Arista Networks (NYSE:ANET) is a leading provider of cloud networking solutions for data centers. The company’s core products include high-performance switches, routers, and network software. Arista Networks is particularly strong in the Ethernet switch market, serving most major CSPs (cloud service providers), including Microsoft (NASDAQ:MSFT) Azure, Meta (NASDAQ:META), and Amazon (NASDAQ:AMZN) Web Services. The company went public in 2014 and has been a compounding machine since then. However, at the current valuation, the market has priced in very optimistic projections.

Business description and competitive landscape

Arista Networks was founded in 2004 by industry veterans Andy Bechtolsheim, Ken Duda, and David Cheriton and headquartered in Santa Clara, California. Through internal R&D efforts and a series of acquisitions, the company became a leading data-driven cognitive cloud networking company. Unlike traditional enterprise data center networks, which use a 3-tiered hierarchical architecture and stack multiple layers of hardware in the networks, Arista’s software and cloud-based programmable networks rely much less on hardware and enable faster and more scalable networks.Arista’s revenue is segmented by three product types. Cloud Networking Switches account for roughly 60-66% of the consolidated revenue. Arista’s cloud networking switches are optimized for AI workloads and are critical for the GPU clusters used by AI data centers. The second type of product offered by Arista Networks is Enterprise Campus & Routing, which accounts for about 20-25% of the consolidated revenue. This product category focuses on corporate networks and WAN solutions such as Wi-Fi routers. Lastly, Arista offers Software and Services, which include CloudVision subscriptions, EOS software licenses, and support. Software and Services has a higher gross margin and a faster growth rate.

In terms of end markets, Arista’s largest and most important end market is the Cloud and IT market, which accounts for 45-50% of the consolidated revenue. Currently Arista serves 7 of the top 10 hyperscalers in the U.S. including Microsoft Azure, Meta, and Amazon Web Services. Enterprise and Government is the second largest end market. Arista serves major Government agencies such U.S. Department of Defense with its Enterprise Campus & Routing products. Arista’s third largest end market is the Financial industry. Financial services companies such as J.P. Morgan and Citadel use Arista’s high-performance switches for algorithmic trading.

Given the product nature of Arista Networks, it is not surprising that North America is the most important geographic region for the company, accounting for 75-80% of the consolidated revenue. EMEA and Asia Pacific represent 20-25% of the group revenue and are new growth markets for Arista Networks.

In the enterprise networking market, Arista’s biggest competitor is Cisco Systems (NASDAQ:CSCO). Cisco is the largest player with very strong position in legacy enterprise networking accounts. However, due to the large legacy business, Cisco is much less agile in adopting software and cloud-based solutions. Hewlett Packard Enterprise (HPE) and Juniper Networks (NYSE:JNPR) are two other competitors of Arista Networks. Hewlett Packard Enterprise has announced the acquisition of Juniper Networks. The acquisition is pending due to antitrust reviews by the Department of Justice.

Compared to its competitors, Arista Networks possesses two important competitive advantages. Firstly, Arista’s products have better performance and lower total cost of ownership (TCO) than its competitors, especially for high-speed Ethernet Switching. The company estimates that its product solution can achieve 30-40% lower total cost of ownership (TCO) over 5 years. In addition, Arista has established strong relationships with hyperscale cloud providers, including Amazon Web Service, Microsoft Azure, and Google (NASDAQ:GOOGL). The company’s products and solutions are used by 7 of the top 10 largest CSPs.

Financial and valuation analysis

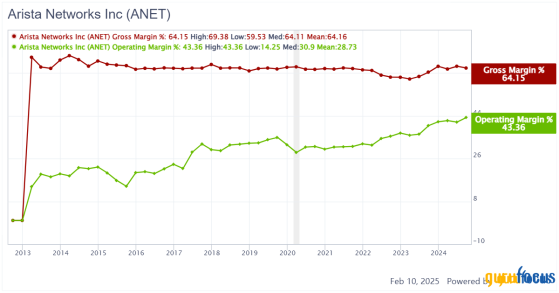

For the trailing twelve months, Arista Networks generated revenue of roughly $6.6 billion. The gross margin improved to 64.4% as the higher-margin AI and Software business experienced faster growth. Arista Networks’ operating margin reached 42.11%. R&D spending as a percentage of revenue declined to 14%, and SG&A expense as a percentage of revenue declined to 8.3%. For the most recent quarter, Arista Networks’ gross profit margin declined sequentially a little bit to 64.1%%, while operating margin reached historical high level at 43.4%.Over the past 5 years, the company’s revenue has grown at an annual rate of 23%. The company’s gross margin has been relatively stable between 51% and 67% during the past decade, while its operating margin and net margin continued to increase year after year. Arista Networks operates an asset-light business model. The company spent very little on capital expenditure and generated very strong free cash flow.

If we use a 10% discount rate and optimistically assume that Arista Networks can grow its free cash flow at 25% over the next 10 years and 4% afterwards, the implied current intrinsic value per share is $120. At the current price of $119, Arista Networks’ stock price is almost fairly valued and offers no margin of safety. Using the reverse DCF tool, Arista Network would need to grow its FCF per share at nearly 24.8% a year to justify today’s valuation. This might be achievable, given the company’s track record.

Risk analysis

Arista Networks faces a few risks. Firstly, competition will likely to increase in the future from both existing competitors and new competitors. For instance, Cisco acquired Spline in order to expand its cloud portfolio. Nvidia (NASDAQ:NVDA) also entered into the AI networking space with the launch of its Spectrum-X platform, which has received very positive feedback from the GPU-optimized networks.Secondly, Arista Networks’ growth is very dependent on the hyperscalers. The sudden rise of Deep Seek is raising significant concerns over the necessity of heavy AI capex spent by AWS, Microsoft, Meta, and Google. For 2025, these hyperscalers are on track to increase AI capex to well over $300 billion. However, it is expected that the AI infrastructure capex will slow down at some point.

Last but not least, from a supply chain perspective, Arista Networks relies on TSMC for advanced chips and outsources 90% of manufacturing to Foxconn (SS:601138) and Jabil. In case of severe supply chain disruption, Arista Networks may have trouble delivering its products.

Conclusion

Arista Networks is well-positioned to capitalize on the AI networking infrastructure boom. Meanwhile, the company’s asset-light business model leads to higher margin improvement due to very high operating leverage. However, its premium valuation has most likely priced in very rosy growth expectations. At the current level, the stock is fairly valued. Investors are better off standing on the sideline and waiting for a better price.This content was originally published on Gurufocus.com