Summary:

- AT&T stock has been a dead money play for investors due the company’s overambitious media plans.

- To fix this image, the company is unloading its media assets to become a learner and financially stable company.

- These efforts may result in a dividend cut down-the-road, making its stock less attractive for income investors.

The largest US network operator, AT&T (NYSE:T) has very few backers in the investment community these days. Its shares have been underperforming the benchmark S&P 500 for many years. They have fallen 35% during the past five years—a period in which the S&P 500 more than doubled.

This highly disappointing performance is the result of the company’s unsuccessful bids to transform itself into an entertainment giant to compete with companies like Disney (NYSE:DIS) and Netflix (NASDAQ:NFLX).

Instead of producing higher returns for its large investor base, the company’s acquisition-focused strategy has saddled the telecom operator with a huge pile of debt, giving it the status of the world’s largest corporate borrower. That debt load, at one point, swelled to about $200 billion, largely accumulated via its 2018 acquisition of Time Warner (NYSE:TWX).

But that is history. These days, Dallas-based AT&T is in the middle of a big transformation and its new CEO, John Stankey, is hopeful that his new strategy will make the company much leaner and focused on its telecom strength.

The biggest part of this overhaul includes AT&T and Discovery (NASDAQ:DISCA) combining their media assets into a new, publicly traded company. The new business, announced in May, will spend $20 billion on content, a level that tops Netflix’s recent programming budget.

WarnerMedia owns cable channels HBO, CNN, TNT, and TBS as well as the Warner Bros. television and film studio. Discovery has a portfolio that includes its namesake network and HGTV. Both companies also offer streaming video portals HBO Max and Discovery+.

Retreat From Media Ambitions

In a webcast presentation during the Goldman Sachs Communacopia conference last month, Stankey told investors once the spinoff of WarnerMedia is complete by mid-2022, AT&T will have returned to its primary network focus, with a priority on expanding 5G wireless and fiber broadband services.

“We’re not going to be talking about restructuring. We’re not going to be talking about transactions. We’re going to be talking about how the management team is executing on a very focused strategy and a very lean and focused business in the best parts of the communication sector,” he said, according to a Bloomberg report.

The company’s retreat from its entertainment ambitions is just not limited to the Discovery deal. Earlier this year, AT&T reached an agreement with private-equity firm TPG to shed a 30% stake in its DirecTV business for $1.8 billion. AT&T had acquired DirecTV in 2015 for $49 billion, at the height of a pay-TV market that has since collapsed due to cord-cutting subscribers.

With the Discovery and DirecTV transactions, AT&T expects to reach its goal of reducing leverage to 2.5 times a year ahead of schedule, and possibly spare bond-holders from any potential ratings action that would push it closer to speculative grade.

Stability Of Dividends In Question

But that restructuring has created doubts in the minds of investors regarding the stability of the company’s $0.52-a-share quarterly dividend. The stock’s 7.6% annual dividend yield, the highest among the blue-chip companies, is a reflection of that risk.

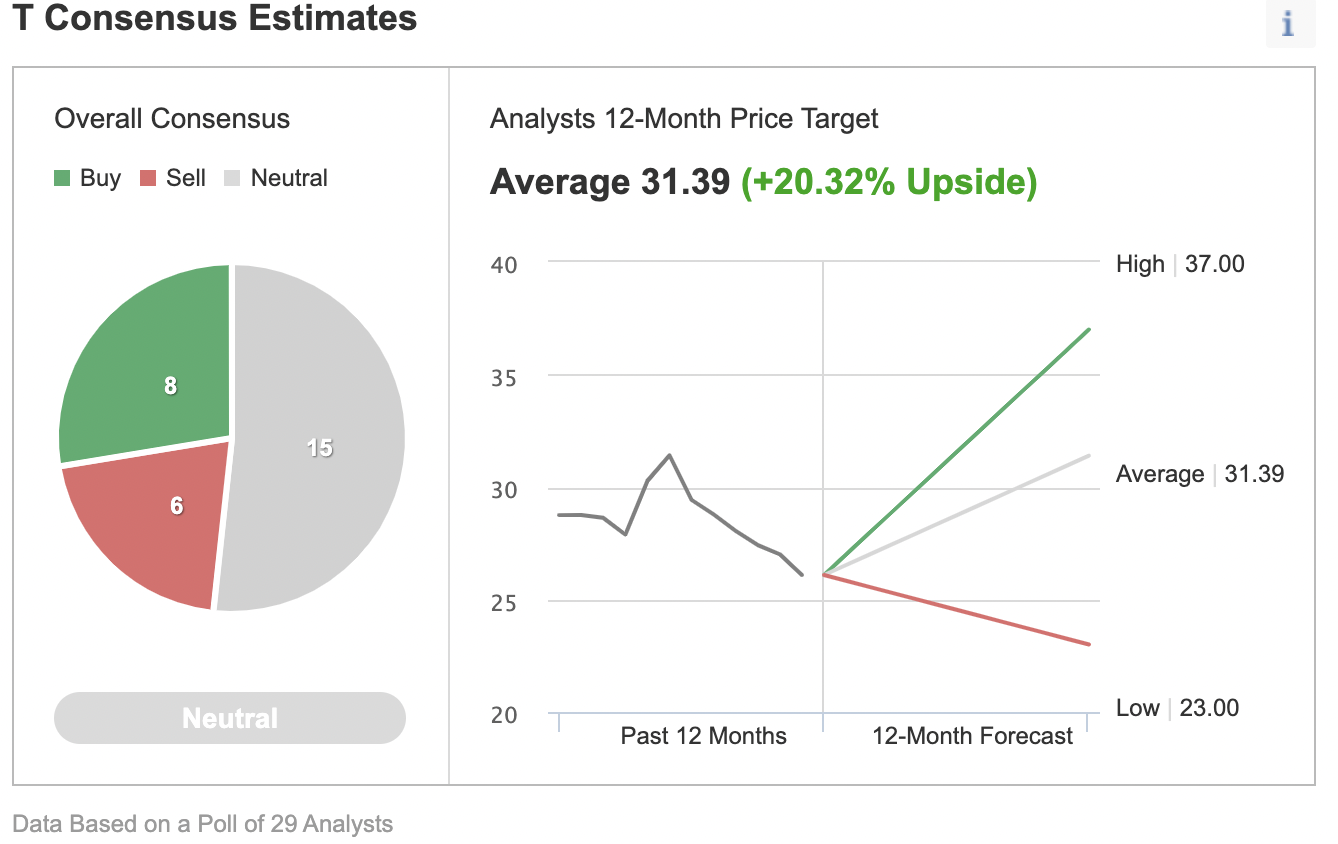

According to a poll by Investing.com, of 29 analysts covering the stock, 15 have a neutral rating on the equity, with eight recommending a buy and six a sell.

AT&T had its price target reduced by analysts at Barclays to $30 from $34 in a research report issued recently. The brokerage presently has an "equal weight" rating on the technology company's stock. Morgan Stanley cut AT&T to an "equal weight" rating and set a $29.00 price target on the stock.

Argus Research in a recent note downgraded AT&T to hold from buy, saying the company’s transformation could lead to a dividend cut in the near term.

The note said:

“While management has assured investors that AT&T will maintain a dividend in the ’95th percentile’ of companies, the math just doesn’t work after taking the DirecTV and WarnerMedia spinoffs into account. As such, we will take a wait-and-see approach as the company restructures through large divestitures while also implementing its costly 5G network buildout.”

Despite this pessimism, AT&T’s move to create a new streaming giant, combining AT&T’s HBO, Warner Bros. and TNT with a roster of Discovery channels, including the Food Network, and reality-TV shows, means the company will have a better chance to succeed in a market where deep-pocketed tech companies like Apple (NASDAQ:AAPL) and Amazon (NASDAQ:AMZN) are spending tens of billions of dollars a year on media content.

AT&T in July reported about 67.5 million worldwide subscribers to its premium channel and streaming service, and now says it will have 70 million to 73 million by the end of 2021.

Bottom Line

AT&T will likely become a much leaner and more focused company by next year if it’s able to successfully complete its current restructuring. The separation of the media assets will allow it to invest aggressively in its new streaming unit, while positioning the core telecom operations to expand when the introduction of the 5G technology is creating new opportunities.

That said, the new AT&T is unlikely to satisfy those investors whose aim is to earn steadily growing income. AT&T, in our view, is now a turnaround bet rather than a company that pays stable dividends.