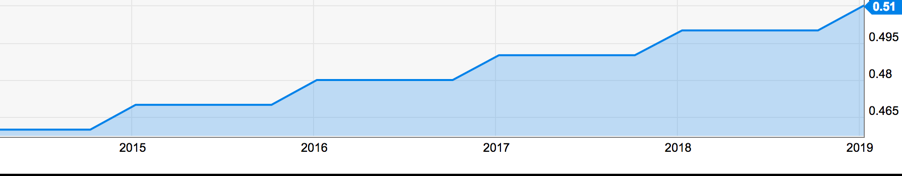

America’s largest telecom operator, AT&T (NYSE:T), has been a great stock for income investors, paying a growing dividend for 35 consecutive years. This has earned it a “Dividend Aristocrat” status only a handful of dividend-paying U.S. companies can claim.

The shares have risen more than 2000% since they first started trading for $1.25 per share in 1983, though they've fallen 12% in the last five years, plunging 15% in the last twelve months. The price closed up 0.7% at $30.85 yesterday.

But AT&T’s status as a fixed income stalwart is now coming under pressure, and a large number of analysts don’t rule out a cut in payouts going forward.

These concerns have grown since the fast, drastic deterioration of another old-economy dividend giant, General Electric (NYSE:NYSE:GE), which last year slashed its once rock-solid dividend, leaving long-term income investors in the lurch. Though there's nothing in common between what GE and AT&T do, both companies are facing weakening demand and ballooning debt.

AT&T became the most indebted non-bank issuer after completing its takeover of Time Warner in June last year for a total value of $102 billion, raising the fear that if AT&T fails to improve its cash flows, a dividend cut down the road will be inevitable. In our view, these concerns are very valid and investors shouldn’t get excited about AT&T's juicy 7% dividend yield , one of the highest among S&P 500 companies.

Last summer, Moody’s Investors Service cited similar concerns when downgrading AT&T debt just above the junk level. “Its low free cash flow after dividends limits financial flexibility,” the rating service had warned, adding:

“AT&T will need to reduce its cash dividends in order to remain competitive with its new peer group that includes other media and technology giants, which have very lean balance sheets.”

AT&T’s Slow Decay

Since then, the financial situation at this telecom giant has worsened, putting into question the ability of CEO Randall Stephenson to turn the company into a modern media company.

The latest evidence of this slow decay that AT&T is facing came from the company’s Q4 2018 earnings report, released on Jan. 30. During the period, the company lost more than 400,000 subscribers at its troubled DirecTV satellite service. For fiscal year 2018 that loss was staggering: 1.24 million subscribers quit Direct TV.

Another troubling sign was that the company's new growth initiative, DirecTV Now streaming service, which also lost 267,000 subscribers — 14% of its subscriber base.

Things in the company’s core business don’t seem to be going in the right direction either. AT&T’s wireless-phone segment added only 13,000 monthly subscribers in Q4 and lost 410,000 users who had data plans for tablets and smart watches, as competition from rival Verizon Communications (NYSE:NYSE:VZ) intensified and customers held back to move on to the new packages.

Our pessimism on AT&T’s future comes from a simple concern: Its legacy businesses are rapidly losing their shine and its debt-laden growth strategy has many hurdles to overcome.

The purchase of Time Warner last June and earlier acquisition of DirecTV have leveraged AT&T's balance sheet to 3.9 times EBITDA. This at a time when operating income is shrinking and the company is under immense pressure from both shareholders and regulators, with the Justice Department seeking an early decision on its review appeal on a court decision that allowed AT&T to buy Time Warner this past summer.

To start generating cash from Time Warner's content assets, AT&T plans to launch a direct-to-consumer streaming service in late 2019. This will compete directly with Netflix (NASDAQ:NFLX), Hulu, Amazon.com (NASDAQ:AMZN) and Disney's (NYSE:DIS) own soon-to-launch streaming service.

In our view, however, the video-streaming landscape is becoming too competitive. Companies with deeper pockets will have better chances of success than AT&T, whose priority right now should be to cut its debt load and save its credit rating.

Bottom Line

AT&T’s $0.51 per share quarterly dividend looks great and is one of the best deals for income investors, but we don’t like companies that deliver cash that exceeds their ability to generate it. The company's payout ratio is currently 53.65% — which, though healthy-seeming isn't a level we believe is sustainable for AT&T unless Stephenson shows signs of a quick turnaround, proving that his debt-laden growth strategy was a bet worth making.