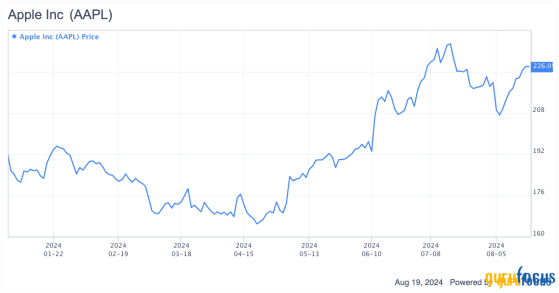

Additionally, despite the Buffett-induced selloff, Apple's stock has managed to recover, outperforming the S&P 500 with an approximately 17% gain year to date compared to the S&P 500's 12.70% increase. However, owning an overpriced, slow-growth blue-chip stock like Apple, especially with interest rates hovering between 4% and 5%, arguably makes little financial sense, even when considering the strength of the brand.

Let's delve a bit deeper to further explore my perspective on the stock.

WWDC AI announcement and execution risksAt the recent Worldwide Developers Conference, Apple announced its ambitious plans to integrate AI technology across its platforms, including iOS 18, iPadOS 18 and MacOS Sequoia, through a partnership with OpenAI's ChatGPT. This initiative, dubbed Apple Intelligence, aims to enhance Siri by using personalized data to generate tailored responses, potentially positioning the virtual assistant as an alternative search engine.

While this represents a significant milestone for the company, there are notable execution risks. For instance, the success of Apple Intelligence may depend heavily on an upgrade cycle, which could be hindered by the current bleak economic environment and looming recession risks. Additionally, with smartphone demand projected to grow modestly at just 4% in 2024, the feasibility of a massive AI-driven upgrade cycle in the near term seems questionable. Further complicating matters, regulatory challenges, particularly the European Union's Digital Markets Act, could limit access to Apple Intelligence features, raising concerns about user privacy and data security.

Challenges in the Chinese marketChina, a key market for Apple, accounting for approximately 19% of total sales, has been a point of concern due to continuous revenue declines. Revenue for the region fell to $14.70 billion (down 7% year over year) in the third quarter, following an 8% year-over-year decline in the second quarter. This downturn underscores Apple's dependence on iPhone sales and its vulnerability to market fluctuations in China.

The disruption in Apple's manufacturing operations in late 2022 due to protests and Zero-Covid restrictions slowed iPhone production, compounding the challenges posed by increased competition from Huawei and Samsung (XKRX:KS:005930). As a result, the company lost its position as the world's largest smartphone provider in the first quarter of 2024, with Chinese manufacturers also making significant strides in technology, enabling them to compete effectively on a global scale. Further, Apple's AI tools face significant regulatory and market obstacles, particularly in China, where ChatGPT is not operational, and there are increasing calls to limit the use of American-made AI models - which could impede its efforts to revive growth in one of the largest consumer markets.

Uncertain AI and other growth prospectsWhile I acknowledge the introduction of Apple Intelligence could potentially strengthen the company's ecosystem, there are legitimate concerns about whether the upside from generative AI tools will be sufficient to justify the company's current valuation and offset the other risks that have been impacting the business. This situation raises the possibility that Apple's shares might be in bubble territory, especially given the numerous challenges it faces and the uncertain impact of its AI initiatives. This concern could have also been another contributing factor to Buffett's recent exit.

As Apple remains a key gatekeeper in the digital world, investors appear eager to reward it for its foray into generative AI. However, the critical question is whether the recent breakout in the stock is actually supported by fundamentals, or if we are witnessing a bull trap. Additionally, Apple has shown revenue declines in several key segments, with the Vision Pro being the most recent example of overhyped expectations failing to translate into meaningful near-term revenue. My prediction that Apple would suspend research and development on the Vision Pro 2 due to poor sales has already come to pass. The central issue now is whether the long-term growth potential from AI will be enough to offset these underlying fundamental challenges.

A closer look at growth, margins and cash flowOn Aug. 1, Apple released its third-quarter results, marking a return to sales growth after a period of declines. The company reported $85.80 billion in sales, representing a 4.90% year-over-year increase that aligned with market expectations. This return to growth is notable as it had not reported growth approaching 5% since the fourth quarter of 2022. However, while it is encouraging to see the company return to this growth benchmark; the low single-digit increase highlights just how optimized and mature its existing business has become.

The company's peak market share is evident in its iPhone segment, which saw a 1% year-over-year decline in revenue during the third quarter, continuing a trend of stagnation outside the Covid-19-induced surge in 2021. Although Apple sold 45.60 million smartphones (up 6% year over year) in the third quarter, the total smartphone market expanded by 12% to 288.90 million units. Consequently, Apple's share of the smartphone market shrank to 16%, down 1 percentage point from the previous year. The pressures in China, where sales have been declining, are a significant factor behind this as Apple faces intensifying competition from local manufacturers like Huawei and Oppo.

Despite the challenges in its hardware categories, Apple continues to find growth in its Services segment. In the third quarter, Services reached an all-time revenue high of $24.20 billion, representing a 14% year-over-year growth rate. This segment includes offerings like AppleCare, AppleOne, Apple TV+, iCloud, Apple Music, Apple Pay and other non-hardware-related revenue streams. The increasing adoption of these services is a bright spot for Apple, now accounting for 28% of total revenue, up from 26% a year earlier. However, it is important to note the company's hardware sales are a key driver for its Services revenue. As hardware revenue continues to decline, I believe we will inevitably see a slowdown in services revenue growth. Therefore, I don't think the Services segment can sustainably offset the declines in product revenue in the long run.

I remain bullish on Apple's margins, particularly due to the strong performance of its Services segment. Last quarter, the unit accounted for over 45% of the company's total gross profits, and with gross margins in this segment reaching an impressive 74%, the overall margin mix is significantly boosted. As Apple continues to generate revenue from its services, I expect margins to remain at these levels, barring any significant deterioration. However, there are potential risks to margins (albeit relatively small), especially with the hype surrounding new product launches that fail to meet expectations. For instance, the Vision Pro has not lived up to its initial sales forecasts. The high investment required to make this segment profitable is reminiscent of Meta's (NASDAQ:META) Reality Labs, which posted a quarterly loss of $3.90 billion. Apple could face similar expenses as it builds out the Vision Pro ecosystem, potentially impacting overall profitability.

Apple's free cash flow yield is another area of concern and could be one reason behind Buffett's decision to reduce his stake. Currently, the company's FCF yield stands at around 3%, which, in my view, is unimpressive compared to risk-free cash yields currently at 5% This is a stark contrast to when Buffett began building his Apple position in 2016, a time when its free cash flow yields exceeded 11% and risk-free cash yields were below 2% (based on one-year Treasury rates). The current setup is the exact opposite, making Apple a far less attractive investment from a cash flow perspective. Moreover, when Berkshire Hathaway acquired Apple shares (NASDAQ:AAPL), the annual cash dividend yield was 2.20%, roughly equivalent to the S&P 500 index average and significantly better than one-year Treasury rates in 2016. Today, however, the dividend yield is just 0.44%, compared to cash investments offering closer to 5% returns. In my view, buying into Apple at these levels, given the equity price risk and minimal dividend yield, is not a sound investment strategy.

Valuation analysisApple is undoubtedly a high-quality company, but even for top-tier players, it is crucial to carefully assess the stock's valuation.

Over the last 15 years, Apple's valuation has rarely been as high as it is today, with the exception of a brief period during the pandemic when tech stocks surged due to exceptionally low interest rates. Now, with interest rates at multiyear highs, Apple's forward price-earnings ratio of around 30 is striking, nearly double its pre-pandemic average. This elevated valuation is particularly surprising given the company's ongoing challenges with weak revenue growth and the recent reduction in Buffett's stake.

If Apple's AI innovations fall short of the high expectations set by the market, the stock could face a significant correction from its current multiple. Should Apple revert to its pre-pandemic average price-earnings ratio of approximately 17.50, the share price would drop to around $132about 42% lower than its current level. With the iPhone segment, its key revenue driver, encountering significant headwinds, any negative reception of the next iteration could catalyze a substantial correction. Much of Apple's gains over the last decade have been driven by multiple expansions, and it's uncertain whether this elevated valuation is sustainable in the long term, especially considering its declining smartphone market share.

From a discounted cash flow valuation perspective, minimal earnings growth is anticipated for 2024, with an expected acceleration in 2025 and beyond, driven by the release of new iPhones and the anticipated positive impact of AI offerings.

Source: valueinvesting.io

Ebitda is projected to gradually increase in the forecasted period, with margins slowly improving as Apple expands into the generative AI field. The DCF model uses a weighted average cost of capital of 9%, which is close to the market's average cost of capital, and a terminal growth rate of 4%. Even under such a bullish scenario, the model yields a fair value of only $170 per share, which represents a downside of approximately 25% from current levels. This suggests that despite the growth opportunities associated with Apple Intelligence, the company's shares could be in bubble territory following their recent rapid appreciation.

Final thoughtsWhile Apple remains a high-quality company, its current valuation, coupled with declining sales in critical segments and competitive pressures, suggests caution. The integration of AI technologies, though promising, may not sufficiently offset these fundamental challenges.

With Apple trading at an elevated valuation and its buyback program becoming less efficient as a result, it might be wise to lock in gains and await a more favorable entry point in the future. Given its unimpressive growth numbers, I believe we will have an opportunity to buy Apple at or below its fair value within the next 12 to 24 months. The downside risks for Apple stock are significant, so I believe investors should exit with Buffett at the current price. However, I do not recommend shorting.

This content was originally published on Gurufocus.com