Gold has emerged as the best-performing precious metal in 2023 amid economic uncertainty and geopolitical tensions that have fueled the demand for the yellow metal. The price of gold has risen by 10.60% since the start of the year.

By contrast, platinum and palladium have performed poorly, with declines of 2.65% and 15.88% respectively. Yet, both should gain significant traction due to the increasing pressures surrounding climate change.

Known for their unique catalytic properties, high melting points, and purity, they are used in a wide spectrum of medical, industrial and electronic applications, ranging from the automotive sector, and electric fuel cell technology to luxury goods.

Furthermore, analysts expect a shortage in the platinum market this year, due in part to the continued long-term decline in South Africa’s supply. South Africa has more than 80% of the world’s platinum reserves and remains the world’s largest producer of platinum group metals (PGMs including platinum, palladium, rhodium, iridium, osmium, and ruthenium).

The recovery of the automotive sector could benefit these precious metals, which are widely used in the manufacturing of catalytic converters. That said, platinum has a much more promising future than palladium. It is increasingly being substituted for the latter in the automotive industry as it is cheaper. Due to its unique chemical and physical properties, platinum is also used in both electrolyzers to produce hydrogen and in fuel cells which can power electric vehicles.

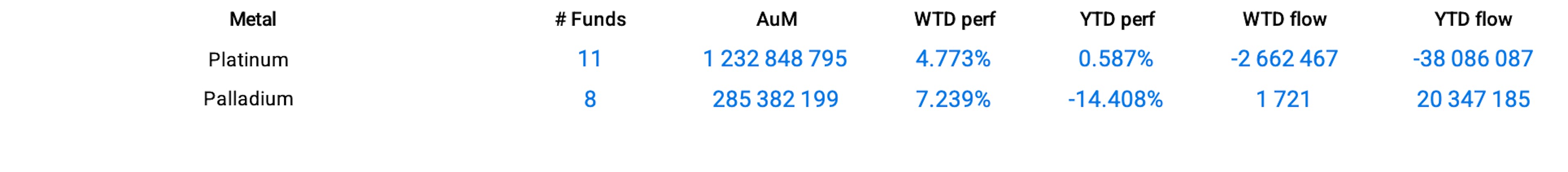

Exchange-traded funds (ETFs) that track the platinum and palladium price indexes saw strong gains last week, with 9 funds out of the 50 best-performing ETFs of the week being platinum and palladium funds. On average, platinum funds were up 4.77% while palladium funds jumped 7.24%.

Group Data

Funds Specific Data