The recurring sentiment from the most recent earnings release of Canada’s Big Six banks has been the importance of having sufficient reserves set aside for credit losses, as unabated inflation continues to call for tighter monetary policy.

Implications of a rising rate environment

Provision for credit losses (PCL), an expense set aside by financial institutions to cover potential losses on loans, credit exposures, and other financial instruments, totaled $3.54 billion for the Big Six banks as of July 31st, which is materially more than the e $1.54 billion registered in the same quarter in 2022. PCLs are a key credit metric for measuring the health of a bank’s loan book and by extension the ability of households and businesses to pay their debts. Each quarter, the banks must assess not only the potential losses stemming from borrowers who have fallen behind on payments, but also consider any changes to their economic forecasts, and whether those changes are more likely to push borrowers into default in the future.

With the Bank of Canada maintaining the policy interest rate at 5% and continuing quantitative tightening, the current elevated interest rate environment is here to stay for the foreseeable future. Pertaining to housing and the ramifications of elevated rates, Bank of Canada Governor Macklem was quoted in a speech to the Calgary Chamber of Commerce stating, “The single price increase that is having the biggest impact on CPI inflation is mortgage interest costs, which have gone up as we’ve increased interest rates. They’re about 30% higher than they were a year ago. When you exclude mortgage interest costs, CPI inflation is close to 2½%, leading some to argue that inflation is effectively back at target. It’s true that if we hadn’t raised interest rates, mortgage costs might be lower today, but inflation throughout the economy would be a much bigger problem for everyone”.

Taking precautious measures

Across the Big Six banks, PCL adjustments differed. The Canadian Imperial Bank of Commerce’s (CIBC (TSX:CM)) report total provision for credit losses was $736 million for the quarter, a material increase from the $493 million reported in the same quarter last year. The Bank of Montreal (TSX:BMO) had a PCL of $492 million, which was a 261 percent year over year third quarter increase, but also included results from the U.S.-based Bank of the West, which was acquired by BMO recently. National Bank (NB) had $111 million in PCLs for the third quarter, which was $57 million in the previous year. The Royal Bank of Canada (TSX:RY) (RBC) reported PCLs of $616 million for the quarter, an increase from the $340 million reported in the previous year. Toronto-Dominion Bank’s (TD) provisions for credit losses in the third quarter reached $766 million, which was $351 million the year prior. Finally, the Bank of Nova Scotia (TSX:BNS) (Scotiabank) reported $819 million in provision for credit losses for the quarter, almost double the $412 million reported a year ago.

In addition to the precautions measures the Big Six banks are already taking, effective November 1st, the domestic stability buffer - a capital buffer that the banks are required to set aside to cover losses during financial uncertainties - will increase by half a percentage point to 3.5 percent. The Office of the Superintendent of Financial Institutions (OSFI), Canada's financial regulator, is raising the amount of capital the country's major banks need to have on hand to cover potential losses as it says financial system vulnerabilities remain elevated and, in some cases, have continued to increase. It is worth noting that in December 2022, OSFI had already increased the buffer by half a percentage point to three percent.

Investing in Canadian Banks

While many bank watchers will view the growth in PCL among banks as a sign that the economic environment is worsening, it could also be interpreted as banks taking a conservative stance in a precarious market environment where they would rather be overcapitalized than not sufficiently prepared. However, many of these financial institutions still identify and capitalize on opportunities to bolster their overall value proposition to their shareholders and clients.

In March 2023, TD Bank completed the acquisition of Cowen Inc. (“Cowen”), an American multinational investment bank. The acquisition advances the Wholesale Banking segment’s long-term growth strategy in the U.S. and adds complementary products and services to the Bank’s existing businesses. Similarly, RBC recently received the requisite approval from the Competition Bureau Canada to proceed with their acquisition of HSBC Canada. The Competition Bureau Canada assessment findings will inform the Minister of Finance’s ongoing review of the proposed corporate action.

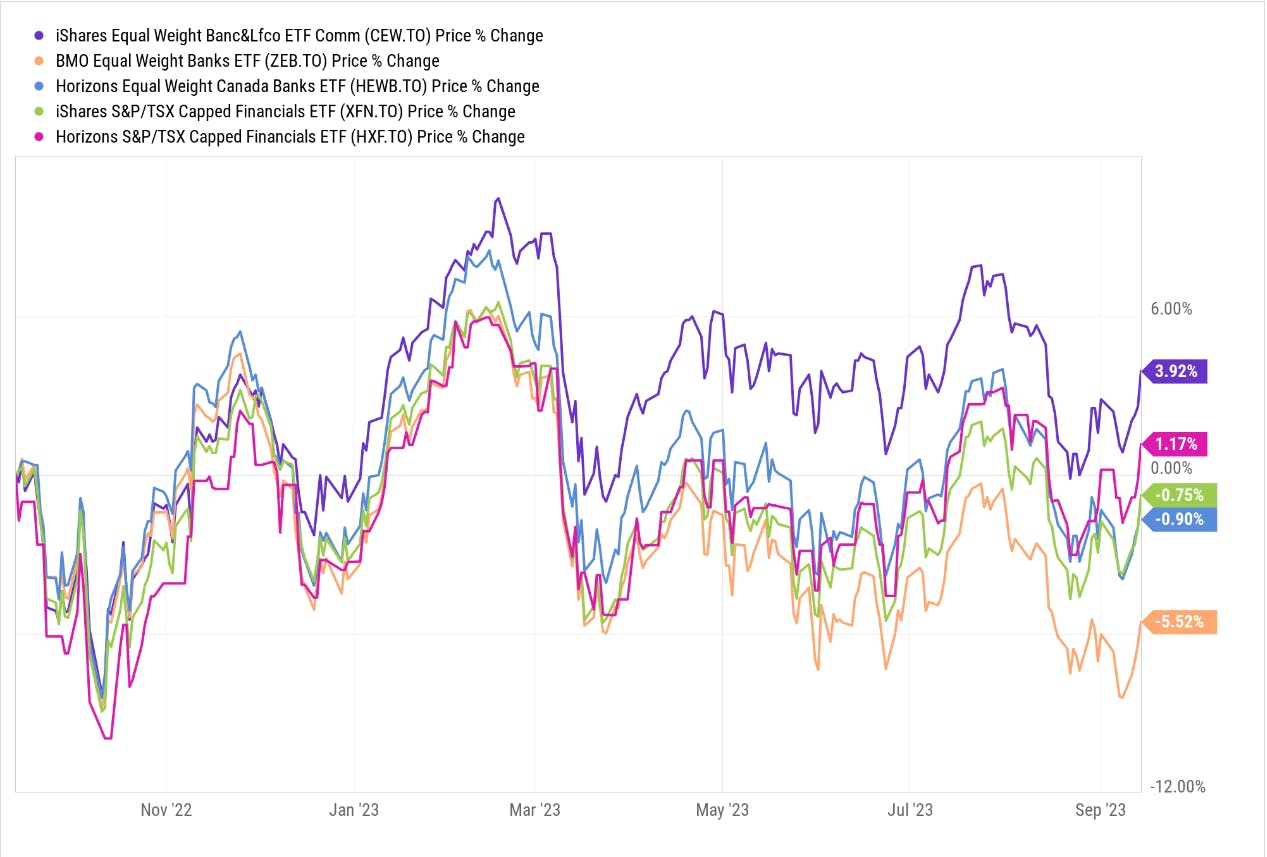

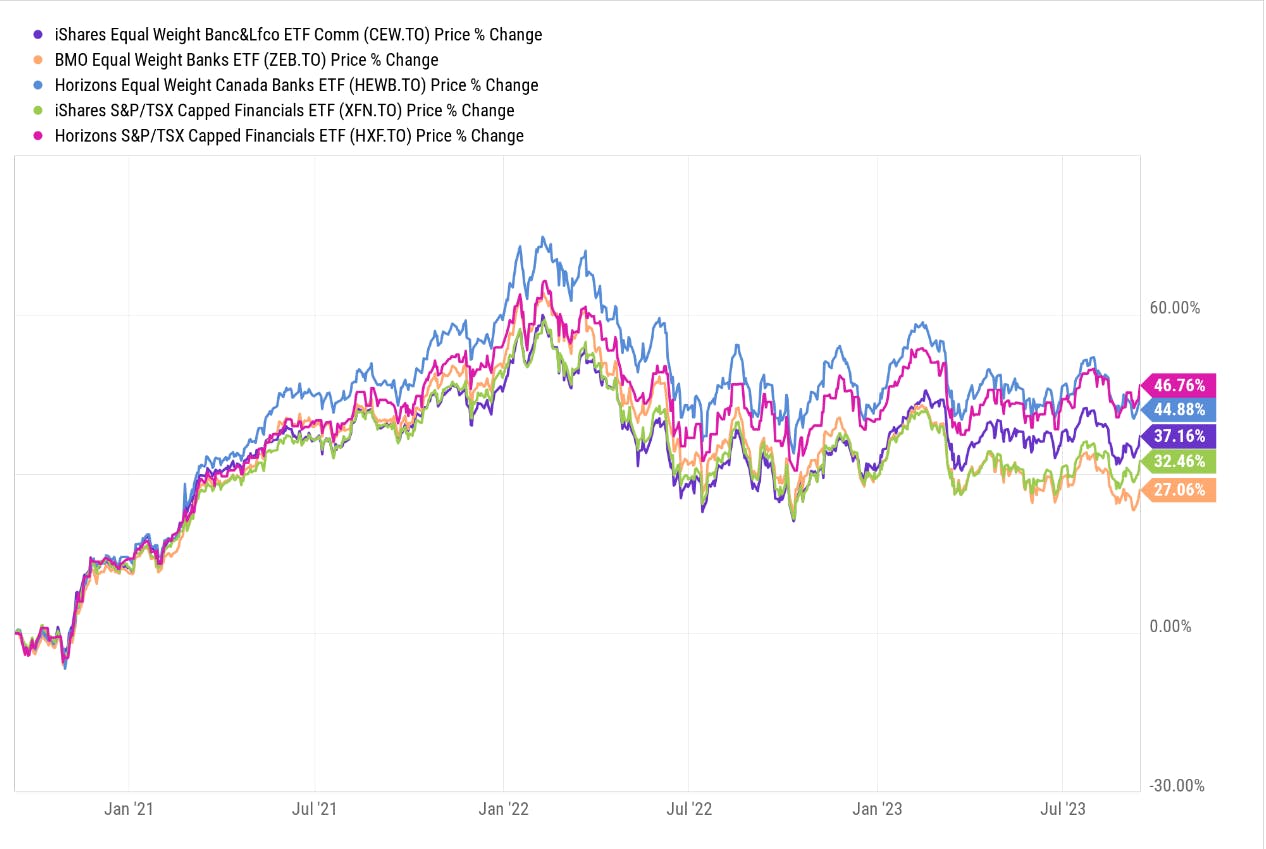

For investors that desire to have broad exposure to Canadian Banks and/or the Canadian financial services sector at large, the iShares Equal Weight Banc & Lifeco Common Class (TSX:CEW) Comm (Ticker: CEW), BMO S&P/TSX Equal Weight Banks (TSX:ZEB) (Ticker: ZEB), Horizons Equal Weight Canada Banks Index ETF (TSX:HEWB) (Ticker: HEWB), iShares S&P/TSX Capped Financials (TSX:XFN)(Ticker: XFN), and Horizons S&P TSX Capped Financials (TSX:HXF) (Ticker: HXF) are worth consideration.

While the recent performance of these solutions reflects current market dynamics, in taking a longer look at the performance of these mandates, they have rewarded investors significantly over time. While ZEB and HEWB both provide exposure equal weight exposure to the Big Six Canadian banks, the former invests in and holds the constituent securities of the Solactive Equal Weight Canada Banks Index in the same proportion as they are reflected in the index, whereas, the latter holds the index directly.

CEW provides investors with diversified equal weighted investments in the largest Canadian banks and Canadian life insurance companies. CEW will endeavor to provide holders of its Units with monthly cash distributions. Presently the ETF is paying monthly cash distributions of $0.041 per unit.

Both XFN and HXF provide investors with exposure to the S&P/TSX Capped Financials Index, which presently (as of September 8th) has material allocations to Royal Bank of Canada (19.34%) and Toronto-Dominion Bank (TSX:TD) (17.09%), followed by Bank of Montreal (9.43%) and Bank of Nova Scotia (8.80%).

Conclusion

Looking forward, the impact of inflation and higher rates is expected to play out over time, and we are still in the early stages of the current credit cycle. For investors interested in Canadian Banks, the abovementioned ETFs, provide exposure to Canada’s Big Six banks and are suited for long-term focused investors who desire to gain exposure to some of the largest firms within Canada’s financial service sector.

This content was originally published by our partners at the Canadian ETF Marketplace.