- Despite losing 20% yesterday, Arm stock remains up nearly 60% in 2024 amid AI market hype.

- Strong sales of ARMv9 chips boosted performance, though analysts suggest the stock is overvalued.

- Let's take a look at the company's fundamentals with InvestingPro to understand whether it is worth the hype.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

Shares of British semiconductor and software design company Arm Holdings (NASDAQ:ARM) have been on a roller on Wall Street this year. Despite the Cambridge-based company's 20% drop yesterday, the microprocessor manufacturer is still up nearly 60% in 2024.

In fact, since the company's heavily-priced $51 IPO on September 14th, Arm has more than doubled its market cap.

The obvious factor behind Arm's incredible performance is the broader AI hype driving the market narrative this year. In fact, the company has been taking several steps towards improving and monetizing its AI offerings, such as the adoption of AI design in all its chips.

But there's more to it. In fact, on the back of solid sales of its latest generation chip, ARMv9, the company has been able to post earnings and outlook beyond expectations. This has even led Morgan Staley to recently more than double its price target for the chipmaker.

But as the company looks set to keep drawing market attention, the question preying on investors' minds is: is it worth the hype?

Let's take a close look at the company's fundamentals with InvestingPro to understand where we stand right now.

Arm's Fundamental Analysis

Between October and December 2023, the company recorded $824 million in revenue (+14% year over year), surpassing analysts' expected revenue of $761 million by 8%.

Furthermore, Arm has raised expectations for growth. The company anticipates achieving revenue between $850 million and $900 million between January and March, with earnings per share (EPS) of 30 cents.

On February 2nd, the experts' forecast from InvestingPro was stuck at 20 cents per share for the next quarter.

But what is the fair value of the British company?

According to analysts and valuation models, Arm's shares, with a market capitalization of over $153 billion, are overvalued.

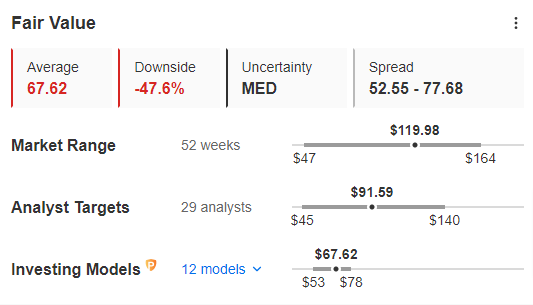

Source: InvestingPro

InvestingPro's Fair Value, summarizing 12 recognized financial models adapted to Arm's specific characteristics, stands at $67.62, or 43.6% less than the current price.

Analysts' consensus estimates are a bit more optimistic, albeit still pricing a 23.6% drop in share price from current levels, setting the target price at $91.59 per share.

However, it should be noted that some individual analysts are more optimistic about Arm. On top of the aforementioned Morgan Stanley (NYSE:MS) upgrade, Jeff

eries has also raised its stock forecasts, setting the target price at $115, up from $98.

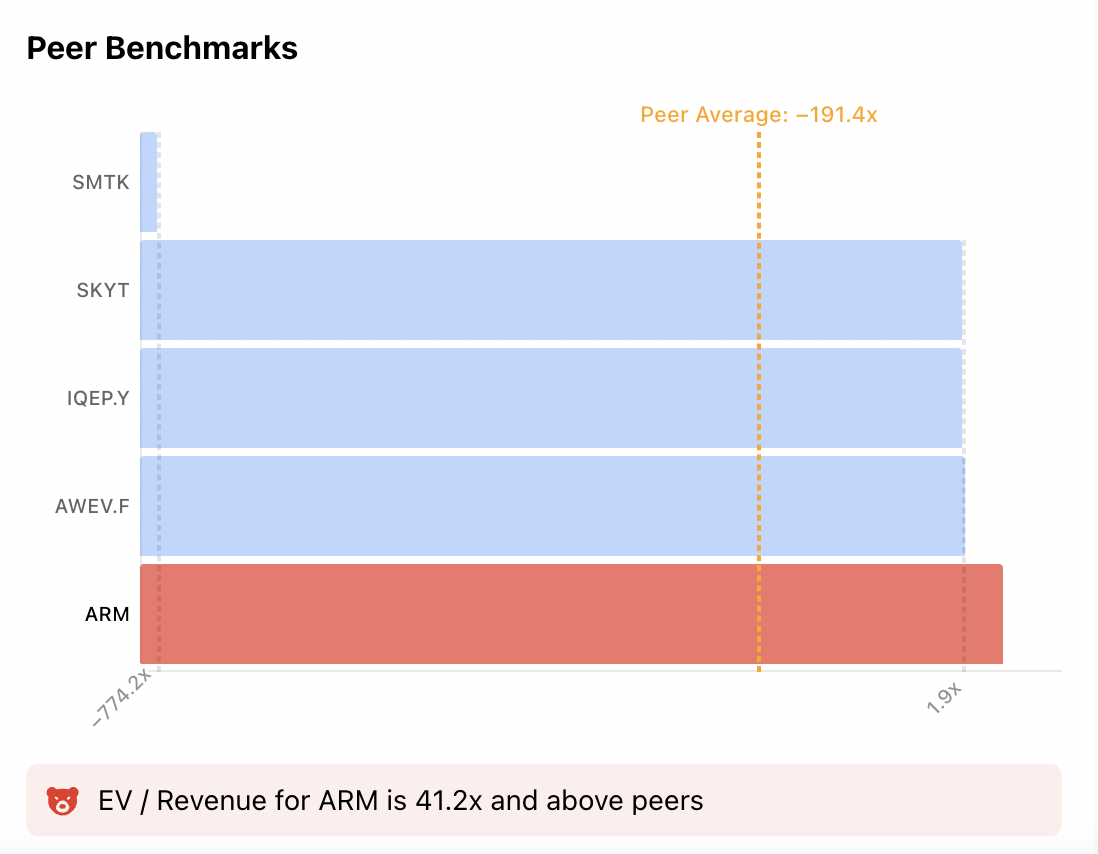

Additionally, utilizing the ProTips offered by InvestingPro, we can observe that the companies revenues compared to the stock price are currently much higher than the ones of Arm's peers. Chart below shows the sector's EV/Revenue comparison.  Source: InvestingPro

Source: InvestingPro

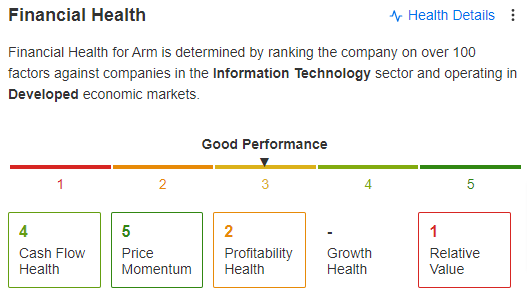

More on the company's risk profile, Arm has a solid financial health level, with a score of 3 out of 5.

Earnings per share forecasts for Arm Since September, analysts have changed their opinions several times regarding the company's earnings per share.

However, since Arm's IPO, EPS estimates have increased by 17%, from $0.26 to $0.30. In the last 90 days, there have been 15 upward revisions and none downward.

Source: InvestingPro

Bottom Line

In conclusion, Arm's stock has undoubtedly delivered great satisfaction to investors so far, with excellent returns since the IPO.

However, despite many analysts raising their EPS forecasts and the company enjoying good financial health, various indicators highlight that Arm's shares are in overbought and overvalued territory.

***

As readers of our articles, you can take advantage of our stock strategy and fundamental analysis platform InvestingPro at a reduced price, with a 10% discount on the annual plan.

You can discover which stocks to buy and sell to outperform the market and increase your investments, thanks to a range of exclusive tools:

- ProPicks: stock portfolios managed by a combination of artificial intelligence and human expertise, with proven performance.

- ProTips: digestible information to simplify complex financial data in a few words.

- Fair Value and Health Score: 2 synthetic indicators based on financial data providing an immediate insight into the potential and risk of each stock.

- Advanced stock screener: Find the best stocks based on your expectations, considering hundreds of metrics and financial indicators. Historical financial data for thousands of stocks: So fundamental analysis professionals can delve into all the details.

And many more services, not to mention those we plan to add soon! Don't face the market alone: join the thousands of InvestingPro users to make the right decisions in the stock market and boost your portfolio, whatever your profile or expectations.

Click here to subscribe with a Super discount valid for annual Pro+ subscriptions!

Don't forget your free gift! Use coupon code GOPROCANADA at checkout to claim an extra 10% off on the Pro yearly and bi-yearly plans.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.