This article was written exclusively for Investing.com

- Sugar prices approached critical technical resistance

- It is a highly subsidized commodity

- Rising Brazilian real bullish for sugar prices

- If 2008-2011 is the model, watch the upside

- SGG, CANE are sugar ETN and ETF products

Sugar is a critical ingredient in foods consumed worldwide. While the health impact of too much sugar is a rising concern because of diabetes and obesity, the sweet commodity remains a staple. Moreover, sugar is also an input in biofuel. While the US processes corn into ethanol, Brazilian ethanol is sugar-based.

Sugar comes from two sources, cane and beets. Cane sugar comes from the stalks of sugar cane plants that look similar to bamboo and grow in tropical climates. Mature beets contain 17% sugar by weight, while ripened cane has around 15%-20% sugar. Cane sugar accounts for about 70% of worldwide production, while beets supply the other 30%. Beets can grow in non-tropical climates.

Sugar trades in the futures markets on the Intercontinental Exchange ICE. Since the early 1970s, the highly volatile sugar price has traded as low as 2.29 cents to as high as 66.0 cents per pound.

Sugar Prices Approached Critical Technical Resistance

Since reaching a low of 9.05 cents per pound in late April 2020, world sugar futures have made higher lows and higher highs.

Source: Barchart44

As the weekly chart shows, nearby sugar futures reached 20.69 cents in November 2021. After correcting to the 17.58 level in late February 2022, sugar futures have been flirting with the 20-cent level in April. The medium-term technical resistance level stands at 20.69 cents per pound. Sugar put in a bullish key reversal trading pattern during the week of Feb. 28, which took the price back to the 20-cent level.

Sugar Is A Highly Subsidized Commodity

Sugar is an essential ingredient in foods worldwide. Many countries subsidize sugar’s price to encourage production and prevent shortages. The US provides sugar growers with subsidies. While July ICE world sugar futures #11 were at the 19.71-cents-per-pound level on Apr. 20, US subsidized sugar futures #16 were trading at a substantial premium to the world free-market price.

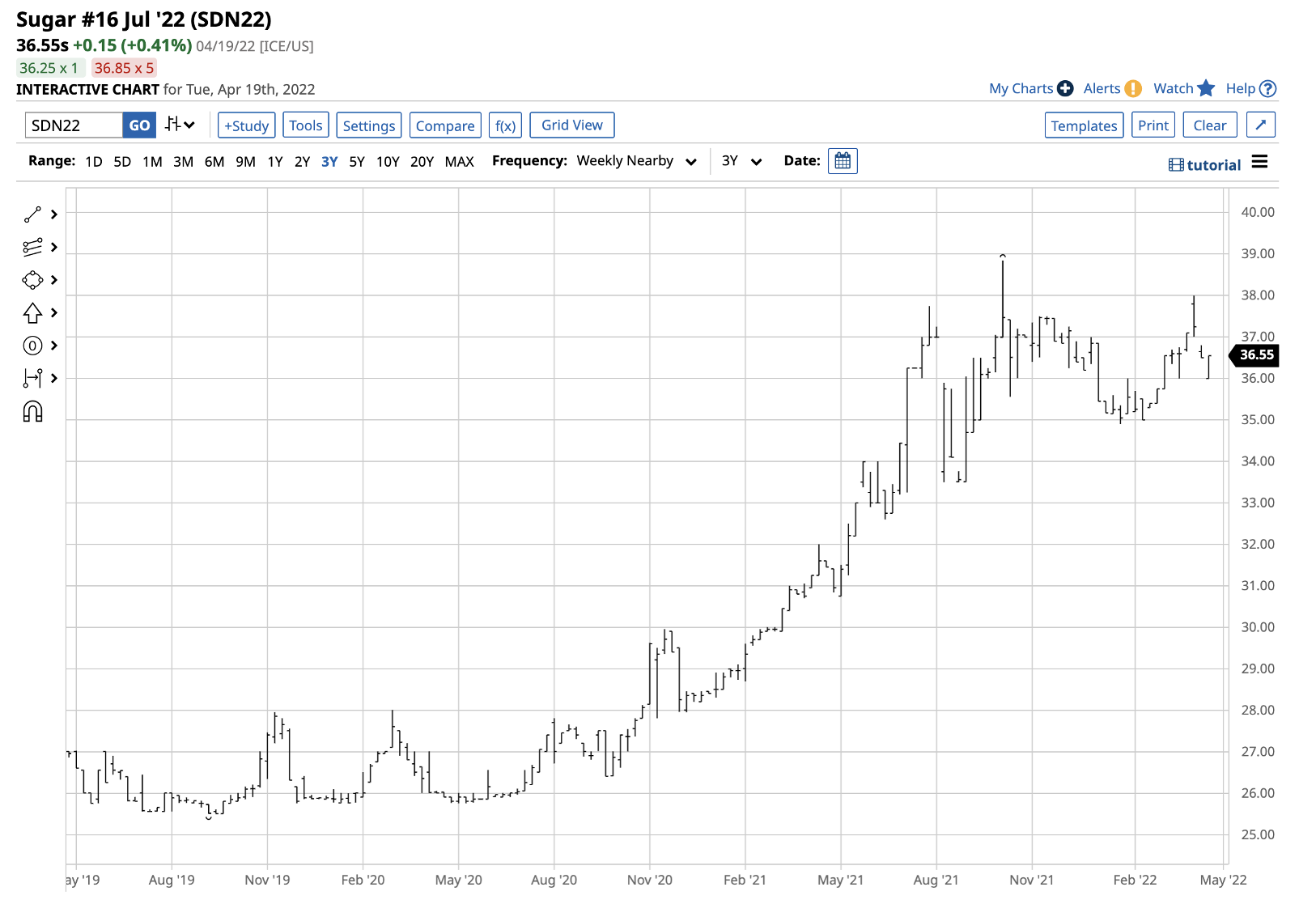

Source: Barchart

The chart shows that the US subsidized sugar futures were at the 36.55-cents-per-pound level, a more than 85% premium to the world free-market price. The EU and many other countries subsidize sugar cane and beet prices.

Rising Brazilian Real Bullish For Sugar Prices

Brazil is the top producer and exporter of free-market sugar. Like most commodities, the US dollar has been the benchmark pricing currency for sugar. ICE futures trade in US dollar terms. Meanwhile, Brazilian local production costs, including labor and other expenses, are in the Brazilian real. A falling real weighs on sugar’s price, as Brazilian supplies experience lower production costs and can sell at higher levels in dollar terms. A rising real has the opposite impact, pushing world sugar prices in dollar terms higher.

Source: Barchart

The chart of the currency relationship between Brazil’s real and the US dollar shows a long-term bearish trend in the real from 2011 through 2020. After consolidating over the past two years, the real broke out to the upside in March and was over $0.21 against the dollar on Apr. 20. A rising real supports dollar-based sugar prices. Brazil is also the leading producer and exporter of Arabica coffee beans and oranges.

A stronger real supports higher coffee and Orange Juice (FCOJ) futures prices. Coffee rose to the highest price since 2011 in February, and FCOJ was at the highest level since 2017 this week. A stronger Brazilian currency is bullish for sugar, coffee and orange prices, as are rising global inflationary pressures across all markets.

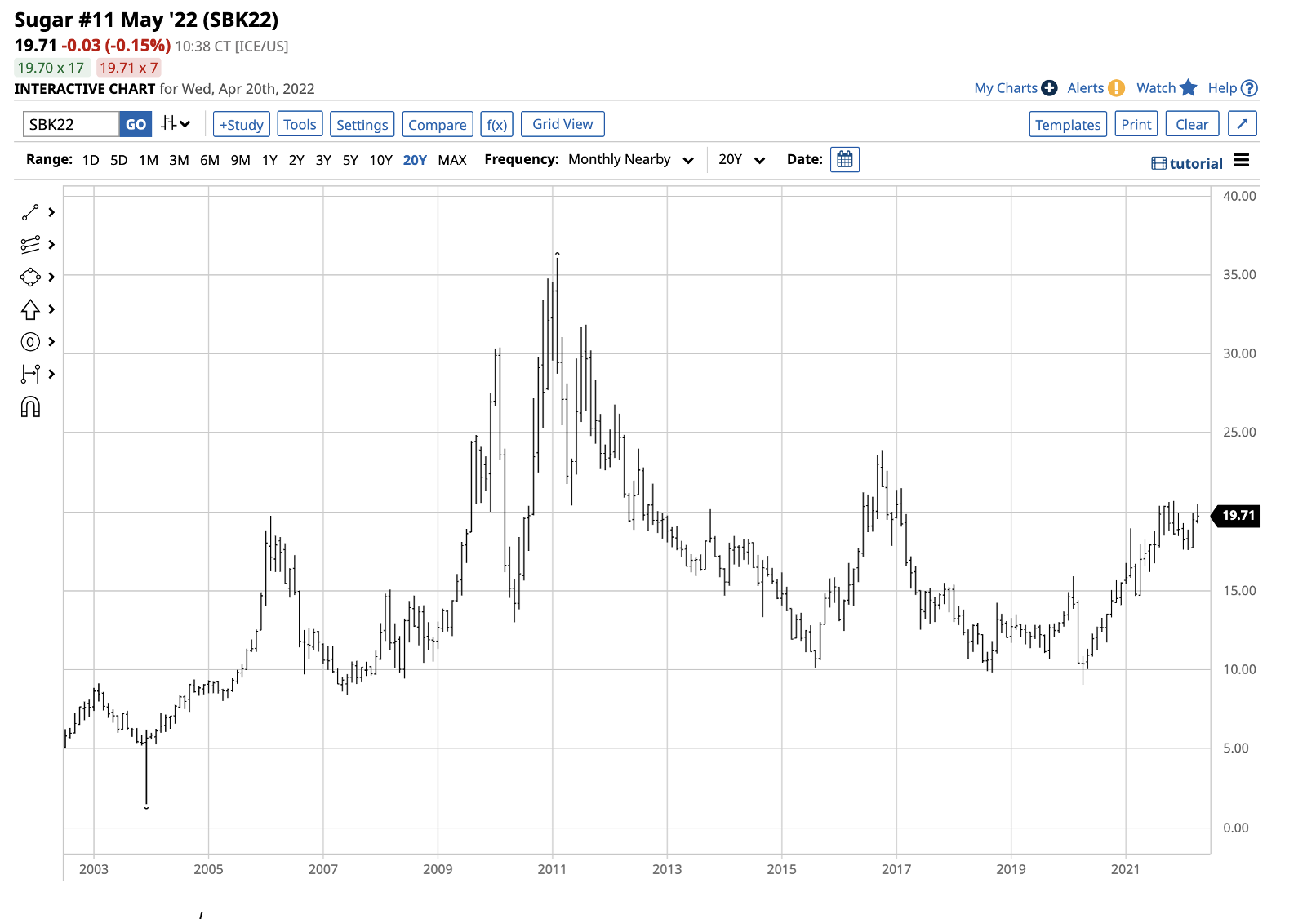

If 2008-2011 Is The Model, Watch The Upside

The difference between central bank and government responses to the 2008 global financial crisis and the 2020 worldwide pandemic is that the level of liquidity and stimulus in 2020 was far higher than in 2008. In both instances, policies to stimulate the global economy planted inflationary seeds that caused commodity prices to soar.

Source: CQG

The chart highlights ICE sugar future’s rally from 9.44 cents in 2008 to a high of 36.08 cents in 2011. Most of the rally occurred from 2010 through 2011. Sugar has already rallied in 2020 through 2021, from 9.05 to 20.69 cents. If the sweet commodity follows the same path, an explosive move could be on the horizon over the coming months.

SGG, CANE Are Sugar ETN And ETF Products

The most direct route for a risk position in the sugar market is via the ICE futures and futures options. Two products offer an alternative for those looking to participate in the sugar market without venturing into the futures arena.

The iPath® Bloomberg Sugar Subindex Total Return ETN (NYSE:SGG) does a reasonable job tracking the sugar price on ICE. At $60.99 per share, SGG had $25.777 million in assets under management and trades an average of 6,794 shares each day. SGG charges a 0.45% management fee. July ICE sugar futures rose from 18.77 cents on Mar. 29 to 20.46 cents on Apr. 13, or 9%.

Source: Barchart

Over the same period, the SGG ETN rose from $58.34 to $62.69 per share, or 7.5%.

CANE is the Teucrium Sugar ETF (NYSE:CANE) product. At the $9.83 level, CANE had $35.706 million in assets under management, trades an average of more than 126,000 shares each day, and charges a 1.88% management fee. CANE holds a portfolio of three actively traded sugar futures contracts to minimize the risks of rolling from one active month to the next.

Source: Barchart

From Mar. 29 through Apr. 13, CANE rose from $9.41 to $10.18 per share, or 8.2%.

Inflation, a rising Brazilian real, and the trend in sugar point to higher prices. Bull markets rarely move in straight lines, so buying on price weakness tends to be the optimal approach. If sugar continues to follow the same path as from 2008 to 2011, the most significant move could be on the horizon over the coming months.