As many of you are no doubt aware by now, France’s left-wing New Popular Front alliance thwarted Marine Le Pen’s National Rally party in a stunning upset, leaving the country without a clear majority in parliament. President Emmanuel Macron’s call for parties to form a governing alliance reflects the profound uncertainty gripping the country. In his open letter, Macron remarked that “no one won,” highlighting the political limbo France now faces.

The gridlock couldn’t have come at a worse time for France or its economy. The Olympics are set to begin in under weeks, and high debt and sticky wage inflation continue to stunt growth. Markets are jittery, and the European Central Bank’s (ECB) task of maintaining stability across the eurozone has just become significantly more complicated.

France, the seventh largest country by GDP, casts a long shadow. It accounts for a significant 20% of the eurozone’s economy. Investors should be aware that this situation could lead to increased volatility in markets, not just within France, but across Europe. The F40, which tracks the 40 largest French companies, is up only 2% year-to-date, compared to the EURO STOXX 50, up 11% over the same period.

Western Leadership Deficit

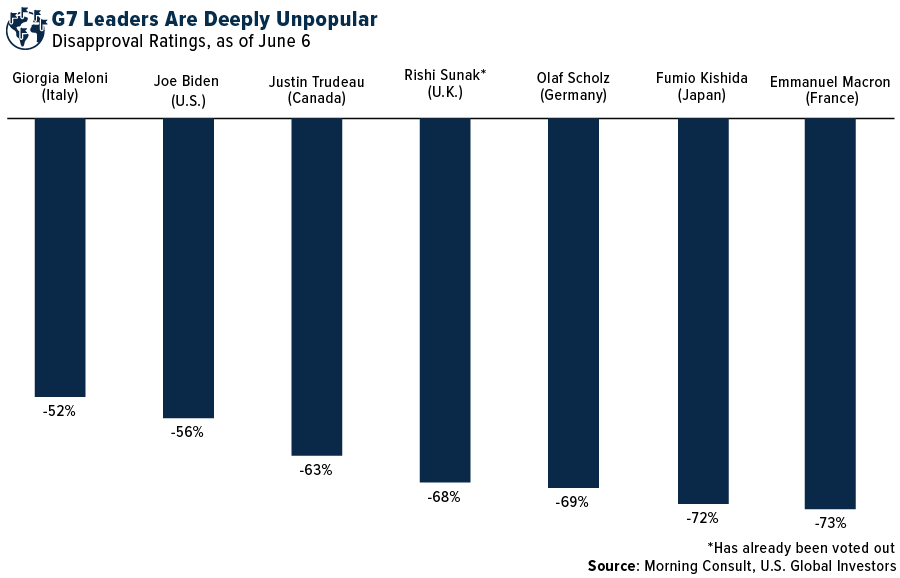

It’s not just France that’s dealing with leadership challenges. When G7 leaders met in Italy last month, their unpopularity was glaringly evident. Italian Prime Minister Giorgia Meloni is the most popular of the group, but even she has a 52% disapproval rating, according to Morning Consult. Contrast this with Indian Prime Minister Narendra Modi, who enjoys a remarkable 70% approval rating, and it’s clear that many Western economies are suffering from a leadership deficit.

I don’t think it’s a stretch to say that the world is stuck in a state of permacrisis, an extended period of global instability. In this decade, there have been more armed conflicts involving state-based and non-state actors than at any time since the 1970s, according to the Uppsala University’s Conflict Data Program. This suggests to me a lack of strong leadership and commitment to peace, which has profound implications for global markets and investor sentiment.

Biden’s Election Outlook Post-Debate

Back home, President Joe Biden faces his own set of challenges, as you know. Following his disastrous debate performance, a Washington Post/ABC News/Ipsos poll found that a whopping 56% of Democratic voters want Biden to drop out of the 2024 race. Prominent figures like George Clooney have openly urged him to step aside, citing concerns about his cognitive fitness.

Saturday’s failed assassination attempt on Donald Trump has given the former president a boost in the polls, but it remains to be seen if this goodwill will persist until Election Day, a little over 110 days from now.

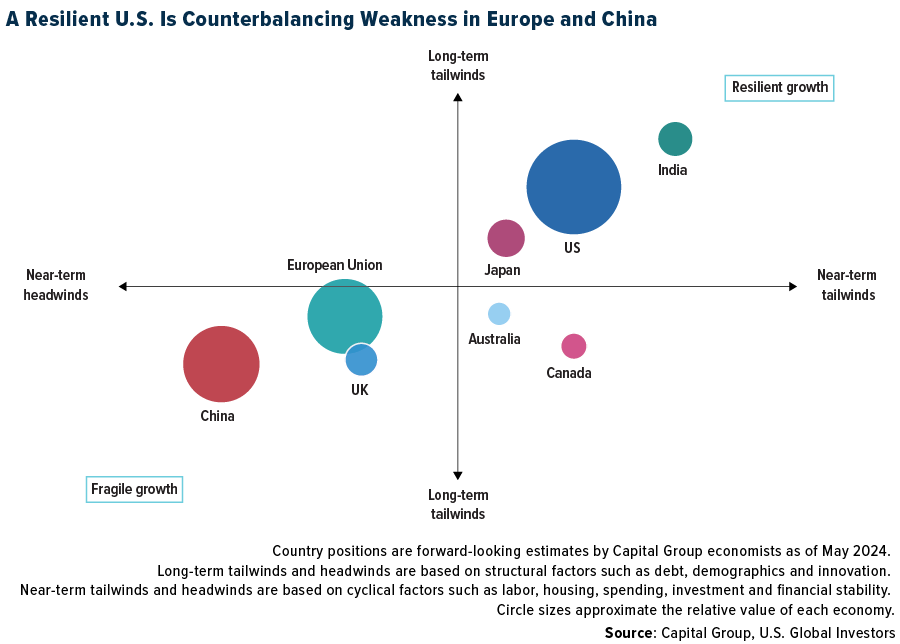

Despite these challenges, presidential election predictor Allan Lichtman—who, using his “Keys to the White House” system, has correctly predicted the outcome of all but one election since the early 80s—still sees a slight advantage for Biden, thanks in large part to the current strength of the U.S. economy. The International Monetary Fund (IMF) forecasts that the U.S. economy will grow at 2.7% this year, more than twice the rate of other major developed countries. And in its midyear report, Capital Group makes the case that the U.S. “is once again serving the critical role of global growth engine.”

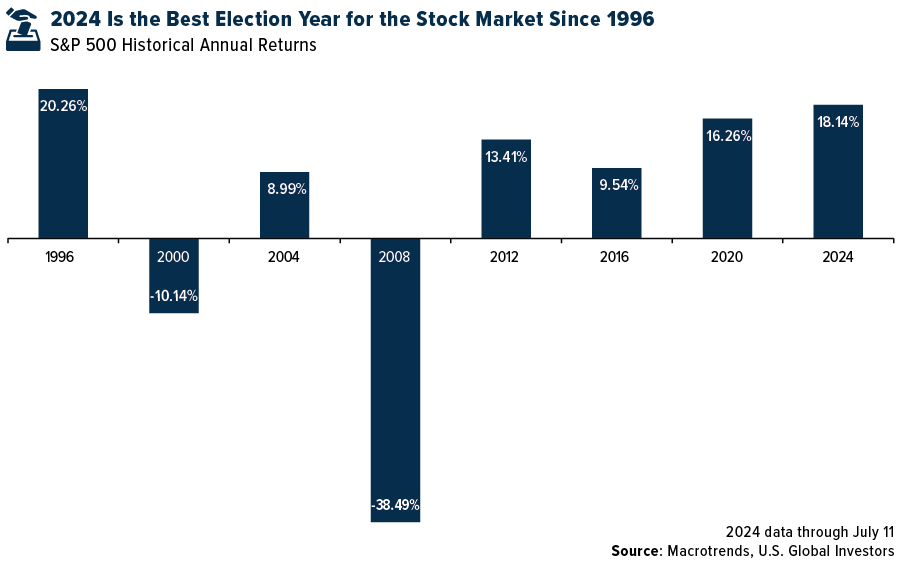

The U.S. stock market is also performing exceptionally well this year, which plays in Biden’s favor. The S&P 500 was up more than 18% year-to-date through July 11, making 2024 the best election year for stocks since 1996, when President Bill Clinton and Senator Bob Dole duked it out.

Gold Near All-Time High

In these uncertain times, I still believe that gold remains a beacon of stability. As I write this, the yellow metal is trading at $2,415 an ounce, about 1% away from its all-time high. A cooler CPI report and higher unemployment have opened the door to a potential rate cut in September; if the Federal Reserve acts, I expect gold to benefit. Diversifying with assets like gold can provide a hedge against the economic and political uncertainties we face today.

Stay informed, stay vigilant and invest wisely!

Bloomberg France 40 Price Return Index is a float market-cap weighted equity benchmark that covers the largest 40 issuers by float market capitalization. The EURO STOXX 50 Index, Europe's leading blue-chip index for the Eurozone, provides a blue-chip representation of super-sector leaders in the region. The index covers 50 stocks from 11 Eurozone countries. The S&P 500 is a market-capitalization-weighted stock market index that tracks the stock performance of about 500 of some of the largest U.S. public companies. The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.