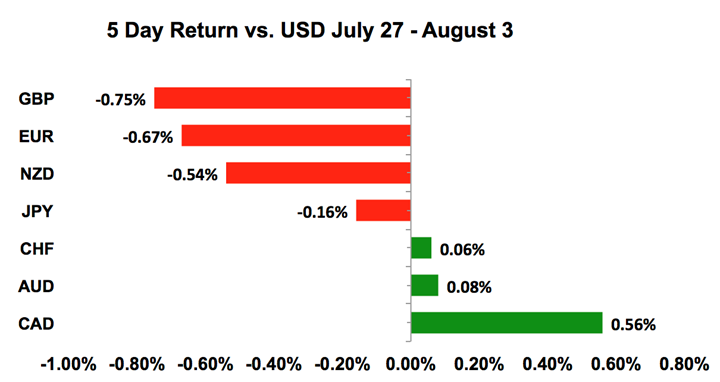

The first week of August was a fairly good one for the US dollar.

The greenback appreciated against all of the major currencies with the exception of the Swiss franc, Australian and Canadian dollars. Sterling was the worst performer while the loonie enjoyed broad-based gains. The Australian and New Zealand dollars bounced off 2-week lows while EUR/USD fell to a 5-week low. It was a very eventful week that included a Bank of England rate hike and a modest calibration of monetary policy by the Bank of Japan. The Federal Reserve’s monetary policy decision and Nonfarm payrolls report were overshadowed by trade tariffs, yuan weakness and PBoC action. In terms of data releases, the next few weeks of August will be quieter but with many traders taking off for summer holidays, low liquidity could also lead to big moves in currencies.

Last year, NZD/USD dropped more than 4% in the month of August. Although the move in GBP/USD was not as severe, the pair still fell 500 pips from high to low. In contrast, EUR/USD experienced a nearly 300 pip rally from its mid-month low as it broke above 1.20 for the first time in 2.5 years. This divergence drove EUR/GBP to its strongest level in nearly 8 years. AUD/USD didn’t move much but USD/JPY hit a 4-month low. In 2015, China rocked the markets in the month August by unexpectedly devaluing its currency. If you take a look at the charts, August 2016 wasn’t a sleepy month for currencies either. So, while the economic calendar is lighter in the weeks ahead, we can’t be complacent especially in an environment of elevated trade and Brexit risks.

US Dollar

Data Review

- Existing Home Sales -0.6% vs. 0.2% Expected

- House Price Index 0.2% vs 0.3% Expected

- Manufacturing PMI 55.5 vs 55.1 Expected

- Services PMI 56.2 vs 56.3 Expected

- Composite PMI 55.9 vs 56.2 Prior

- New Home Sales -5.3% vs -3.1% Expected

- Advance Goods Trade Balance $-68.3b vs $-67.0b Expected

- Wholesale Inventories 0.0% vs 0.3% Expected

- Durable Goods Orders 1.0% vs 3.0% Expected

- Durable Ex. Transportation 0.4% vs 0.5% Expected

- GDP Annualized 4.1% vs 4.2% Expected

- Personal Consumption 4.0% vs 3.0% Expected

- Core PCE 2.0% vs 2.2% Expected

- University of Michigan Sentiment 97.9 vs 97.1 Expected

- University of Michigan Current Conditions 114.4 vs 116.5 Prior

- University of Michigan Expectations 87.3 vs 86.3 Prior

Data Preview

- US Producer Price Index - Potential for downside surprise given a drop in price component of ISM and lower oil prices

- US Consumer Price Index - Will have to see how PPI fares but the risk is to the downside given lower gas prices and a stronger dollar

- Japanese Q2 GDP - Growth is expected to accelerate but Japanese data has been mixed

Key Levels

- Support 110.00

- Resistance 112.00

This month’s Federal Reserve’s monetary policy announcement and US Nonfarm payrolls report failed to help the dollar even though both event risks were specifically negative for the greenback. Starting with the Fed, there were no surprises in the FOMC statement. The central bank described the economic activity as strong and affirmed the need for gradual rate increases. While some economists argued that there was a mild dovish shift in the language, with the Fed using the word 'strong' instead of 'solid' to describe US growth, the change does not cast doubt on September tightening. The same is true of the jobs report. While jobs growth slowed significantly in the month of July (from 248K to 157K), the June data was revised up. The unemployment rate declined and average hourly earnings grew at a faster pace. Unfortunately, on a day when USD/JPY was already weak, the data miss gave traders another reason to sell. This week’s inflation report isn’t expected to help the greenback as the stronger data and lower gas prices puts pressure on CPI.

The Bank of Japan’s monetary policy announcement was also a big disappointment. Interest rates were left unchanged and while they would allow long-term yields to “move upward and downward depending on economic and price developments,” the BoJ intends to keep rates near zero. They also lowered their inflation forecast and pledged to keep extraordinary policies in place for an “extended period of time,” widening the gap between Fed, BoE and ECB policies. These actions tell us that fighting inflation and boosting growth is more important to the central bank than boosting commercial bank profitability. The announcement sent the yen tumbling but the move was short-lived because 10-year JGB yields hit 18-month highs, forcing the BoJ to step into the market to buy 5 to 10-year bonds to drive yields lower. In the near term, anyone trading USD/JPY should keep an eye on JGB yields.

However, there may be no bigger driver of currency flows than US-Chinese trade tensions. Last week, the US government proposed $200bn in fresh tariffs on Chinese goods. China responded with $60bn in retaliatory tariffs. They’ve also been manipulating the Yuan. For the past 3 months, they allowed the Renminbi to weaken significantly to help exporters but on Friday, they boosted the reserve requirement on foreign currency forwards from 0 to 20% in an attempt to curb Yuan weakness. The war is far from over and any positive or negative headline could have a significant impact on the dollar and currencies this month.

British Pound

Data Review

- Bank of England Raises Interest Rates by 25bp

- GfK Consumer Confidence -10 vs -9 Expected

- BRC Shop Price Index (YoY) -0.3% vs -0.5% Prior

- Nationwide House Prices 0.6% vs 0.1% Expected

- Manufacturing PMI 54 vs 54.2 Expected

- Construction PMI 55.8 vs 52.8 Expected

- Services PMI 53.5 vs 54.7 Expected

- Composite PMI 54.3 vs 54.9 Expected

Data Preview

- Visible Trade Balance, Industrial Production, Manufacturing Production and GDP - Potential for upside surprise. GDP likely to be stronger given rise in consumer spending and improvement in trade but drop in manufacturing PMI index suggests weaker trade in June

Key Levels

- Support 1.2950

- Resistance 1.3250

Instead of rising, sterling broke down after the Bank of England raised interest rates for the first time in 2018. This move may be confusing but the BoE has no intention of tightening again this year and could even loosen monetary policy if Brexit causes market disruptions. Data hasn’t been great with manufacturing and service sector activity slowing in July and consumer confidence falling. However, inflation is well above the central bank’s 2% target so the BoE felt compelled to act. Governor Carney wasn’t particularly concerned about the economy but he felt that “one hike a year isn’t a bad rule of thumb.” Sterling has been under pressure for the past few months as Prime Minister May struggles to reach a Brexit agreement with the European Union. Investors share Carney’s concern that negotiations are entering a “critical period” and the “chance of a no deal Brexit is uncomfortably high.” He felt that “some scenarios may require a rate cut.” All this talk of possible easing in a tightening cycle makes investors nervous so unless there’s progress on Brexit negotiations or data takes a turn for the better, we will see GBP/USD at fresh 1-year lows. Second quarter GDP, trade balance and industrial production numbers are scheduled for release on Friday.

Euro

Data Review

- EZ Consumer Confidence -0.6 vs -0.6 Expected

- GE CPI 0.3% vs 0.4% Expected

- GE Retail Sales 1.2% vs 1.0% Expected

- GE Unemployment Change -6k vs -10k Expected

- GE Unemployment Claims 5.2% vs 5.2% Expected

- EZ Unemployment Rate 8.3% vs 8.3% Expected

- EZ GDP (QoQ) 0.3% vs 0.4% Expected

- GE Manufacturing PMI 56.9 vs 57.3 Expected

- EZ Manufacturing PMI 55.1 vs 55.1 Expected

- EZ PPI 0.4% vs 0.3% Expected

- GE Services PMI 54.1 vs 54.4 Expected

- GE Composite PMI 55.0 vs 55.2 Expected

- EZ Services PMI 54.2 vs 54.4 Expected

- EZ Composite PMI 54.3 vs 54.3 Expected

- EZ Retail Sales 0.3% vs 0.4% Expected

Data Preview

- GE Trade Balance, Current Account Balance and Industrial Production - Potential for upside surprise given rise in manufacturing PMI index.

- EZ Retail Sales - Stronger German retail sales offset by weaker French spending

Key Levels

- Support 1.1500

- Resistance 1.1800

For the first time in more than a month, EUR/USD closed below 1.16. The sell-off in the euro last week was mainly a function of US dollar strength as Eurozone fundamentals took back seat to bigger stories. Data from the Eurozone was mostly weaker with stronger inflation offset by falling confidence, weakening growth and slower gains in retail sales. Germany’s trade balance is the only important report on next week’s calendar. Technically the pair is vulnerable to additional losses after having ended the week at a 1 month low. We expect EUR/USD to test 1.15 and we are watching EUR/JPY for a possible move down to 128.

AUD, NZD, CAD

Data Review

Australia

- Building Approvals 6.4% vs 1.0% Expected

- AU PMI Manufacturing 52.0 vs 57.4 Prior

- Trade Balance 1873m vs 900m Expected

- PMI Services 53.6 vs 63 Prior

- Retail Sales 0.4% vs 0.3% Expected

- Retail Sales Ex Inflation (QoQ) 1.2% vs 0.8% Expected

- Chinese Composite PMI 53.6 vs 54.4 Prior

- Chinese Non-Manufacturing PMI 54 vs 55 Expected

- Chinese Manufacturing PMI 51.2 vs 51.3 Expected

New Zealand

- Building Permits -7.6% vs 7.1% Prior

- Business Confidence -44.9 vs -39 Prior

- Unemployment Rate 4.5% vs 4.4% Expected

- Employment Change (QoQ) 0.5% vs 0.4% Expected

- Avg. Hourly Earnings (QoQ) 0.2% vs 1.0% Expected

Canada

- GDP 0.5% vs 0.3% Expected

- Manufacturing PMI 56.9 vs 57.1 Prior

- International Merchandise Trade -0.63b vs -2.3b Expected

Data Preview

Australia

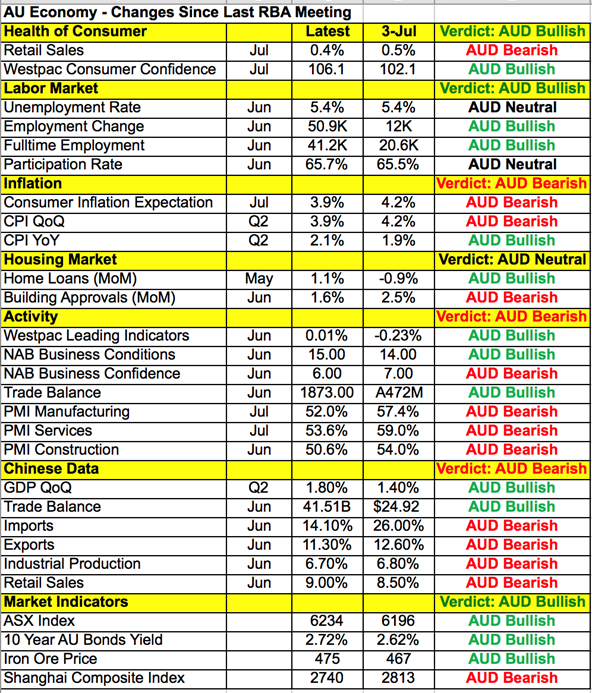

- RBA Rate Decision - Data has improved but given China risk, RBA will remain neutral

- China Trade Balance - Chinese data is hard to predict but trade could be negatively affected by yuan weakness

New Zealand

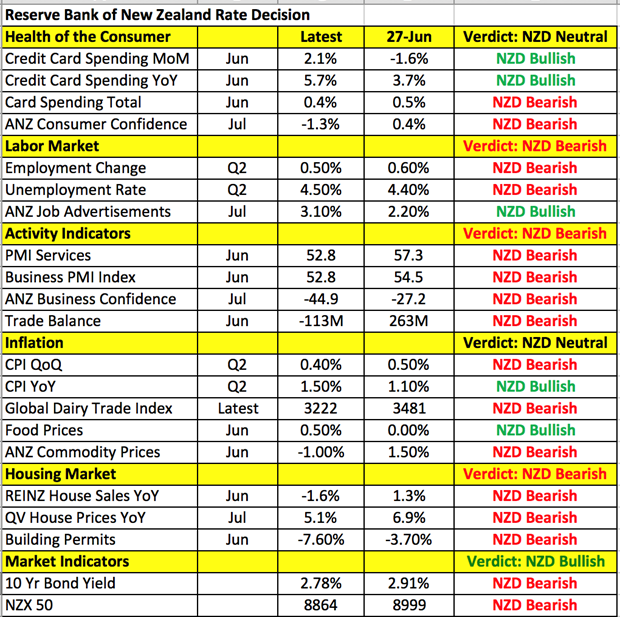

- RBNZ Rate Decision – Central bank likely to leave the door open to easing given data deterioration

- 2YR Inflation Expectation - Potential for downside surprise given Commodity prices dropped in Q3

- Manufacturing PMI - Potential for downside surprise given the sharp drop in business confidence

Canada

- IVEY PMI - Potential for downside surprise given Drop in Markit PMI

- Employment Report - Will have to see how IVEY PMI index fares

Key Levels

- Support AUD .7300 NZD .6700 CAD 1.2950

- Resistance AUD .7500 NZD .6900 CAD 1.3250

Our focus shifts to the commodity currencies this week with monetary policy meetings for Australia and New Zealand. AUD and NZD dropped to 2-week lows on the back of mixed data and US dollar strength. This week, further losses will require dovishness from the Reserve Banks. Both the RBA and RBNZ are expected to leave monetary policy unchanged but their outlooks could be vastly different. The RBNZ has many reasons to be cautious while the RBA could find cause for optimism. When Australia’s central bank last met, they talked about progress in the labor market and pickup in inflation. Since then, we’ve seen even stronger job growth and a rise in consumer confidence. Inflationary pressures eased slightly but still remain strong on a quarterly and annualized basis. The bad news is that the weakness in trade and manufacturing activity most likely worsened over the past month with the Chinese Yuan falling to a 6-month low against the Australian dollar. US-China trade tensions pose a serious risk to Australia and New Zealand’s economy that cannot be ignored. So far, the RBA has refrained from commenting on slower growth in China and trade wars. If that’s case this time as well, AUD/USD will rise on RBA. However, if external risks make their way into the RBA statement or Governor Lowe’s comments, AUD/USD will fall to fresh 1-year lows. Chinese trade numbers are also scheduled for release and could have a significant impact on AUD and NZD.

The Reserve Bank of New Zealand, on the other hand, will keep the door open for future easing. When they last met in June, they left interest rates unchanged and said they are well positioned to manage a rate change in either direction. They also tweaked the wording of the statement slightly to suggest that they could change interest rates and the fact that NZDUSD dropped to a 2 year low following the announcement reflects the fear that the next move could be a rate cut. Unfortunately, New Zealand’s economy only worsened since then. Card spending is up but consumer and business confidence declined. Service and manufacturing sector growth slowed significantly while the trade surplus turned to a deficit. Inflation increased but dairy prices are down. The only saving grace is the weakness of the New Zealand dollar. It helps to make NZD dairy more attractive on the global market and more affordable to Chinese importers who are grappling with Yuan weakness. With that in mind, the RBNZ has very little reason to be optimistic. Having just tweaked the language in their monetary policy statement at their last meeting, they still want the market to believe that a return to easing is possible. For this reason, we expect NZD to underperform in the week ahead, particularly against AUD.

The Canadian dollar is performing well because investors believe that the Bank of Canada will raise interest rates before the end of the year. Over the past few weeks, we have seen a series of stronger economic reports ranging from retail sales, CPI to GDP and trade. Canada’s economy expanded by 0.5% in May up from 0.1% the previous month. Most remarkably, the country’s trade deficit shrank to 626 million, which is a significant improvement from the prior deficit of -2.77B. Despite the US’ tariffs on steel and aluminium, exports hit a record high thanks to robust demand for energy and aircraft sales. As a result, the market is pricing in a 77% chance of a rate hike in December. USD/CAD has broken below 1.30 and we expect the pair to extend its losses in the coming weeks if data continues to surprise to the upside. IVEY PMI and employment numbers are due for release this week, encouraging further volatility in the loonie.