ASML (NASDAQ:AS:ASML) is well-known among technology investors as "the most important tech company you've never heard of." The statement is largely true, given its monopoly on supplying the machines used by the world's largest advanced semiconductor foundries. While 2025 was initially expected to be a blockbuster year for the stock, the outlook has recently shifted. With a revised and weaker demand forecast, ASML's stock price has declined significantly. While the market's response is understandable, I believe the stock is slightly oversold in the near term. This correction presents an opportunity for a 20% increase in its enterprise value over the next 12 months.

Q3-informed operational analysisASML reported year-over-year normalized EPS growth of 15.66% in Q3, alongside revenue of $8.13 billion. However, it also issued a much weaker 2025 outlook than previously anticipated. Just a few months ago, management projected total revenue growth for 2025 of 45%. Now, the consensus revenue estimate has been revised down to just 15%.

Management noted delays in the timing of lithography demand, particularly for extreme ultraviolet (EUV') systemsASML's core productdue to slower ramp-ups in fabrication. While this has received little attention, I believe much of this demand issue is tied to the slowing expansion of AI data centers, likely to impact 2025, 2026, and 2027. ASML invested heavily in expanding its production capacity throughout 2024 but was unable to fully capitalize on the surge in demand driven by heightened AI sentiment. Now, as production capacity has increased, demand for AI data centers is tapering, meaning key foundries are seeking fewer machines.

For instance, Samsung (KS:005930) (SSNGY) has delayed the delivery of ASML's EUV equipment for its new factory in Texas, citing difficulties securing major customers. Intel's (NASDAQ:INTC) delay in expanding its European fabs and Taiwan Semiconductor Manufacturing Company's (TSMC') (NYSE:TSM) cautious approach to new node adoption are also contributing to the slower rollout of advanced lithography tools like EUV systems. Furthermore, trade tensions and export restrictions with China are limiting ASML's ability to sell certain machines. Given these factors, the expensive transition to fine-resolution EUV machines has caused customers to delay adoption.

This is a serious revelation for investors and a factor I wish I had identified earlier. The semiconductor and AI industries are in a state of flux, but it's increasingly evident that the semiconductor sector of AI is cyclical. Semiconductor sales can't provide recurring revenue outside of technology ramp-ups, such as with AI infrastructure build-outs. While companies like Nvidia (NASDAQ:NVDA) have successfully developed recurring revenue platforms through software and cloud services, this is far more challenging for a machine maker like ASML. The initial upcycle for AI infrastructure may be nearing its peak as growth rates are starting to slow. From a macro perspective, ASML may have missed this cycle's highest-growth opportunity window.

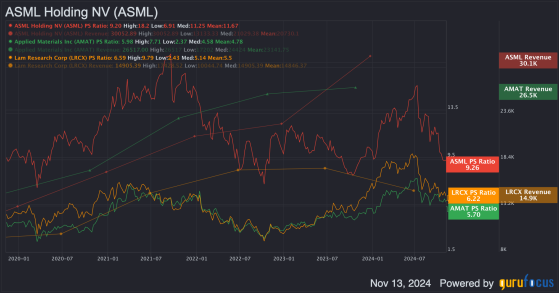

Valuation and financial analysisAs of this writing, ASML's shares have declined by approximately 22.5% since the Q3 report, driven entirely by the weaker 2025 outlook. The company's forward P/E GAAP ratio now stands at 33, reflecting a 17.5% decline from its five-year average, while its forward EV-to-sales ratio is 8.83, a 17.6% decline from its five-year average. This valuation contraction is justified, given the much weaker growth outlook. ASML's five-year historical average forward GAAP EPS growth CAGR was 22.4%, but it currently sits at a significantly lower 16.8%.

With management forecasting 2025 revenue between $30 billion and $35 billion, I estimate they will likely reach the upper end of this range. After underperforming their previous forecast, it seems management is now underpromising with the intention of overdelivering. I project the company could achieve a full-year revenue of at least $33 billion. With an EV-to-sales ratio expansion to approximately 9.5 over this period, the company's enterprise value could reach $313.5 billion, representing a 19.23% increase from the current $262.93 billion.

ASMLApplied Materials (AMAT)Lam Research (NASDAQ:LRCX)| Forward EV-to-EBITDA Ratio | 21.13 | 15.79 | 16.72 |

| Normalized EPS 2025 Growth Estimate | 29% (independent) | 13.7% (consensus) | 18% (consensus) |

Based on the analysis above, I'm inclined to consider ASML moderately undervalued at the moment for a near-term allocation. Despite the weaker 2025 outlook reported by management, I still expect the year to be strong in terms of market sentiment. While the market is generally efficient, it tends to momentarily oversell stocks on bad news. In this case, I believe ASML presents a compelling near-term value opportunity. Furthermore, while it is richly valued compared to Applied Material and Lam Research, it has the growth ratesand the market-leading positionto support this.

ASML's revenues are cyclical, so the growth surge expected in 2025 won't last indefinitely. Unfortunately, semiconductor stocks aren't typically suited for passive long-term allocations (unless one is comfortable enduring significant volatility). Instead, I believe semiconductor stocks are best purchased near the start of an upcycle and sold close to the peak. While it's impossible to time the market perfectly, buying and selling based on fundamental growth trends is a prudent strategy in this sector. The difference with ASML is that it has established a market-leading position, and with long-term trends in AI, particularly as the market shifts toward model inference demand and away from model training, ASML is well-positioned to continue benefiting. However, there will be a downcycle after the current AI model training infrastructure build-out is completed. For this reason, I do not believe now is the right time to buy ASML as a long-term investment. I'd suggest monitoring its valuation closer to Q4 2025 and then holding it for five to six years if the valuation remains reasonable throughout the period.

Conservative discounted EBITDA analysisWhile my 12-month enterprise value target offers valuable insight into the near-term returns investors may expect, a discounted EBITDA model provides a more thorough assessment of the company's intrinsic value. Although 2025 and 2026 are likely to be particularly strong growth years for ASML, the company has several robust years of expansion ahead. For this discounted EBITDA model, I am using a six-year time frame, which I believe could be the optimal holding period for cyclical, medium-term ASML investors.

Starting with projected full-year revenue of $30 billion in December 2024 (to be conservative and for the highest security possible), I estimate revenue will grow at an average year-over-year rate of 12.5% through to December 2030. The company's current EBITDA margin is 33.8%, slightly above its five-year average of 33.12%. To maintain a conservative outlook, I assume an average EBITDA margin of 32.5% over the projection period, accounting for the effect of current pressures. Based on these assumptions, ASML's estimated full-year EBITDA for 2024 will be approximately $10.14 billion, increasing to around $19.77 billion by 2030. Given ASML's 10-year median EV-to-EBITDA ratio of 26.5, which aligns closely with the current trailing 12-month ratio of 26.65, I am applying a terminal multiple of 26 in this model.

MetricValue| Current Enterprise Value | $262.93 billion |

| WACC (Discount Rate) | 13.67% |

| Starting EBITDA (2024) | $10.14 billion |

| Closing EBITDA (2030) | $19.77 billion |

| Terminal EV/EBITDA Multiple | 26 |

| Terminal Enterprise Value Estimate (2030) | $514.02 billion |

| Six-Year Implied CAGR | 11.82% |

| Six-Year Discounted Intrinsic Enterprise Value | $238.29 billion |

| Margin of Safety | -9.37% |

Moreover, ASML plays a crucial role in the semiconductor supply chain, making it essential to understand the macroeconomic and geopolitical risks stemming from current international tensions. We are in a precarious moment in history, and tensions between China and the West could escalate, even with a Trump presidency. Trump has made it clear that he will impose heavy tariffs on China and other importing countries, raising concerns of a potential trade war. However, because Trump has a transactional and economically competitive approach to international relations (rather than hostile), as well as an isolationist stance geopolitically, I believe conditions between the U.S. and China will remain quite robust for at least the next four years. This supports my investment thesis for ASML, and I believe it is prudent to proceed with capital allocation to the semiconductor and technology markets.

ConclusionASML is about to enter an upcycle, which I expect could bring volatility in its stock price by 2026 or 2027 if it becomes overvalued. ASML appears attractive as a near-term cyclical allocation rather than a long-term one, but it also could work as a medium-term holding if the valuation remains reasonable over the next five to six years. While 2025 may not be as robust as I initially projected three months ago, the opportunity remains strong. Despite rising competition from Chinese companies and a vulnerable macroeconomic environment driven by geopolitical factors, ASML is worth buying at its current valuation for exposure to the forthcoming growth.

This content was originally published on Gurufocus.com