The gyrations in the foreign exchange market spurred by the panicked response to Chinese machinations may have been the last spasm before the summer doldrums grip the dollar. The Dollar Index had its worst week last week in nearly two months, but all that really happened was that it moved to the lower end of its ranges. The recent string of US economic data suggests that Q2 growth is closer to 3.0% than the 2.3% of the most recent estimate, and that Q3 has begun on firm footing.

The speculative market and many investors are long dollars in anticipation of a Fed hike in September. Even some who harbor strong doubts do not want to have to explain how they were short dollars when the Fed hiked rates. They seek, as the saying goes, to "minimize their maximum regret." This does not rule out dollar losses, but they are likely to prove limited in magnitude and duration.

It is also possible for shocks to disrupt, but Greece seems well on its way of a third assistance program. Although few if any give it high odds of succeeding to put the country on a more competitive and sustainable path, it no longer poses an existential risk. This can change but is unlikely to in the next several weeks. After disrupting the capital markets last week, Chinese officials in word and deed appear to be stabilizing the market. The economic data calendar is also relatively light, and in any event, it is unlikely to dramatically alter macro-views.

Specifically this means that the euro's range following China's move may contain the bulk of the price action in the days ahead. That range is $1.1025 to $1.1215. The technical indicators are somewhat supportive, but the top seems fairly secure.

The dollar's story against the yen is similar. The range traced out following the China's move was JPY123.80 to almost JPY125.30. Japanese exporters are among the forces capping the upside, frustrating many who think the yen should be weaker on ideas the BOJ will expand QE.

Sterling is more resilient. The prospects for a BOE hike are supporting sterling though we continue to think it is more than six months away. Sterling finished near the upper end of the week's range. Above $1.5660, where several technical indicators converge. The $1.5700 resistance needs to be overcome to signal a move in into the $1.5800-$1.5900 band.

The Reserve Bank of Australia appears to have signaled that, at least for the period ahead, it will rely on the currency to provide the stimulus the economy still requires rather than interest rates. Ironically this has helped support the Australian dollar, which recovered quickly from the China-induced sell-off to new multi-year lows near $0.7200. Indeed, the recovery was so quick the technical indicators such as the RSI could not even register it, leaving a bullish divergence. The upper end of the range is seen near $0.7450 and then $0.7500. This should be sufficient to cap it.

The Canadian dollar's technical tone looks constructive, but we are suspicious. The five-day moving average has fallen below the 20-day average. The MACDs have trended lower, and the RSI has begun firming. However, the two-year interest rate differential quickly recouped the mid-week slide, and the US premium posted the highest weekly close since 2007. Oil prices bounced after setting new six-year lows before the weekend, but the Canadian dollar still struggled to gain traction. The CAD1.2950 area marks the lower end of the US dollar's range. The CAD1.3200 area marked the multi-year high set earlier this month, initial resistance is seen in the CAD1.3100-20 band.

The October crude contract is most active now. It fell to almost $42.15 before reversing higher into the weekend. With the US rig count rising again (six out of the past seven weeks), refinery difficulties, limited storage capacity, and still high output, it is hard to see what can emerge to lift prices. Bounces then still look to be short and shallow. Technically, the $44.00-$44.50 area may be a potential cap.

We had thought that if the US 10-Year Treasury yield broke the 200-day moving average it could fall toward 2.00%. On the event, it fell to 2.04% and quickly recovered. It managed to test the 20-day moving average near 2.21% before the weekend. This area is technically significant, but it requires a move above 2.30% to given any hope of seeing 2.50% again.

Once again the S&P 500 break of the 200-day moving average provided to be a bottom, not a top. The 200-day moving average now comes in near 2076. On the upside, 2100-2110 is the first important hurdle.

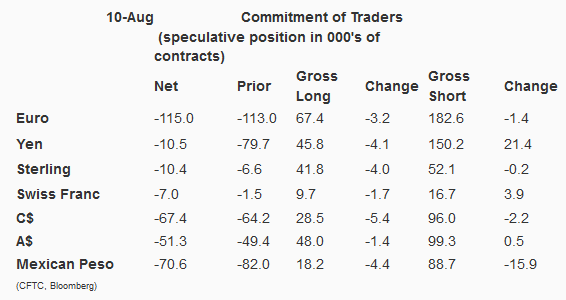

Observations based on speculative positioning in the futures market:

1. There were two significant gross currency adjustments (10k+ contracts) in the reporting week ending August 10. The gross short yen position jumped 21.4k contracts to 150.2k. It has increased by nearly 50% over the past month. The gross short Mexican peso position was slashed by 15.9k contracts, leaving 88.7k.

2. The broad theme was the reduction of exposures. Of the 14 gross positions we track, 11 were cutting positions. The gross short yen position was already cited. The gross short franc position increased by 3.9k contracts to 10.7k. The gross short Australian dollar position rose by 500 contracts to 99.3k.

3. One development that seems largely unappreciated is that the net short euro position has been halved since late-June. It stands at 115k contracts, having peaked at 227k contracts. The gross short position topped out in March near 271k contracts. It stands now at 182.5k contracts. The gross long position bottom in late-May near 38.7k. Now it stands at 67.4k. The bears still dominate, but the positions are not nearly as extreme.

4. After switching from short to long a few weeks ago, the net long US 10-year Treasury position continued to grow. It increased by nearly 50% from 32.5k contracts to 47.8k. This was a function of more longs being established. The gross longs increased by 19.8k contracts to 500.2k. The bears sold into the bounce and increased their shorts 4.4k contracts to 452.4k.

5. The net long speculative long position in light sweet crude oil continued to fall. It fell 21.3k contracts to 225.8k. It late May, it was near 350k. During this reporting period, the longs barely grew at 478.9k contracts. The bears added 21.4k contracts to their short position, raising it to 253k contracts.