Daily FX Market Roundup April 23, 2019

Kathy Lien, Managing Director Of FX Strategy For BK Asset Management

With the Easter holidays behind us, we are finally beginning to see bigger moves in currencies. EUR/USD dropped to its lowest level in 3 weeks, USD/CHF climbed to its strongest level in more than 2 years and NZD/USD fell to 3-month lows. The greenback rallied against all of the major currencies except for the Japanese yen, which was held back by yields and 112 resistance. An unexpected increase in new-home sales helped to support the greenback and sustain risk appetite but EUR and A$ are lower because investors are worried that Wednesday’s Australian inflation and German IFO reports will surprise to the downside. Despite an increase in commodity prices, consumer inflation expectations in Australia have been falling. In the Eurozone, the outlook remains negative as the Bundesbank thinks growth could be weaker than forecast.

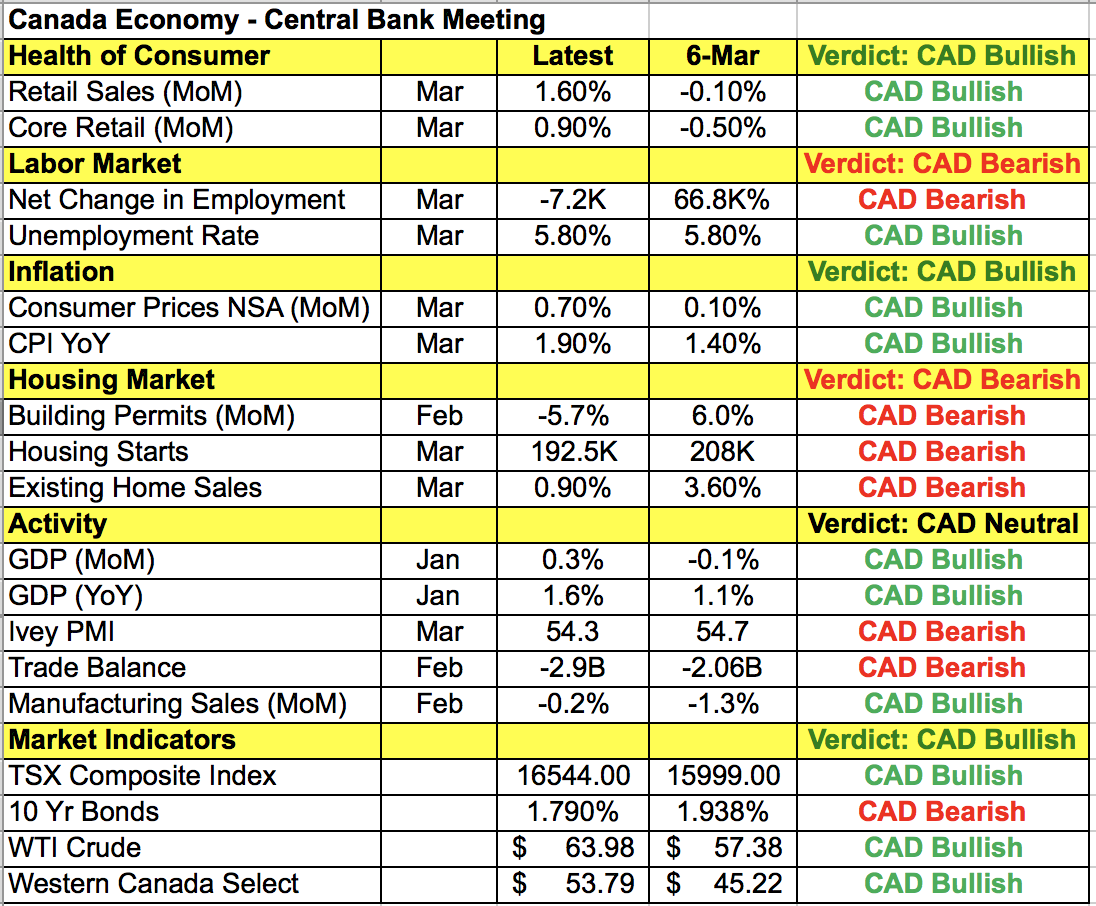

However Wednesday's biggest event risk will be the Bank of Canada’s monetary policy announcement. USD/CAD shot higher Tuesday despite rising oil prices because investors are worried that the central bank could talk rate cuts. In March, the BoC sent USD/CAD tumbling to 2-month lows by expressing concern about growth pointing to increased uncertainty on the timing of future rate hikes. At the time, they were worried about consumer spending, housing and inflation. Fast forward 7 weeks and some of those concerns will be alleviated by the recovery in retail sales and an uptick in CPI growth. However that may not be enough to alter the central bank’s dovish bias. Aside from the monetary policy announcement, we’ll also hear from Governor Carney and Deputy Governor Wilkins. USD/CAD has been trading in a narrow 1.3290 to 1.3400 trading range since the beginning of the month and Tuesday’s breakout is a sign of investor expectations. If the BoC downplays recent data improvements and focuses on uncertainty, USD/CAD could squeeze up to 1.35. If there is even a hit of optimism however we could see USD/CAD slip back down to 1.3330 quickly.

The Bank of Japan begins their 2-day monetary policy meeting on Wednesday and Japan’s economy hasn’t been doing great. According to the latest reports, household-spending growth is slowing, the trade surplus narrowed, confidence is down, manufacturing, services and industrial production growth are weaker and inflation is low. Japan’s economy is widely believed to have contracted in the first quarter. None of this will push the central bank to change monetary policy but they could downgrade their economic assessment. Japan and the US are motivated to reach an agreement quickly but there’s a lot at stake and President Trump has made his displeasure with Japan’s massive trade surplus well known. The risk is to the downside for the Japanese yen but chances are there will be very little reaction to BoJ.