Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway (NYSE:BRKa) (NYSE:BRK.A) (NYSE:BRK.B) sold about 34 million shares of Bank of America Corp. (NYSE:NYSE:BAC) between July 17 and July 19, 19 million shares between July 22 and 24 and another 18.40 million shares between July 30 and Aug. 1, according to recent Form 4 filings.

The guru's actions immediately caught my attention as it is only the second time that Berkshire has cut its stake in the bank. The first time the conglomerate cut its Bank of America investment was in the fourth quarter of 2019, but the scale was much smaller. Although the recent sale represents roughly only 7% of Berkshire's holding, it is still the first meaningful sale since Buffett's initial purchase in 2011.

Buffett has been a net seller of bank stocksThe Oracle (NYSE:ORCL) of Omaha has been a net seller of banks stocks for the past five or six years. For instance, he started cutting the Wells Fargo (NYSE:NYSE:WFC) position gradually in 2019 and exited it entirely in the first quarter of 2022. Along with Wells Fargo, Buffett sold off his stakes in Goldman Sachs (NYSE:NYSE:GS) and JPMorgan Chase (NYSE:NYSE:JPM) in 2020. Then in the first quarter of 2023, Buffett cleared out of both U.S. Bancorp (NYSE:NYSE:USB) and Bank of New York Mellon (NYSE:NYSE:BK).

One can argue that Berkshire has also bought some bank stocks during this period. For instance, Buffett acquired a $3 billion position in Citigroup (NYSE:C) during the first quarter of 2022. However, Buffett has been reducing his overall exposure to the banking sector for a few years, but has continued to hold on to Bank of America.

It has been argued that Buffett is selling the stock because of increased regulatory scrutiny Berkshire has to face once its equity stakes goes above the 10% threshold. However, I do not think this argument is very strong as the conglomerate has been across the 10% threshold for Bank of America since the second quarter of 2019. In fact, Berkshire's ownership has increased to as much as just a little more than 13% in the first quarter of 2024. Also, back in 2016, it asked the Federal Reserve for permission to keep expanding its stake in another bank, namely Wells Fargo, after surpassing the 10% threshold. Therefore, it appears to me that Buffett has no problem with the increased scrutiny as long as he thinks the benefit outweighs the cost.

There is no doubt Buffett's confidence in Bank of America has paid off, driven by consistent organic growth and share gains. For instance, after the Covid-19 pandemic, the bank's consumer deposit balances have grown more than 30%. The company generated almost $90 billion of earnings between 2021 and 2023. Further, the stock has outperformed the KBW Bank Index over the past decade.

Recently, however, there have been some growing concerns over its business fundamentals.

Net interest income pressureIn the aftermath of the pandemic, Bank of America's net interest income has increased from $43 billion in 2021 to $56.9 billion in 2023. This increase is easy to understand. In a rising interest rate environment, banks benefits from the faster repricing of loans and other earning assets than funding cost of interest-bearing liabilities. The company also benefited from loan growth and deposit growth during this period.

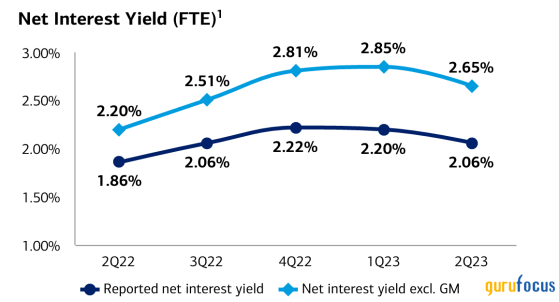

However, the tailwinds which drove the NII growth started to reverse. The reported net interest yield peaked in the fourth quarter of 2022 and net interest yield excluding global markets peaked in the first quarter of 2023.

Understandably, Bank of America's net interest income also peaked in the fourth qarter of 2022, along with the peak in net interest yield, as higher deposit costs and lower deposit balances more than offset higher asset yields.

The bank's management has guided multiple times that the second quarter of 2024 would be the bottom of the NII trend in the rate cycle and it should start to rise in second half of 2024. However, there are many assumptions behind the guidance. For instance, a key assumption for the second-quarter NII trough is that the Fed will make three rate cuts this year. If this key assumption is wrong, then the rebound of net interest income will take longer than the bank's management expects.

Slower loan growthAnother concern is the slowdown in loan growth. Bank of America's loan growth has lagged its deposits growth over the past few quarters. For instance, the average loan balance grew 1% in the first quarter and 0.50% in the second quarter. As a result, the bank's excess deposit levels above loans has reached as high as $1.08 trillion at the start of 2022, more than doubling from the pre-pandemic level of roughly $450 billion.

While this excess has come down to $850 billion as of the second quarter of 2024, it is still very large by historical standards. This excess provided liquidity, but it has also dragged on Bank of America's net interest yield as this excess liquidity is invested in lower-yield short-dated cash and available for sale securities.

Rising consumer delinquency rateIn its fourth-quarter 2023 earnings presentation, Bank of America shared an interesting chart of historical consumer net charge-off rates.

The chart shows consumer net charge-off rates have been very low for a very long time. After the pandemic, it hit a bottom due to stimulus money and Covid-related forbearances. However, the trend has reversed since the end of 2022. The question is whether the increase is the reversion to pre-pandemic levels or a long uptrend, especially if interest rates stay longer than people expect.

ConclusionAfter the pandemic, Bank of America has benefited from a few tailwinds that drove strong fundamental growth. However, there are some clear signs that the tailwinds it enjoyed have turned into headwinds. As both economic and geological uncertainty increase, the trajectory of its business fundamentals also become more unpredictable. This might explain why Buffett trimmed some of Berkshire's stake. Based on patterns from the guru's past actions, I would not be surprised if he further trims its holdings of the bank.

This content was originally published on Gurufocus.com