The S&P 500 has continued its upward trajectory, surging by 3.11% in July, while the cumulative gains over the past 3 months stand at 10.06%.

Obviously, the Fed’s indication that it might pivot has contributed to the positive sentiment among investors. However, it's also worth noting the resilience of the US economy, which has played a significant role in this outlook.

The unemployment rate currently hovers between 3.5% and 3.6%, near 50-year lows. Remarkable.

To top it up, the latest earning reports for Q2 2023 came in slightly higher than expected for most companies, further improving the market’s confidence.

But despite this renewed optimism, the higher sentiment should be a cause for concern for any investor.

BTC Maintains Resilience Despite Falling Volumes

Bitcoin's price remained relatively stable in Q2, even as altcoins like BNB experienced double-digit drawdowns.

The latest report by Coingecko reveals that BTC outperformed the overall crypto market cap by 6.9%, though it lagged behind the Nasdaq and S&P 500, which gained 14% and 8%, respectively.

This is interesting as BTC usually behaves like a risk asset and typically outperforms the Nasdaq both to the upside and downside.

Will BTC hold up if the equities market tumbles? Time will tell.

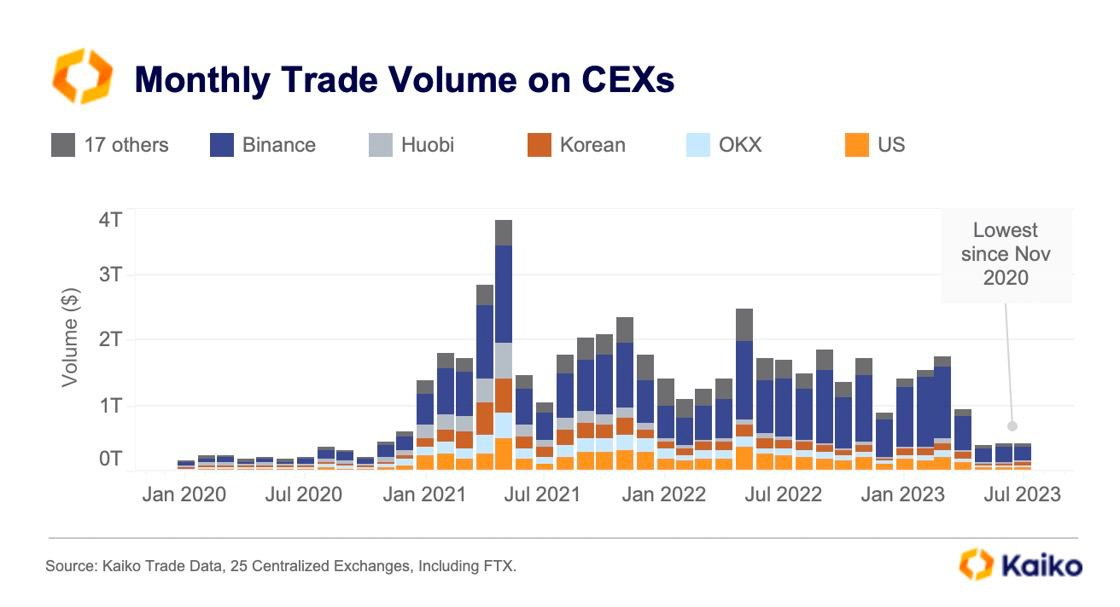

However, in spite of BTC's resilience, the declining volumes and activity in the crypto space are evident. Monthly volumes are the lowest they've been since November 2020.