Amazon.com Inc. (NASDAQ:AMZN) is a giant in the realms of e-commerce, cloud computing and digital entertainment. The company, which was initially established as an online bookstore in 1994, has become one of the most influential companies in the world.

With services such as Amazon Prime and the cloud computing service AWS, strong customer orientation alongside technological leading-edge products, it not only changed the retail industry, but created unprecedented new benchmarks. Even amid market fluctuations, Amazon has been continuously demonstrating the sustainability factor, satisfying investors with optimistic results and new innovations. In my opinion, Amazon's Cloud strength and operating income momentum are solid indicators to where the company's focus lies.

This analysis dives into Amazon's operating and financial status, strategic decisions and future opportunities and why it is poised to stay as a potential opportunity for value investors.

Resilience amidst market volatility The company's first-quarter 2024 performance was well-received by the market, but the stock has shown quite a bit of volatility since then. At one point, it fluctuated very close to the $200 resistance level, but did not cross it. However, when Amazon released a mixed second-quarter earnings report on Aug. 1, shares dropped 7% in after-hours trading, which, in my opinion, was an overstated response from the market.

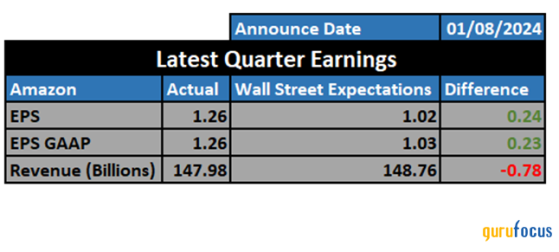

The e-commerce giant delivered mixed results, beating earnings per share expectations but falling short on the revenue front. The consensus for earnings was $1.02, while its actual earnings were $1.26, which was 24 cents higher than projections. However, with revenue of $147.98 billion, Amazon missed Wall Street's forecast by $780 million.

What stood out from Amazon's earnings release, and what we will be focusing on in this discussion, was the strong acceleration of growth and the massive operating income improvements in the Cloud segment. While e-commerce in North America also performed well for, the force undoubtedly belongs to the Cloud segment that is now expected to generate over $40 billion of the run-rate operating income in the next year. I believe investors are underestimating the potential for operating income growth, which may support further increases to its valuation and indicates where Amazon's future focus is pointed.

An in-depth look at financialsContrary to headlines, overall, the second quarter was a good one for Amazon. Total revenue was up by 10.12% year over year, bringing total revenue for the first half up by 11.29%. The combination of an additional $13.59 billion in revenue and improved efficiency enabled the company to generate $14.67 billion in operating income, translating to a 91.02% year-over-year increase ($6.99 billion). However, the total revenue declined as compared to the previous quarter by 3 percentage points, primarily due to a slowdown in the e-commerce segment.

Amazon Web Services, however, witnessed an increasing rate of revenue growth, rising from 17.20% in the first quarter to 18.88% in the second quarter. This is primarily due to the company's decision to transition from on-premise infrastructure to cloud solutions, citing the increasing demand to implement artificial intelligence technologies. Cloud businesses overall have remained robust during the most recent quarter with Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) posting healthy revenue growth, suggesting these companies know where the future lies and are not cutting back on digital transformation investments.

One of main takeaways from the earnings report that I believe we will see more and more of in the future is that there is sustained operating income growth across all of Amazon's operations, especially cloud. With a market share of more than 30%, the cloud segment delivered 19% year-over-year growth. This was mainly due to signing new services contracts with Databricks, ServiceNow (NYSE:NOW) and GE HealthCare (NASDAQ:GEHC), among others, which I believe will only increase in the future.

The most critical figure is the amount of operating income the AWS segment incrementally added to the results. In the second quarter, the segment contributed $9.30 billion to operating income, which is a whopping 74% increase year over year. In comparison, the Google Cloud segment posted $1.20 billion in operating income. That means AWS made 8 times more profit for Amazon over the same period.

AWS is progressing toward becoming a $100 billion-plus annual revenue company with around $40 billion of recurring operating income. Importantly, 57% of its total operating income growth came from the AWS segment in the second quarter. As we are entering a new generation of technological growth focused on AI, Amazon looks poised to capitalize on it like it did with the cloud in the early 2010s.

It is not just Amazon driving cloud growth, however. The whole cloud market is experiencing exponential growth. Currently, projections form Precedence Research indicate the cloud computing market has the potential to reach $2.30 trillion, growing at a rate of 17% annually with 2023 as the base year.

Advertising is another segment that has been expanding rapidly for Amazon, generating over $2 billion in additional revenue year over year. As such, there is potential in video advertising within the Prime Video service.

ValuationsCurrently, Amazon shares trade at a price-earnings ratio of 45, making it the second most expensive large-cap tech company after Tesla (NASDAQ:TSLA), which trades at a price-earnings ratio of 56. However, from a long-term earnings per share growth perspective, Amazon arguably remains one of the best investments as it is projected to grow its earnings at an annual rate of 23% in the long term, mainly because of its cloud business.

In my opinion, Amazon justifiably trades at one of the highest earnings multiples due to its stronger-than-average projected earnings per share growth. This growth primarily hinges on cloud and despite a slight top-line miss in the second quarter by the company as a whole, the cloud growth story remains intact. AWS is positioned for significant growth and new contract wins. I see operating income margin expansion as a catalyst for the stock, along with continued AI spending.

Growth in the AI and cloud markets requires constant investment. Amazon is sitting on $71.18 billion in cash on hand, with an additional $17.91 billion in short-term investments. With $89.09 billion in liquidity and only $54.89 billion in long-term debt, the company has a strong balance sheet, allowing it to allocate capital as needed to expand its operations without concerns about debt obligations.

On a trailing 12-month basis, this is the 8th consecutive quarter where Amazon's cash from operations increased along with its free cash flow. Having surpassed $100 billion in cash from operations on a trailing 12-month basis, the company is still spending over $50 billion annually on capital expenditures and generating $54.98 billion in free cash flow. I believe this allows it to continue increasing the amount of cash from operations it makes, and even if they feel the need to increase capex during the AI boom to accelerate growth, it should ultimately correlate to higher growth in FCF. Hence, it would have no apparent problem putting in more cash to accelerate its cloud and AI dominance.

RisksDespite Amazon's dominance, there are still some risks to consider as an investor. The biggest risk, in my view, is a potential slowdown in the cloud business or operating margin contraction if the U.S. enters a recession. While the company's cloud business is growing rapidly, its reliance on this segment for operating income gains is increasing.

Another risk lies in the e-commerce segment, which it still heavily relies on. The business accounted for over 65% of total second-quarter revenue. A recession could lead to reduced consumer spending, impacting e-commerce sales. It is essential not to overlook the challenges in the retail segment while focusing on AWS's growth. Having said that, Amazon's massive e-commerce scale suggests it is well-positioned to weather weakness compared to smaller peers.

Moreover, Amazon Prime membership gives the company a highly competitive advantage to keep its e-commerce dominance. As seen below, its fast and reliable shipping capabilities are considered the "number one reason" for Prime membership.

The Amazon Prime-driven competitive advantages extend into Prime video. Over the past year, its advertising business has generated over $50 billion in revenue, positioning the company incredibly well in the digital advertising market.

Final thoughtsAmazon offers a promising growth outlook for the third quarter. With impressive cloud results, especially with regard to the incremental operating income growth, the company looks set to capture the cloud market as it did with the e-commerce market a decade ago. The Cloud segment is on track to achieve $40 billion or more in annual recurring operating income over the next 12 months based on run-rate results and with the secured contract wins for AWS segment in the second quarter alone.

From a broader perspective, both sales growth and the operating margin look very good and are likely to remain strong going forward. This suggests that earnings per share can continue its upward trajectory for fiscal 2025. I see a huge opportunity in Amazon for long-term investors as generative AI and machine learning will drive additional revenue across various business segments in the future. The company's financial metrics are moving in the right direction, and based on historical levels, this may be one of the best times to invest in the stock.

This content was originally published on Gurufocus.com