The runup in yields for most of the major asset classes has peaked, based on the trailing 1-year payout rates for a set of ETFs through Friday’s close (Jan. 5, 2024).

That’s hardly surprising, given the slide in government bond yields in recent months, but it’s a reminder that the low-hanging fruit of relatively rich yields is increasingly in the rear-view mirror.

The potential for a new leg up in yields can’t be ruled out, however. The main catalysts that could drive payout rates higher again include a sharp drop in asset prices and/or a fresh spike in inflationary pressures.

The former is probably the more plausible scenario vs. the latter for the near term. But while we’re waiting for Mr. Market to decide what comes next, here’s a quick look at what’s on offer via trailing 12-month yields.

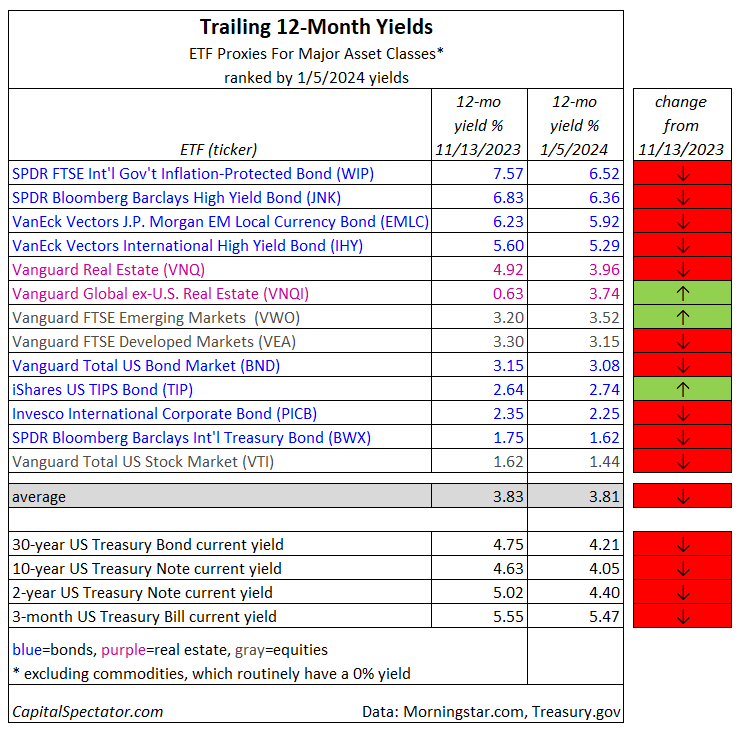

The main takeaway in the table above: most yields are down compared with our November update.

Three exceptions: foreign property shares (VNQI), emerging markets stocks (VWO), and US inflation-indexed Treasuries (TIP). Otherwise, the directional bias in yields is negative.

Leading the pack once more for the highest yield: inflation-indexed government bonds ex-US via SPDR FTSE Inflation-Protected Bond (NYSE:WIP), which tops the field with a 6.52% payout rate over the past year, according to Morningstar.com. That’s far above the 4.05% rate for the benchmark 10-year Treasury Note.

Note, too, that the average yield for the asset class proxies above was essentially unchanged at 3.81% vs. the November profile–a reminder that building portfolios with a globally diversified mix of assets offers a higher degree of stability in terms of ex-ante yield.

As usual, there are caveats to keep in mind when searching for attractive yields. First, the trailing payout rates may or may not prevail in the future. Unlike the opportunity to lock in current yields via government bonds, historical payout rates for risk assets by way of ETFs can be misleading. In some cases, dramatically so. Consider VNQI, which has posted widely changing payout amounts in recent years.

Keep in mind, too, the ever-present possibility that whatever you earn in yields via ETFs fund could be wiped out, and more, with lower share prices. That’s a reason to also consider total return expectations when looking for yield opportunities.