- After the Fed meeting, eyes are now on Berkshire Hathaway)'s annual meeting, set to take place on the weekend.

- Apple's earnings release today holds significant weight for Berkshire's portfolio performance.

- Analyst revisions remain limited, but technical analysis suggests a potential downside for Berkshire's stock price.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

-

- ProTips: digestible information to simplify a lot of complex financial data into a few words.

- Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can delve into all the details themselves.

- And many other services, not to mention those we plan to add in the near future.

The highly anticipated Berkshire Hathaway (NYSE:BRKb) (NYSE:BRKa)Shareholders' Meeting, nicknamed the "Woodstock for Capitalists," is set to take place this weekend.

This iconic event has transformed over the years, evolving far beyond a typical shareholder gathering. Investors flock to the meeting not only to connect with fellow shareholders but also for the chance to witness and hear legendary investor Warren Buffett speak live.

However, the mood surrounding the event is tinged with a touch of caution. Berkshire Hathaway's stock is currently undergoing a correction. This, coupled with the Fed's continued hawkish stance, raises the possibility of further downside for the stock.

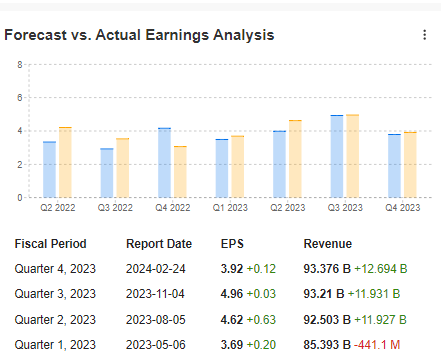

Beating analyst expectations could help slow this trend before it reaches its initial target zone. This correction is not out of the ordinary, considering last year's strong performance where most results surpassed forecasts.

Source: InvestingPro

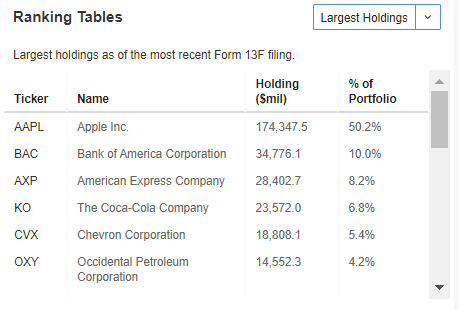

Buffett's Portfolio Structure Mostly Unchanged

Analyzing the latest F13 filings, Berkshire Hathaway's portfolio composition remains largely unchanged. Apple (NASDAQ:AAPL) retains its biggest holding, exceeding 50%, followed by Bank of America (NYSE:BAC) and American Express Company (NYSE:AXP).

Source: InvestingPro

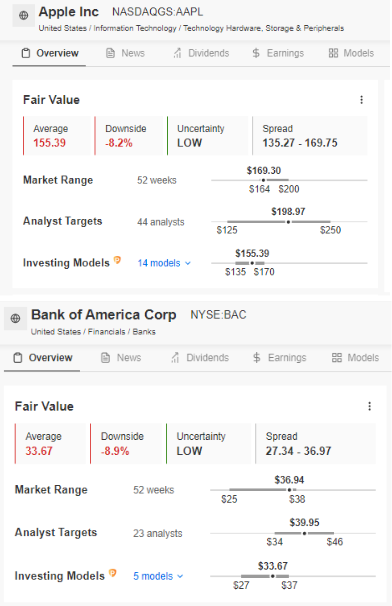

According to InvestingPro's fair value analysis, the leading stocks show negative fair values (except AXP), suggesting a potential correction ahead.

Source: InvestingPro

Source: InvestingPro

Apple's earnings release today will significantly impact not only the company itself but also Buffett's portfolio performance.

Analyst Revisions Remain Limited Ahead of Earnings

Analyst revisions for both A and B share classes of Berkshire Hathaway are scarce and have minimal influence on the projected earnings per share or revenue. For the B class, which is more accessible to retail investors, the current forecasts are:

Source: InvestingPro

Traditionally, these forecasts serve as a key reference point for investors to gauge potential upside or downside in the final results.

How Long Could the Correction Last?

If a corrective price movement occurs, the technical analysis suggests ample room for the stock to move downwards. The next target for sellers would be the confluence of the upward trend line and the support zone around $370 per share.

A decisive break below this area would signal a strong bearish trend. However, such a significant decline would likely require a substantial miss in the earnings report, coupled with a broader market sentiment turning risk-averse.

***

Want to try the tools that maximize your portfolio? Take advantage HERE AND NOW of the opportunity to get the InvestingPro annual plan for less than $10 per month.

For readers of this article, now with the code: INWESTUJPRO1 as much as a 10% discount on annual and two-year InvestingPro subscriptions.ProPicks: AI-managed portfolios of stocks with proven performance.

Act fast and join the investment revolution - get your OFFER HERE!

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.