After a period of cooling off its impact on the markets, fear of the coronavirus played havoc on Wall Street again yesterday. Consequentially, the tech heavy Nasdaq had its worst day since early September, dropping by almost 4%.

In times like these, a more comprehensive stock analysis can steer investors in the direction of returns. Rather than looking solely at more conventional factors like fundamental or technical analyses, other metrics can play a key role in determining whether or not a particular stock is on a clear path forward.

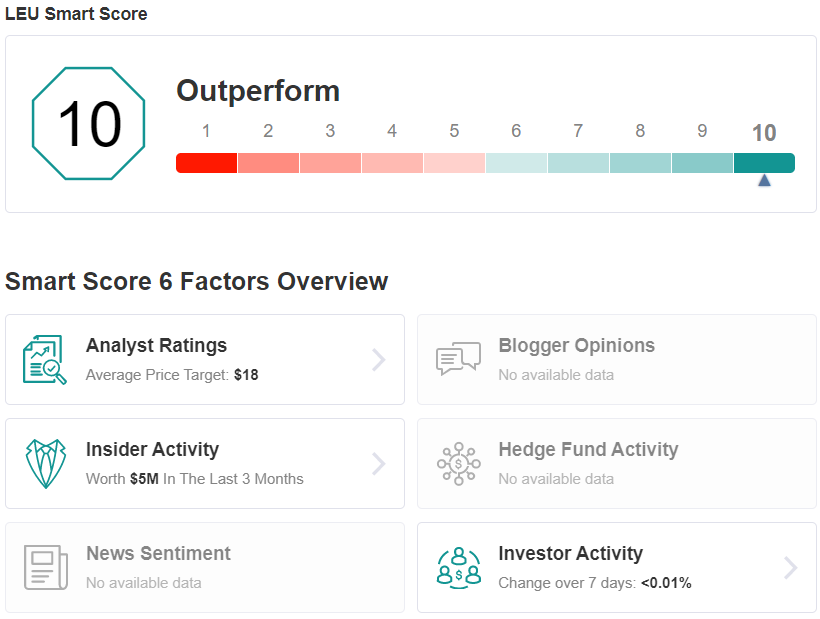

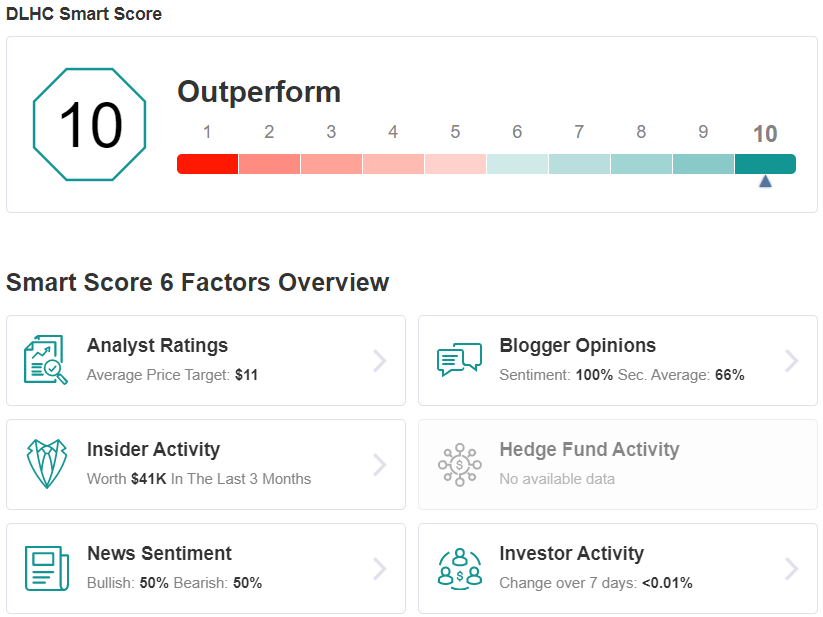

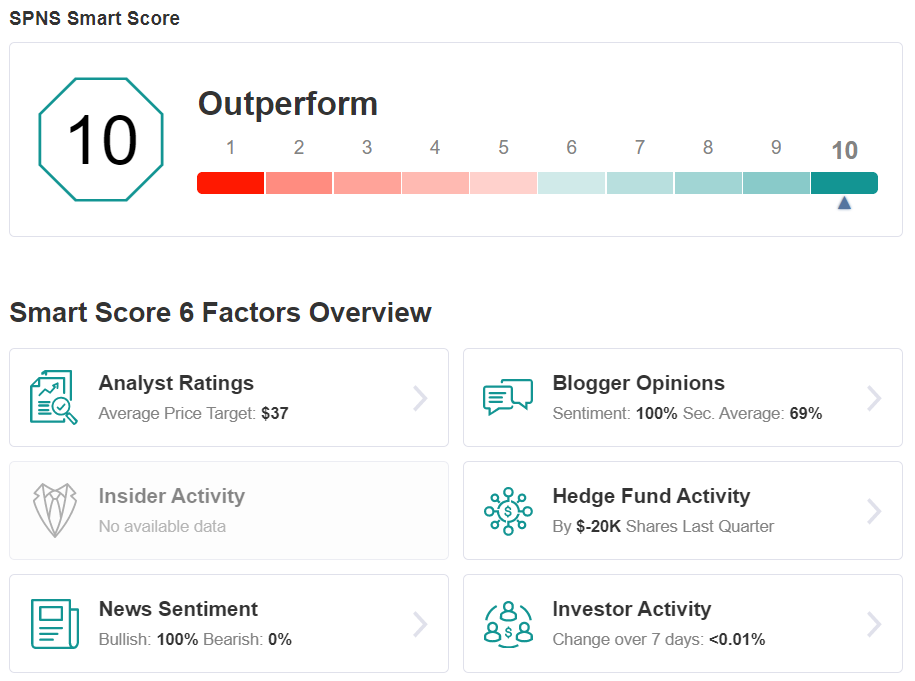

Investing.com offers a tool that does exactly that. The Smart Score measures six key metrics including fundamentals while also taking into account analyst, blogger and news sentiment as well as hedge fund and corporate insider activity. After analyzing each metric, a single numerical score is generated, with 10 being the best possible result.

Using the Best Stocks to Buy tool, we were able to pour through the platform’s database, filtering the results to show only the names that have earned a “Perfect 10” Smart Score. We found three that fit the profile. Let’s jump right in.

Centrus Energy Corporation (LEU)

First on the list is Centrus Energy (NYSE:LEU), a company whose niche is shown by its stock ticker. Centrus is a supplier of ‘low enriched uranium,’ or LEU, for the commercial power market. LEU is the fuel used in civilian sector nuclear power plants. Centrus has a global customer base, and an order-book that’s filled out to 2030. In addition to producing and supplying LEU for power generation, Centrus offers expertise in uranium handling and nuclear fuel design, and provides tritium for the US Navy.

After seeing revenues dip in Q1 this year – no surprise, since most of the world’s economies dipped – Centrus reported a sequential gain in Q2’s top line. Revenues came in at $75.7 million, with the net income reported at $33.7 million. The net income was far ahead of the $15.6 million net loss registered in the year-ago quarter. In line with the strong results, LEU shares have gains 44% year-to-date.

Among LEU’s fans is Roth Capital analyst Joe Reagor, who rates the stock a Buy and gives it an $18 price target. This figure indicates a robust 82% upside potential from current levels.

In his comments, Reagor noted that LEU is best suited as a long-term stock play, writing, “We believe LEU is poised to show revenue and earnings growth over the next two years due to strong contract margins. Additionally, we see long-term growth opportunities beyond 2022… We also note that the company anticipates significant revenue growth over the next two years, which should drive meaningful earnings growth, in our opinion.”

Overall, Centrus has 2 recent Buy reviews on file, making the analyst consensus view of the stock a Moderate Buy. The shares are selling for $9.90 and their $18 average price target matches Reagor’s above.

LEU’s perfect Smart Score is based on three factors: positive analyst sentiment, solid corporate insider activity, and strong fundamentals. (See LEU stock analysis)

DLH Holdings (DLHC)

Our last Prefect 10 stock, Atlanta-based DLH Holdings (NASDAQ:DLHC), is primarily a government contractor agency. The company controls tech subsidiaries that offer tech solutions for business process outsourcing and program management. Clients include the US Departments of Health and Human Services, Defense, and Veterans Affairs, as well as the National Institutes of Health and the Centers for Medicare and Medicaid Services.

Federal Government contracts are good work for the companies that can win them, and DLH’s share price and quarterly results reflect that. The stock has more than doubled so far this year, gaining 116%. The company also seems to have fared well despite the corona crisis. Revenues remained steady from 2H19 through 1H20, ranging between $51 and $54 million. Both the lowest and highest top-line results were recorded in 2020. Earnings gave an even clearer indication of strength, rising to 33% to 16 cents per share in Q1, and staying there in Q2.

Earlier this month, DLH announced the acquisition, in a deal worth $32 million in cash, of IBA, one of the Defense Department’s tech providers in the health sector. DLH funded the acquisition through a draw on its revolving credit facility.

Covering this stock for Canaccord, 5-star analyst Ken Herbert notes positive aspects of the IBA move. He writes, “The acquisition strengthens DLHC’s position with the U.S. Department of Defense (DoD), in particular. We believe the acquisition should continue the push into higher margin, higher growth markets, and it should continue to be well-received by investors.”

Herbert sets a Buy rating on the stock, and adds a $12 price target that implies room for 27% growth in the year ahead. (To watch Herbert’s track record, click here)

The Moderate Buy rating on DLHC is based on 2 recent reviews, both Buys. This is stock is currently priced at $9.07 and its $11.50 average price target suggests it will grow 26% from that level over the next months.

In addition, bloggers show Bullish sentiment on DLHC, as do insiders. All comes down to a perfect Smart Score. (See DLHC stock analysis)

Sapiens International (SPNS)

Last but not least is Sapiens International (NASDAQ:SPNS), which provides software to the reinsurance, property and casualty, as well as the life and annuity insurance spaces. Based on its solid standing in the industry, J.P. Morgan has high hopes for this tech name.

Writing for the firm, 5-star analyst Sterling Auty told clients, “Sapiens has carved out a lucrative segment of the insurance market, where it provides software and services to carriers ranging from the largest reinsurance companies down to tier 4-5 P&C carriers globally. The work that it has done to broaden the product portfolio over the last three years is paying off, and we expect a revenue mix shift toward more consistent and profitable subscription revenue. If this shift materializes, we would expect to see multiple expansion that delivers share price outperformance.”

Unlike some of its competitors, SPNS works with P&C insurance companies while also focusing on life, annuity and reinsurance carriers. According to Auty, this increases the total addressable market to approximately $40 billion, compared to roughly $20 billion for P&C software providers.

“The insurance vertical, and in particular P&C insurance, we believe, is the most attractive vertical segment for software providers based on the very high customer retention rates that create significant lifetime customer value,” Auty explained.

It should be noted that instead of targeting the largest carriers in every region, the company is looking for where the appropriate openings are, market-by-market. On top of this, offering software, cloud solutions and “all of the needed services to create a turnkey single source vendor has helped Sapiens establish the beachhead in segments of the overall market,” in Auty’s opinion.

When it comes to its financial position, from 2015-2019, revenue gained 16%, with it also ramping up in 2019 and 1H20. “We believe the intelligent segmentation of the market is going to allow Sapiens to increase the percentage of revenue coming from subscription software, making growth more durable and profitable moving forward,” Auty mentioned.

In line with his optimistic approach, Auty kicked off his coverage by assigning an Overweight rating and $40 price target. This target brings the upside potential to 47%.

Turning to the rest of the Street, 2 Buys and 1 Hold were published in the last three months. So, SPNS is a Moderate Buy. The $37 average price target puts the upside potential at 28%.

Analysts are not alone in their bullish take on SPNS’s potential. The company's perfect Smart Score indicates a positive news sentiment and even bullish opinions from the financial blogging community. (See SPNS stock analysis)

To find more ideas for stocks trading at attractive valuations, visit Investing Insights.