By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

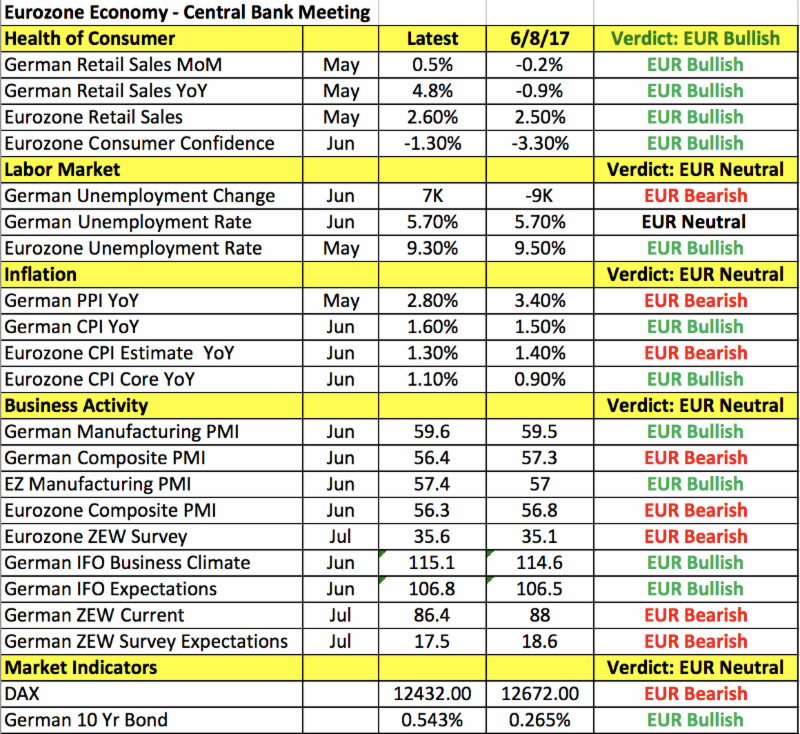

Just hours ahead of the European Central Bank's monetary-policy announcement saw profit taking drive EUR/USD off its highs. Hawkish comments are not a done deal so we could see further unwinding of long euro traders ahead of European Central Bank President Mario Draghi's press conference on Thursday. The ECB is widely expected to leave interest rates and its asset-purchase program unchanged but economists and investors are divided on the degree of Draghi's hawkishness. Here are the facts: we know that Mario Draghi is thinking about changing policy from an accommodative to neutral stance but that was when EUR/USD was trading at 1.12 and not 1.15. We also know that the ECB is not happy with how much the euro has risen off these comments because a day later, when EUR/USD rose from 1.12 to 1.14, they said the market misinterpreted Draghi's guidance. The Eurozone economy is on the path to recovery but as shown in the table below, inflation is low, recent activity is mixed, investor confidence has fallen and financial conditions tightened. German bond yields doubled since ECB's last meeting in June and the euro is at 1-year highs. For an export-dependent economy with low inflation, the rise in the currency reduces the pressure on the central bank to remove policy accommodation. But the euro is still cheap on a 5- or even 10-year basis and there's no doubt that Draghi is in the same head-space as Yellen, Poloz and Carney — who all believe that it's time to normalize monetary policy.

So where does that leave the euro going into this month's monetary-policy meeting? We think the ECB will disappoint. If it talks taper now, the EUR/USD would break 1.16 and probably rise as high as 1.20 ahead of the September rate decision, when the ECB forecasts will be released and when we expect the central bank to reduce asset purchases. It is in ECB's best interest to halt the one-way move, ease the euro off its highs by repeating that inflation is not on a self-sustainable path and then gradually set expectations for taper from a lower base. That way, instead of driving the euro to 1.20 on hawkish comments on Thursday and then setting it on a course to 1.25 when ECB officially reduce asset purchases, it could take some of the steam out of the rally now and manage it higher later. Ultimately, ECB policy is moving in the direction of less accommodation so even if the euro dips, it's a buy into the September rate decision.

Stronger housing-market numbers did not stop investors from selling dollars. Investors took USD/JPY to lows despite larger-than-expected increases in housing starts and building permits. Even a mild uptick in U.S. rates failed to help the currency, which broke through the 50-, 100- and 200-day SMAs. Having rebounded off its lows by the end of the NY session, USD/JPY is now trading at a very precarious level — it can either hold support near 111.70 or it could extend its losses down to 110.50. While the Bank of Japan's Wednesday-night rate call could decide the fate of USD/JPY, no surprises are expected from the central bank. The only change it could make is to lower its inflation forecast, putting BoJ further away from bringing inflation back to target. If the BoJ drops its CPI forecast, it could be enough to trigger a relief rally in USD/JPY. It won't, however, stop the dollar from falling as the market loses confidence in the Fed's optimism. Jobless claims and the Philadelphia Fed Manufacturing Index are scheduled for release Thursday and there's a good chance that manufacturing in the Philadelphia region slowed last month, just as it did in New York.

Thursday will also be a big day for sterling with UK retail sales scheduled for release. Ever since Governor Mark Carney suggested that rates could rise, the market started to doubt his hawkishness. Softer data validated the market's skepticism and if retail sales also miss, GBP/USD will find itself well below 1.30. Consumer spending is expected to rebound after falling sharply in May but stagnant prices and low wage growth could dampen spending. Yet selling sterling ahead of the event is not wise because according to a separate survey released by the British Retail Consortium, spending increased in June. This retail-sales report will determine how GBP trades for the rest of the week and the move that transpires will have continuation.

Meanwhile the commodity currencies continued to race higher with AUD/USD closing in on 80 cents and NZD/USD rising to a fresh 8-month high. Whether AUD/USD breaks that level or rejects it hinges entirely on Wednesday night's Australian employment report. Job growth is expected to slow after rising strongly the previous month. The unemployment rate is also expected to move slightly higher. If job growth exceeds expectations on a full-time basis, market momentum should take AUD/USD easily above 0.80. However, if jobs are shed, it could end the rally in AUD/USD. USD/CAD fell to a 14-month low on the back of stronger manufacturing sales and higher oil prices — we continue to believe that the pair is headed 1.25. NZD/USD is moving in lockstep with AUD but the momentum is beginning to ease.