Despite ASML (AS:ASML)'s recent stock plungethe largest single-day drop since 1998driven by a sharp decline in net bookings and a downgraded 2025 outlook, the market's reaction seems exaggerated and likely an overreaction.

With the semiconductor industry poised for a major growth wave, ASML's dominance in EUV lithography systems, strong financials, and long-term profitability make it a compelling buy at current levels.

The stock is now undervalued, presenting a prime opportunity for investors to take advantage of a high-quality company trading at a discount amidst short-term market volatility.

ASML's Mixed Earnings: Strong Growth Overshadowed by Sharp Decline in Bookings

Surprise earnings and market reaction ASML revealed mixed third-quarter results. Net sales grew by 20% quarter over quarter to 7.47 billion, beating estimates of 7.17 billion. Net income rose 32% to 2.08 billion, topping estimates of 1.91 billion. The strong numbers were offset by the sharp decline in net bookings.Net bookings at the company plunged 53% quarter over quarter to 2.63 billion, coming in well below the consensus estimate via Bloomberg at 5.39 billion. This sharp decline reflects a slowing of new orders, which is a leading indicator of future revenue.

Given the disappointing bookings along with changed market dynamics, ASML updated its sales forecast for 2025. Presently, the company projects net sales of 30 billion to 35 billion, from its previous projection of a range of 30 billion to 40 billion. Other than that, a gross margin is expected at 51% to 53%, while the forecast had been between 54% and 56%.

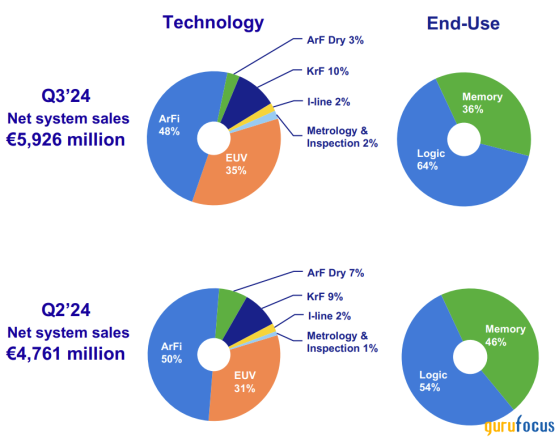

Lastly, the technology breakdown of ASML's net system sales between Q2 and Q3 of 2024 reveals interesting trends. In Q3, EUV sales increased from 31% to 35%, while ArFi sales slightly dropped from 50% to 48%. On the end-use side, the logic sector continues to dominate, contributing 64% of sales in Q3, up from 54% in Q2, reflecting the ongoing demand for advanced semiconductor equipment in logic applications. Conversely, memory sales dropped from 46% in Q2 to 36% in Q3, signaling slower demand in this segment.

Source: ASML

Contributing Factors to the Decline Weakening Demand Beyond AI

While demand for AI-related chips remains robust, ASML commented on the slower recovery elsewhere in the semiconductor market: Logic and memory customers are pushing orders as spending remains cautious due to excess inventory. Aggressive competition in the foundry business has contributed to a more muted ramp of new nodes at some customers, driving multiple fab push-outs and changes in the timing of lithography demand, in particular for EUV systems.China has been a major market for ASML, accounting for about 40% of its sales in the past year. However, geopolitical tensions and export restrictions have cooled demand. The U.S. government's clampdown on exports of semiconductor technology has barred ASML from selling advanced machines to Chinese customers, denting the revenue it gets from the region.

ASML's CFO, Roger Dassen, had said China would likely normalize at around 20% of total revenue for next year. The recovery in the memory chip market is slower than expected. The overall memory chip market saw very limited capacity additions but rather more focus on technology transitions, especially those related to the demand for AI applications, including HBM and DDR5. This has contributed to more meager orders for ASML's equipment, hence affecting net bookings and future revenue at the company.

Markers of this wider economic slowdown are starting to appear beyond the semiconductor industry. Decreased consumer purchasing power, especially in key markets like China, is slashing demand for electronic devices. This slump ripples downwards, impacting not only semiconductor manufacturers but also their equipment suppliers, adding to the challenges faced by ASML.

Source: Bloomberg

Despite the latest setbacks, ASML's basic business model has not fundamentally changed. ASML enjoys almost monopoly status in manufacturing the required EUV lithography systems, which are basically needed to make an advanced semiconductor chip with nodes smaller than 7 nanometers. That gives ASML a real competitive advantage and presents high barriers to entry for any would-be competitors.

ASML recorded net sales of 28 billion in the most recent fiscal year and had a gross margin of 51%. Even after the revision of its future sales forecast, the company expects to realize net sales growth both in 2024 and 2025. Profitability remains very solid, with net income growing and gross margins around 50%.

Free cash flow was higher over Q2 2024, and the company keeps investing heavily in research and development, having invested 4 billion last year to keep its edge in technology.

ASML's Valuation Drop Signals Undervaluation: A Strong Buy Opportunity for Long-Term Investors

Given the stock's decline, ASML's P/E has compressed to ~37x based on FY2025 consensus estimates from a 10-year average of 34x and an industry group average of 32x. Discounted Cash Flow (DCF) analyses offer further insights, with a DCF based on earnings valued at around $730, indicating the current price is below future earnings potential, offering an attractive entry point.Lastly, the GF value of $874, suggests that ASML offers potential upside for long-term investors, particularly considering its strong cash flow, robust earnings, and growth potential in a high-demand industry. Therefore, ASML stands as a wonderful company trading at a good price, boasting market dominance and near-monopolistic power in EUV lithography systems.

Geopolitical Risks and Slower Demand Weigh on ASML's Growth Outlook

On the other hand, customer caution, geopolitical risks, and a slower recovery of some market segments might weigh on the near-term prospects for ASML. These may be ongoing issues reflected in its performance and its stock price. Of concern is that net bookings are lower; their level is presumably due to sustained demand softness, excluding AI-related products.According to the futurist Peter Shankman, the new Dutch export regulations requiring ASML to obtain licenses for certain sales to China could significantly reduce the company's revenue from one of its largest markets. The restriction will limit how much it can sell its advanced lithography equipment to Chinese customers, which may cut its growth in one of its most vital regions. With increased political tensions between the United States and China, further trade restrictions could domestically core down its supply chain, reducing its competitive advantage and making ASML less capable of capitalizing on the growing global demand for semiconductors, especially in AI, 5G, and IoT sectors.

With China accounting for approximately 20% of its total revenue, down from nearly 50% in the last quarters, ASML will mitigate geopolitical risks in the country. Of course, if lost revenue contributed by China is not offset by high demand in other regions, this may be translated into an impact on overall growth. Carefully considered: the complex geopolitical environment faced by ASML is a challenge for the company in order to keep market leading.

It could be overreaction by the market on account of short-term disturbances and may provide a very valid entry point for long-term investors to buy into the ASML fundamentals and growth prospects at better levels. Yet, long-term investors should be cautious and consider the cyclicality in the semiconductor industry along with uncertain geopolitics.

In particular, the further trade disputes and export restrictions, especially between the U.S. and China, would further affect ASML's operations in key markets and further increase operation and revenue constraints at ASML. Prolonged saturation or high sustained decline in the semiconductor industry would adversely affect sales and profitability of ASML. Economic conditions that would reduce spending from consumers and businesses on electronic devices would have an adverse effect on demand for semiconductors and related equipment.

For the most part, ASML has enjoyed an excellent competitive position, although diversification, either in alternative technologies or simple competition, may likely erode market share over time. Continuous invention and innovation will be required to stay ahead in this rapidly changing industry. Supply Chain Disruptions Global supply chain issues, such as critical component or material shortages, could affect ASML's production capabilities and delivery schedules. This might have an impact on the company's capability to meet customer demand and maintain profitability.

ASML Positioned to Ride the $700 Billion Semiconductor Wave Amid AI Boom and Geopolitical Crosswinds

The semiconductor industry is expected to experience high growth from 2025 to 2027, reaching over $996 billion in market values by 2033, growing at a CAGR of about 6.5%. Such upper growth will be driven by the development of AI, 5G, IoT, and autonomous vehicles-all these require high-value chips produced by advanced lithography equipment from ASML.With over 85% market share, ASML leads in manufacturing the EUV lithography systems that are needed to produce chips at 7nm and below, thus having the most to gain from this ramp. However, the company remains incredibly exposed to the Chinese economy, where roughly 15-20% of its sales emerge amid economic slowdowns and geopolitical tensions, including U.S. export restrictions forbidding them to sell advanced equipment to Chinese customers.

The outcome of the U.S. election may further affect ASML's prospects through trade policy and tariffs affecting exports of semiconductor equipment to China. A change in administration may slacken or heighten these restrictions, flowing through to revenues at ASML.

Meanwhile, the AI industry is expected to grow at a rate of about 35% per year, and the AI hardware market might reach over $90 billion by 2025, further enriching demand for value-added semiconductors and lifting demand for ASML technology. Despite these challenges, ASML is well-positioned for long-term growth, given its technological lead in enabling worldwide demand for semiconductors.

Conclusion

Despite ASML's recent drop in bookings and reduced outlook, the company's strong market position in advanced lithography, particularly in EUV systems, positions it well for future growth. The anticipated drop in revenue from China has already been factored into its projections, and the cyclical nature of the semiconductor industry suggests long-term demand will remain robust, especially with the rise of AI, 5G, and IoT technologies. For long-term investors, the current stock price presents a potential buying opportunity as ASML remains essential to the global chip supply chain.This content was originally published on Gurufocus.com