ASML Holding (AS:ASML) NV (NASDAQ:ASML) is a supplier of photolithography systems used in making semiconductors and thus is truly a sole source of supply.

Having taken the top slot technologically, especially on extreme ultraviolet lithography systems, places this company in an enabling position with almost all the largest semiconductor producers around the world.

It is time, therefore, that an intrinsic evaluation of the price target of this firm up until 2025, against a back drop of basic parameters or revenue growth and gross margins, is conducted through valuation analysis on targets on earnings per share and P/E multiple.

Steady Revenue Growth: A Testament to ResilienceASML guided FY25 revenue in a range of 30-35 billion, up moderately from the 28 billion expected in FY24. Revenue growth will depend on high demand for EUV systems since next-generation semiconductor nodes really cannot be made without them; for the chipmakers to achieve smaller geometries with greater performance, these systems have become quite indispensable. Demand due to the growth in EUV adoption is high across sectors such as artificial intelligence, 5G, and high-performance computing, where leading-edge chips are needed.

Another important driver of their revenue growth becomes IBM (NYSE:IBM), which includes Upgrades and Service for ASML's existing systems. Once the installed base is growing, IBM provides visibility of recurring and relatively stable income in a cyclic semiconductor market. By 2025 FY, IBM contributes a higher share than currently to their total revenue-reflecting capability to monetize an expanding asset base.

Offsets from geopolitical tensions and export controls are expected to see China sales for Fy25 down 30% year over year, a big challenge considering that China has been one of the biggest markets for ASML over the last couple of years. The company, however, is expected to make up for this with its strong positioning in markets such as the U.S. and Europe, driven by increased investments in semiconductor production capacity.

Assuming the midpoint of the guidance at 32.5 billion, ASML's ~11% CAGR from FY24-FY30 provides a clear roadmap for success. The revenues in FY30 are expected to reach 44-60 billion, reflecting across-the-board stellar growth for the systems and IBM segments. This forecast has shown that ASML has been resilient against the current global woes while commanding its stellar position in the semiconductor industry.

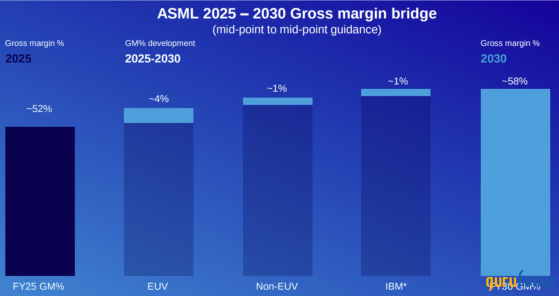

Margin Expansion: The Power of EUV SystemsThe gross margin trend has been a mainstay of profitability for ASML and a driver of shareholder value. From 44% in FY14 to approximately 51% in FY24, the steady improvement has been fueled by the growing profitability of EUV systems and economies of scale achieved through higher production volumes. These systems, designed for advanced semiconductor manufacturing, command significantly higher margins compared to older technologies.

Gross margins for FY25 are expected to be between 51% and 53%, below the long-term target of 56-60% by FY30. This is for several reasons: first, increasing penetration of higher-margin 3800E systems should help improve margins over time. These systems are much better in both performance and efficiency to be highly appealing to semiconductor manufacturers.

However, the ramp of high-NA systems leads to some headwinds that will be discussed. While these types of systems set the next frontier in leading-edge lithography, their immediate profitability is substantially lower due not only to generally higher production costs but also in general to problems with scaling the new technologies in the first starts. Revenue growth from high-NA systems expected in FY25 at a dilutive gross margin negatively impacts overall GM. However, scalability and cost savings will make high-NA another strong contributor to significant margin expansion toward the end of the decade and beyond.

Besides, the margin improvement at IBM should support profitability. Other services, such as performance upgrades and productivity enhancements of EUV systems, provide not only recurring revenue but also higher margins over time. The gross profit by FY25 is expected to reach around 16.9 billion, underscoring ASML's capability to keep strong profitability while navigating the complications of an evolving market.

ASML Investor Day 2024 Deck

Valuation Insights: A Modestly Undervalued GemThe premium valuations of ASML across key valuation metrics underpin their leading market positions and healthy prospects for growth in its market segment. With this in mind, at the moment, ASML shares change hands at a P/E ratio of about 38.44 for the last trailing twelve months, a level of stock price that indicates the strong possibility of continuous growth. A forecasted EPS of EUR 22.20 in the fiscal year '25, matched with a forward P/E multiple of 40x, leads to a target price of around EUR 880.

This valuation represents the strong capability of ASML in terms of its earnings generation, along with its strategic investment in high-growth areas. Besides the P/E metrics, one can also have an additional understanding from ASML's price-to-sales, or P/S, ratio. The TTM P/S ratio is about 10.99, reflecting such high growth of revenue and its premium market position. Using a somewhat lower forward multiple of 10 on projected FY25 revenue of 32.5 billion yields a target price of 793. This valuation also justifies our view that ASML remains well placed in the semiconductor space.

A DCF valuation gives a much better view of the intrinsic value of ASML. Using the following assumptions: 9% CAGR revenue, 56% terminal gross margin, and an 8% discount rate, the calculated intrinsic value for ASML will be more than 865. This is rather in line with the GuruFocus GF Value, which also hints at ASML being only modestly undervalued. These could be signs of very significant upside potential for the long-term investor, especially one who could tolerate near-term volatility.

TakeawayWhile ASML does confront some near-term challenges, such as reductions in sales throughout China and shipment delays of its EUV product line, its longer-term growth trajectory remains on track. From here, they're projecting this year's commitment to innovation and leadership in technology is going to translate to a value reaching 6-6.6 billion by the end of FY30.ASML is investing in high margin product lines and increases from the Installed Base Management segment put it well on their way for the newer growth opportunities still arising within today's semiconductor space.

To investors, ASML represents a unique opportunity to seek exposure to one of the most important players within the value chain of semiconductors. Though facing current volatility, the robust financial model, in addition to market dominance and growth potential, makes it stand out in a highly competitive industry. Having intrinsic value above current market prices, ASML offers resilience and growth to those with a long-term investment horizon.

This content was originally published on Gurufocus.com

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.