Stocks finished lower following a hotter-than-expected CPI report and a weak 30-year Treasury auction. The CPI data knocked the indexes off their pre-market highs, while the weak Treasury sent rates surging and markets plunging.

The CPI came in a tenth hotter than expected on the monthly and yearly data, with rates moving sharply higher into the 1 PM Auction, with the 30-year trading around 4.8%, up about 11 bps daily. The auction priced at 4.84%, a weak showing, and that sent the 30-year rate surging to finish the day higher by 17 bps or 4.87%.

This also took the 30-year back above that key resistance level at 4.8%, which was area rates were flirting around, and a level that data back to around 2011. So, the move back above 4.8% is a big deal.

Since Friday, the move in the equity market has been tied to rates on the long end of the curve moving lower. So, if rates should continue to move higher following yesterday’s weak Treasury auction, one would think that the equity market gains will recede.

Dollar Index Rebounds

Additionally, the US Dollar Index rose yesterday after falling for six straight days. The dollar index has broken out and could now be on its way higher to test the 107.10 area.

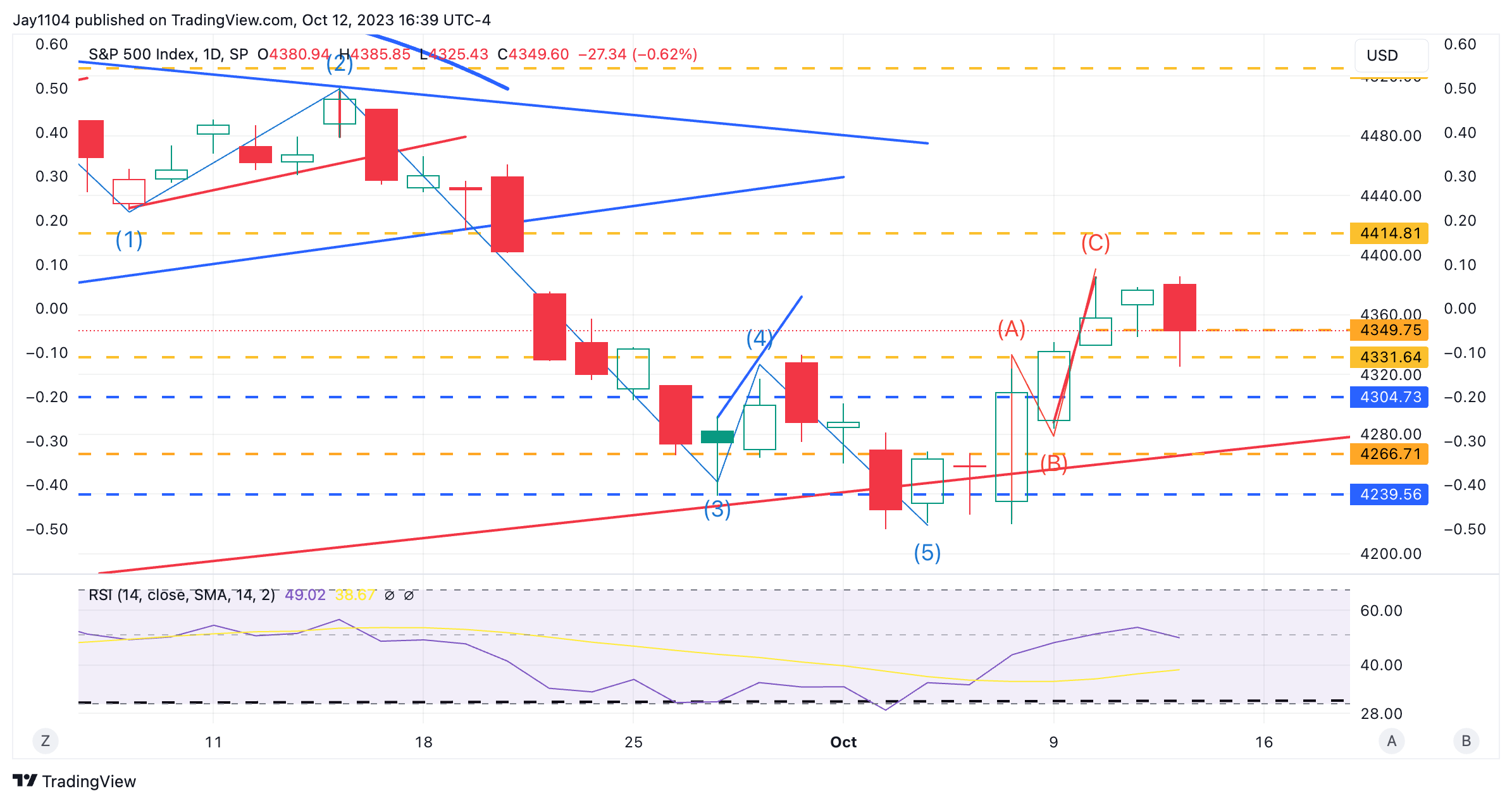

S&P 500 Forms a Double Top

The S&P 500 may have formed a double top on the hourly chart. It must be confirmed today, with a move lower and towards 4,300. What is also key is that the high at 4,385 has also held thus far.

Yesterday also created a bearish engulfing pattern on the S&P 500, and that could also be signaling a turning point in the recent rally.

Nasdaq at a Resistance

For yesterday at least, the NDX high was at resistance at a downtrend that started back in the middle of July, with the index reversing yesterday at 15,330. It could be something. It could be nothing. The Nasdaq also formed a bearish engulfing pattern yesterday as well.

JPMorgan Q3 Results and Earnings Report Ahead

today, JPMorgan (NYSE:JPM) will report results, and earnings estimates for the third quarter have been steadily rising, so it would seem the bar is a bit higher this time around. The stock has been falling into today’s results and doesn’t seem to reflect the excitement of analysts’ estimates.

Overall, S&P 500 earnings estimates have risen since the middle of July by around 1%. Generally, in the first and second quarters, we saw earnings revised lower into earnings season and revised higher as earnings season progressed. This time seems to be different, with estimates rising into earnings season.

Given the stock market’s gains since the spring, it would seem that expectations will again be for better than expected results, but this time, the bar is higher and not as low as the previous two quarters, and that may make this earnings season more challenging than perhaps some expect. But we shall see. Maybe JPMorgan’s results will tip us off.