Carney sees few tariff-free options in potential Canada-U.S. trade deal

Despite a string of rejections by the U.S. Securities and Exchange Commission (SEC) for spot Bitcoin ETFs, BlackRock (NYSE:BLK), the world's largest asset manager, has filed its own proposal. The SEC's concerns over the unregulated nature of the crypto space and potential fraud have been consistently cited as reasons for rejection to date.

Although the U.S. has yet to see a spot Bitcoin ETF, such ETFs are already trading successfully in Canada, benefiting from the more accommodative stance of Canadian regulators.

In the U.S., the first exchange-traded fund backed by physically settled Bitcoin was launched more than two years ago. Furthermore, the SEC has greenlit Bitcoin futures ETFs, which do not invest directly in Bitcoin but rather use futures contracts. A notable example includes the ProShares Bitcoin Strategy ETF. Additionally, Grayscale Bitcoin Trust (GBTC), an older vehicle that has amassed over $19 billion, also provides U.S. investors with an alternative way to gain exposure to Bitcoin. However, as GBTC is structured as a closed-end fund rather than an ETF, its market price has often deviated significantly from the actual value of the underlying Bitcoin holdings. Grayscale Investment LLC has already tried to convert its flagship GBTC into an exchange-traded fund but the SEC rejected its application, arguing the proposal did not meet anti-fraud and investor protection standards.

Given the SEC's track record to date and its recent lawsuit against Coinbase (NASDAQ:COIN), the proposed custodian for BlackRock's product, you could logically wonder if there’s any hope of approval. Yet, BlackRock has introduced an enhanced degree of oversight related to cryptocurrencies which potentially strengthens its case. Indeed, the inclusion of a surveillance-sharing agreement is seen as a crucial element that could tip the scales in favor of approval. This agreement allows for monitoring and reporting potential market manipulation, a concern previously raised by the SEC. Additionally, speculation has arisen that BlackRock's filing could serve as a mediator in the SEC's lawsuit against Coinbase, potentially contributing to a more favorable outcome for the proposed ETF. While no official indications have been given by the SEC regarding a change in its stance, the prevailing sentiment suggests a higher likelihood of approval for BlackRock's Bitcoin ETF.

And in a notable development, hot on the heels of BlackRock's announcement, Invesco and WisdomTree, have filed their own respective applications for spot Bitcoin ETFs. Fidelity Investments, meanwhile, has also disclosed its intentions to join the ranks. Such a surge of interest from prominent investment firms underscores the growing momentum and widespread recognition of Bitcoin as a viable investment vehicle.

This bullish backdrop helps explain Bitcoin’s remarkable ascent, to reach its highest point in thirteenth months, surpassing the $30,500 mark. The ProShares Bitcoin Strategy ETF (BITO) thus gained +17.83% week-over-week, bringing its year-to-date performance to +72.62%. Meanwhile the Grayscale Bitcoin Trust jumped almost 27% over the week, up 131.48% YTD.

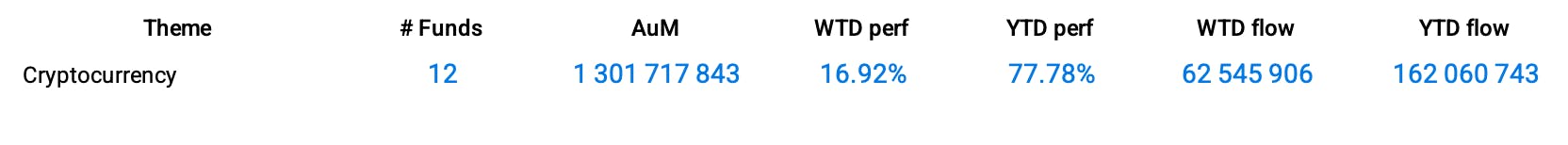

Group Data: Cryptocurrency Segment

Funds Specific Data: BITO, BITQ, XBTF

This content was originally published by our partners at ETF Central.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.