In this Bitcoin (BTC) price prediction for 2024, 2025, and 2030, we will analyze the price patterns of BTC by using accurate trader-friendly technical analysis indicators and predict the future movement of the cryptocurrency.

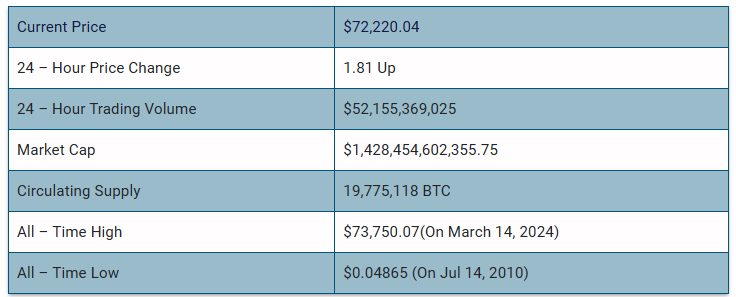

Bitcoin (BTC) Current Market Status

What is Bitcoin (BTC)?

Bitcoin (BTC) is the original decentralized digital currency created by the pseudonymous founder(s) Satoshi Nakamoto in 2009, introducing the concept of blockchain technology. BTC utilizes a peer-to-peer network and operates on a proof-of-work (PoW) consensus, where validators secure transactions through energy-intensive “mining.” The cryptocurrency has a fixed supply cap of 21 million BTC, with less than 1.35 million BTC remaining to be mined as of February 2024.

Bitcoin has shown a significant transformative journey since its inception. From being the first cryptocurrency to gaining widespread recognition, it has become a dominant force in the global financial landscape. Bitcoin holds the title of the “largest cryptocurrency” by market capitalization, and its adoption has expanded into various sectors, from retail to education and the introduction of real-world Bitcoin ATMs.

Currently, the approval of spot Bitcoin exchange-traded fund (ETF) gained widespread attention from both individuals and institutional investors, which would further propel the adoption of BTC. Furthermore, the upcoming Bitcoin halving, scheduled for April 2024, will see a 50% decrease in mining rewards.

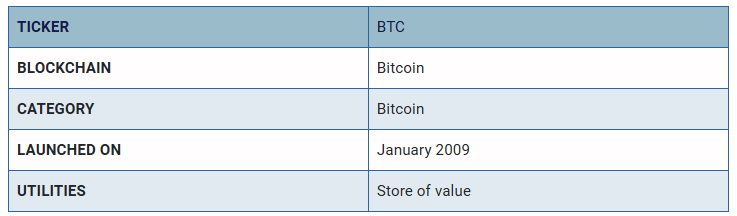

Bitcoin 24H Technicals

Bitcoin (BTC) Price Prediction 2024

Bitcoin (BTC) ranks 1st on CoinMarketCap in terms of its market capitalization. The overview of the Bitcoin price prediction for 2024 is explained below with a daily time frame.

In the above chart, Bitcoin (BTC) laid out a descending broadening wedge pattern. A descending broadening wedge is a bullish reversal pattern. The pattern is an inverted ascending triangle because it is made up of two converging lines with a horizontal line for the resistance and a bearish downward slant for the support.

At the time of analysis, the price of Bitcoin (BTC) was recorded at $72,432. If the pattern trend continues, then the price of BTC might reach the resistance levels of $75,507 and $104,902. If the trend reverses, then the price of BTC may fall to the support of $64,967 and $52,456.

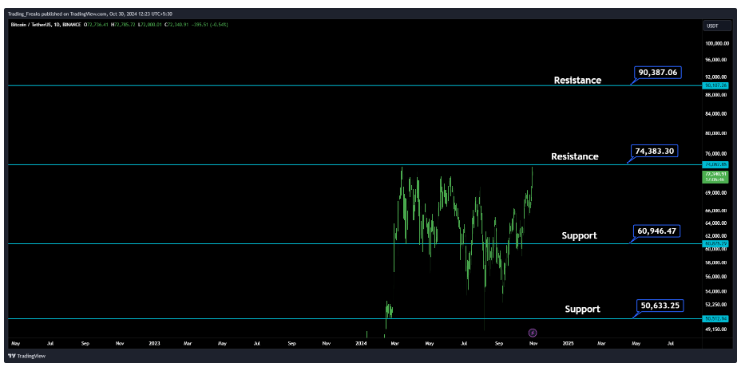

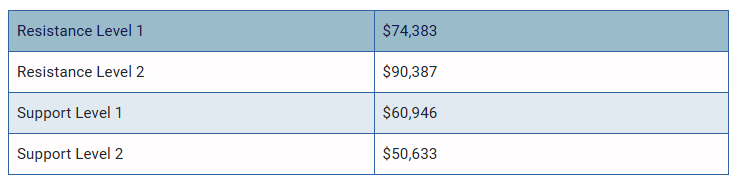

Bitcoin (BTC) Resistance and Support Levels

The chart given below elucidates the possible resistance and support levels of Bitcoin (BTC) in 2024.

From the above chart, we can analyze and identify the following as resistance and support levels of Bitcoin (BTC) for 2024.

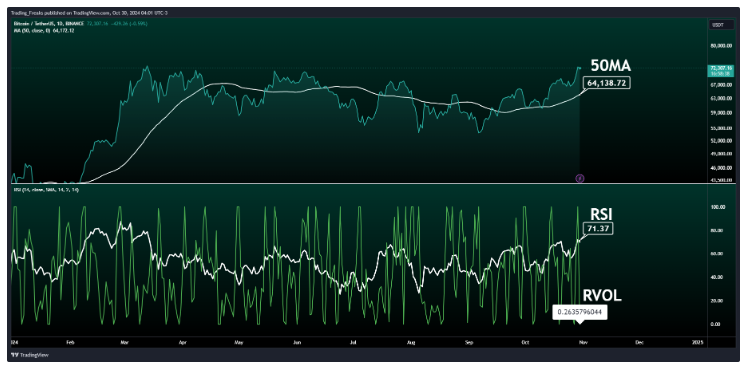

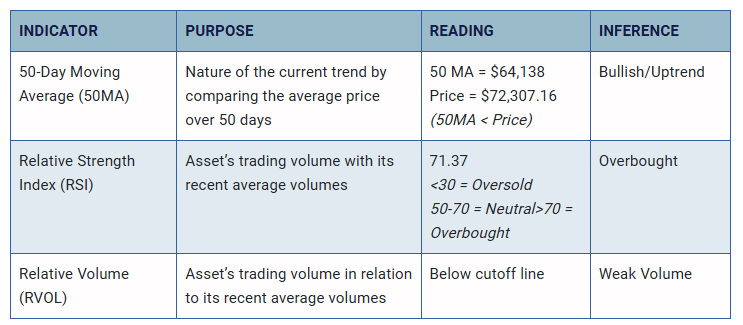

Bitcoin (BTC) Price Prediction 2024 — RVOL, MA, and RSI

The technical analysis indicators such as Relative Volume (RVOL), Moving Average (MA), and Relative Strength Index (RSI) of Bitcoin (BTC) are shown in the chart below.

From the readings on the chart above, we can make the following inferences regarding the current Bitcoin (BTC) market in 2024.

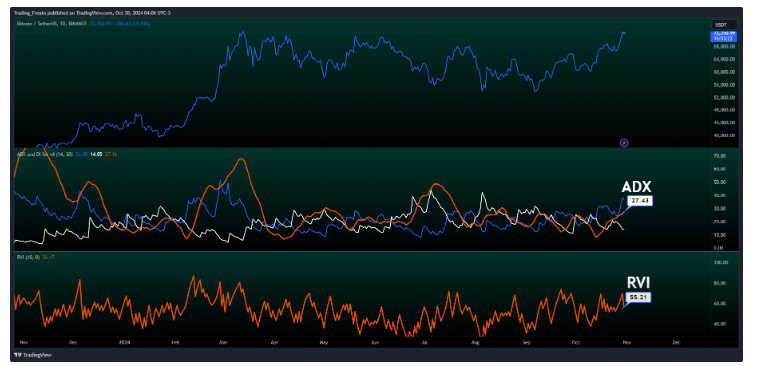

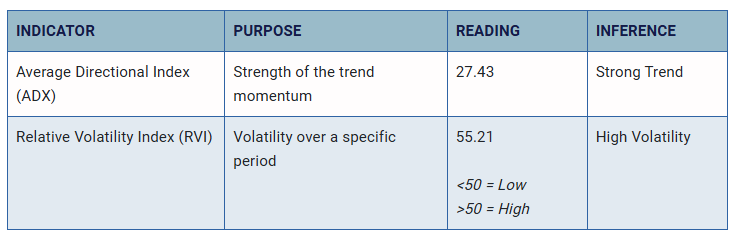

Bitcoin (BTC) Price Prediction 2024 — ADX, RVI

In the below chart, we analyze the strength and volatility of Bitcoin (BTC) using the following technical analysis indicators — Average Directional Index (ADX) and Relative Volatility Index (RVI).

From the readings on the chart above, we can make the following inferences regarding the price momentum of Bitcoin (BTC).

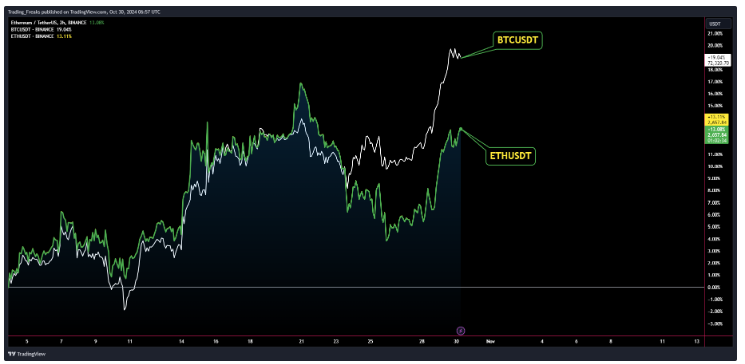

Comparison of BTC with ETH

Let us now compare the price movements of Bitcoin (BTC) with that of Ethereum (ETH).

From the above chart, we can interpret that the price action of BTC and ETH are seen to exhibit similar trajectories.

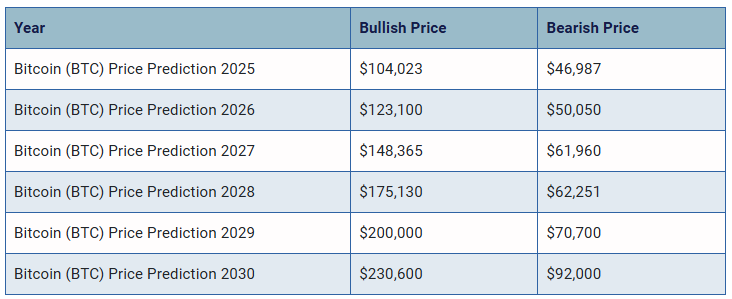

Bitcoin (BTC) Price Prediction 2025, 2026 – 2030

With the help of the aforementioned technical analysis indicators and trend patterns, let us predict the price of Bitcoin (BTC) between 2025, 2026, 2027, 2028, 2029, and 2030.

Conclusion

In conclusion, the bullish Bitcoin (BTC) price prediction for 2024 is $90,387. Comparatively, if unfavorable sentiment is triggered, the bearish Bitcoin (BTC) price prediction for 2024 is $50,633.

If the market momentum and investors’ sentiment positively elevate, then Bitcoin (BTC) might hit $89,916. Furthermore, with future upgrades and advancements in the Bitcoin ecosystem, BTC might surpass its current all-time high (ATH) of $73,750 and mark its new ATH.

This content was originally published by our partners at The News Crypto.