Asset managers have substantially underperformed the S&P 500 index over the past five years. The top-10 listed asset managers appreciated 10% per year, on average, during this period compared with the S&P 500 that has returned over 20% annually.

We highlight five key trends to watch for in 2022:

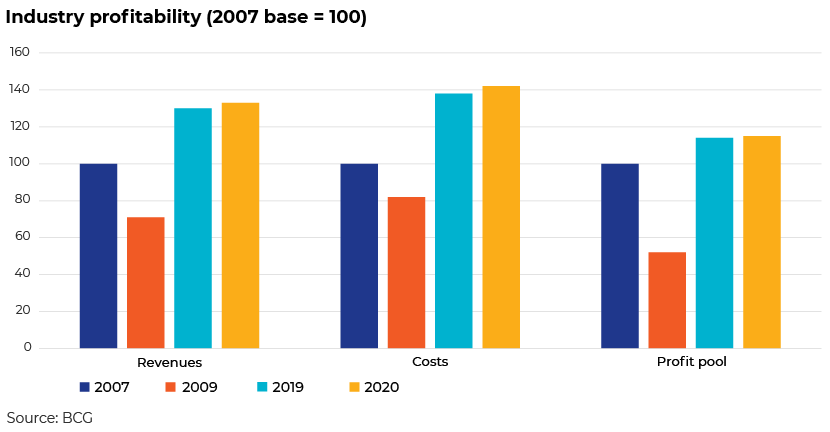

Trend #1: Industry profit pools remaining flat as cost-cutting measures lag fee compression (despite AuM growth)

Profit pools for the global asset management industry have remained flat recently despite healthy organic flows and AuM growth thanks to strong market performance. Industry costs have increased at a faster pace than revenue because of pressure on fees and a shift of assets away from actives to passives. We expect this trend to continue, as the industry has struggled to cut costs aggressively despite industry consolidation.

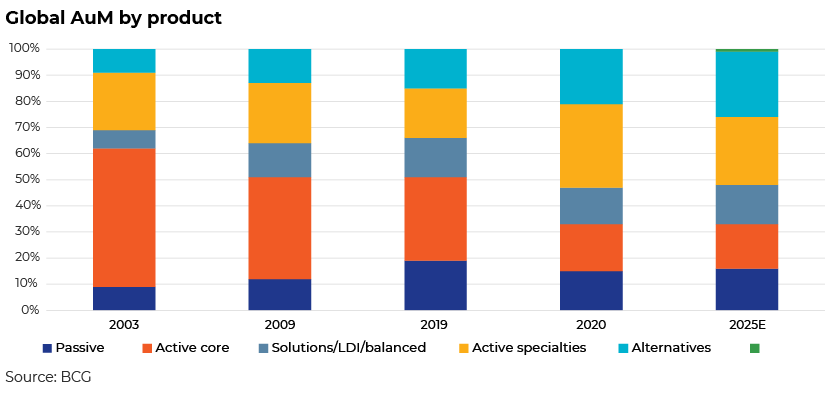

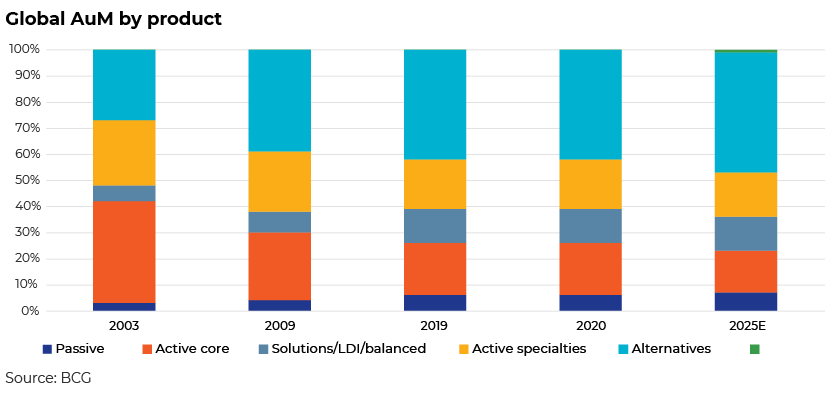

Trend #2: Asset owners likely continue to allocate more assets to passives and private markets

The global industry’s AuM is likely to continue to accelerate the shift towards passives on one side and private markets on the other as asset owners allocate investments strategically to drive the most value from asset managers. Alternatives present the most attractive revenue opportunity for asset managers, with its share in the industry revenue pool increasing from 42% in 2020 to 46% in 2025. The share of revenue from passives is likely to remain flat despite significant increases in AuM as fees remain depressed.

Trend #3: Fixed income may see a turnaround in 2022 as global central banks normalise policy

Fixed-income investors have had a difficult 2021 as excess central bank-driven liquidity pushed real yields deeper into negative territory. We expect the fixed-income market to recover in 2022 as global central banks normalise policy and as yields and credit spreads improve.

Trend #4: Emerging-market equities outperforming developed-market equities

Developed-market equities have outperformed emerging-market equities in 2021. The underperformance in emerging markets was primarily due to the lacklustre performance of Chinese equities because of the regulatory crackdown on internet companies and the woes of China’s property sector. We expect this trend to reverse going forward as Chinese equities present an attractive opportunity from a valuation perspective. However, investments in Chinese equities remain a challenge for global investors because of limited research coverage and quality, the high costs of a trained talent pool and language constraints to cover these markets from global financial centres.