1: Introduction

Barrick Gold (NYSE:GOLD) announced its earnings for the fourth quarter and full year of 2024 on February 12, 2025. This article updates my Gurufocus article from December 2, 2024, in which I analyzed the third quarter of 2024.

Barrick Gold, based in Toronto, Canada, operates some of the largest gold mines in the world, located in North America, South America, Africa, and the Middle East. By the end of 2024, the company reported total gold mineral reserves of 89 million ounces and approximately 18 million tons of copper.

The mineral reserves have significantly increased following the release of the feasibility study for the Reko Diq project in Pakistan and Lumwana in northwestern Zambia. When comparing reserves among two of Barrick’s main competitors, we find that Newmont Corporation (NYSE:NEM) reported attributable proven and probable gold mineral reserves of 134.1 million ounces and 13.5 million tons of copper. In contrast, Agnico Eagle (NYSE:AEM) reported gold reserves of 54.3 million ounces and 0.35 million tons of copper. This figure includes 50% of the St. Nicholas project in Mexico and the Upper Beaver project in Canada.

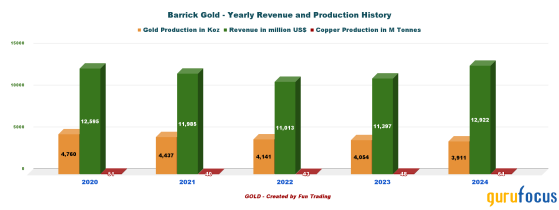

Barrick Gold produced a record 3,911 K gold ounces and 64 million tons of copper in 2024, up from 4,054 K ounces of gold and 48 million tons of copper in 2023. The revenue for 2024 was a record $12.9 billion, up 13.4% year over year.

2: A disappointing stock performance has left me puzzled.

In my article about Newmont Corporation, I discussed the potential for a merger between Barrick Gold and Newmont Corporation, and I highly recommend reading it. This merger could make the stocks of both companies more appealing to investors who are disappointed with their recent performance, especially with gold closing at $2,924 per ounce today. The chart comparison below illustrates that GOLD and NEM have significantly underperformed the group.

Recent analysis indicates that GOLD and NEM have significantly underperformed compared to gold bullion and even copper over the past three years, as shown in the chart below.

This paradox has generated numerous hypotheses, but investors remain cautious about the current situation. They are looking for changes to make GOLD a more successful category.

In my article about NEM, I suggested the possibility of a merger between NEM and GOLD, as both stocks have consistently lagged behind the gold sector for years. A merger between the two companies could be highly beneficial. However, NEM and GOLD will face significant challenges in achieving this goal.

Additionally, a key incentive for GOLD is to increase its dividends to a minimum yield of around 3.5% and buy back more shares. The important factor is that free cash flow is growing significantly, especially with gold prices approaching $3,000 per ounce. Free cash flow could reach $1+ billion in 1Q25 alone.

A reminder: Besides the quarterly dividends, Barrick repurchased 28.675 million shares in 2024 under the share buyback program announced in February 2024, including 21 million shares in the fourth quarter.

3: Location, Location, Location.

One important weakness for Barrick comes from the difficult geographic location of some of its mines, especially in West Africa and Papua New Guinea (Porgera). Barrick Gold experienced so many issues in Africa that it would take three articles to cover the topic fully. However, let’s talk about the most recent issue.

The Loulo-Gounkoto complex in Mali has become the center of a major dispute between Barrick Gold and the government of Mali. The government claimed that Barrick’s operations in the country owed substantial taxes. As a result, around three metric tons of gold, valued at approximately $245 million, have been seized from the mining site by the Malian Junta, which has been in power since 2020. This prompted Barrick to temporarily suspend operations at the complex. The situation is nearing resolution, but we are still waiting for the Mali government’s signature on the documents. According to Reuters:

In February 2025, Barrick agreed to pay $438 million to the Malian government. This settlement facilitated the release of detained employees, return of seized gold, and resumption of operations at the Loulo-Gounkoto mine. The agreement is pending formal approval by Mali’s government, with an official announcement expected soon.Yes, it’s no typo: Barrick is willing to pay $438 million to resume its operations in Mali, which might not be the end of the drama. Furthermore, neighboring countries could draw inspiration from Mali’s situation and make their own claims. We all remember what happened with the North Mara gold in Tanzania.

4: A critical analysis of the fourth quarter results. Operational challenges.

4.1: Revenue and gold production

Barrick Gold Corporation announced its fourth-quarter 2024 earnings on February 12, 2025, showing a strong financial performance. The company reported earnings per share of $0.57, which exceeded analyst expectations, compared to $0.27 in 4Q23. Revenue for the quarter was $3.645 billion, reflecting a 19.2% increase year-over-year. Barrick Gold’s EBITDA was $2,411 million in 4Q24, up from $1,349 million last year.

Gold revenue accounted for 91.3% of total revenue in 4Q24, as illustrated in the chart below:

Barrick’s attributable gold production in the fourth quarter reached 1,080,000 ounces (sold 965,000 ounces), representing a 2.5% increase compared to the previous year. Furthermore, Barrick Gold produced 64 million tons of copper in 4Q24, an increase from 51 million tons in 4Q23.

Barrick Gold reported an average realized gold price of $2,657 per ounce, which is a 7.3% increase compared to the previous quarter and a 34.8% increase year over year.

During the same period, the average realized copper price decreased by 7.3% quarter over quarter to $3.96 per pound. However, the copper price rose 4.8% year over year.

The gold production comes from about 14 producing mines, as shown below:

Randgold (LON:RRS)’s production comes from three African mines: Loulo-Gounkoto in Mali, Kibali in the Democratic Republic of the Congo (DRC), and Tongon in Cote d’Ivoire. The Carlin and Cortez operations in Nevada include the Goldrush and Fourmile sites, with Fourmile being a key development project for Barrick Gold.

Barrick owns the Fourmile Project, an advanced exploration and development initiative near the Cortez Complex in Nevada. It is recognized as one of the highest-grade gold discoveries in North America. While Barrick fully owns the Fourmile Project, there is potential for its integration into the Nevada Gold Mines joint venture under certain conditions, though that is still several years away.

4.2: Costs and Debt

AISC rose by approximately 6.37% to $1,451 per ounce this quarter. However, the company significantly reduced AISC compared to the prior quarter, as shown in the chart below.

Total debt remains stable at $4.729 billion, while cash, cash equivalents, and marketable securities total $4.074 billion. After accounting for total cash, Barrick’s net debt is $655 million. Given its strong cash flow and liquidity, Barrick’s debt situation looks quite manageable. Conversely, Newmont Corporation reported a net debt of $5.308 billion (total debt jumped with the Newcrest acquisition).

5: Conclusion

Barrick Gold reported significant increases in its mineral reserves in 2024. The attributable proven and probable gold mineral reserves rose by approximately 23%, bringing the total to 89 million ounces at a grade of 0.99 grams per tonne (g/t), up from 77 million ounces at a grade of 1.65 g/t in 2023. Additionally, copper mineral reserves experienced a remarkable increase of over 220% due to the Reko Diq project, as previously indicated.

Although Barrick Gold has fewer gold reserves than Newmont Corporation, it leads in copper-attributable reserves, holding 18 million tons compared to Newmont’s 13.5 million tons. Based on profit margins of 42%a significant increase from 27% last yearalong with a gold price of $3,000 per ounce and a copper price of $4.43 per pound, the fair value of Barrick Gold’s stock is estimated to be around $65 per share.

Unfortunately, GOLD is far from reaching this valuation and is trading around $19.33 now.

Like many important gold stocks, gold appears cheap compared to its proven and probable reserves, which now include the Reko Diq project in Balochistan, Pakistan. However, this undervaluation appears to be justified by the low quality of some of the company’s assets, especially those located in Africa.

I previously discussed the Loulo-Gounkoto mining complex in Mali, which is facing operational disruptions due to a dispute with the Malian government over new mining laws and tax claims. Barrick Gold has also encountered ongoing issues for several years, especially with the former Acacia mine in Tanzania, now referred to as the North Mara, Bulyanhulu, and Buzwagi mines. Even the large copper-gold project, Reko Diq, is located in a politically unstable region with active insurgencies. I could also talk about Porgera mine in Papua New Guinea.

Furthermore, Barrick’s all-in-sustaining costs (AISC) have exceeded those of its peers. These factors, along with the inherent geopolitical and operational risks in some African regions, have increased investor concerns, putting downward pressure on Barrick Gold’s stock price.

Finally, Barrick Gold offers a low dividend despite generating substantial free cash flow. Its dividend yield is approximately 1.6% after Canadian 25% withholding tax, significantly lower than that of its oil industry peers.

These significant issues explain why GOLD is lagging behind its peers. Hopefully, management will become more shareholder-friendly in 2025.

This content was originally published on Gurufocus.com