Reflecting the trend of recent weeks, Bitcoin once again experienced a significant increase, surpassing the $37,000 threshold on Thursday. This spike can be largely attributed to optimism around the expected green light for a spot Bitcoin exchange-traded fund (ETF) by the US Securities and Exchange Commission (SEC), with industry insiders anticipating the potential approval to result in substantial capital pouring into the digital currency. Accordingly, the FT Wilshire Top 5 Digital Assets Index (FTWT5) gained +15.60% last week, bringing its year-to-date performance to +109.13%.

Bitcoin’s bullish trend climbed to unprecedented levels on Wednesday, fueled by a report by CoinDesk stating that the SEC had begun serious talks with Grayscale Investments about the terms of its proposal to convert its Bitcoin trust, often referred to as GBTC, into a Bitcoin ETF (TSX:EBIT). This development has served to reinvigorate the enthusiasm of cryptocurrency investors across the globe.

Interestingly, another factor propelling Bitcoin's latest price hike is the considerable liquidation of short-selling positions. Meanwhile, in an intriguing turn of events, a mysterious 'Bitcoin whale' has been reported buying large quantities of approximately $15 million worth of Bitcoin every three hours. The identity and reasons for the repeated acquisitions on such a scale remain a subject of speculation among internet users, with figures like Warren Buffet and BlackRock (NYSE:BLK) being hinted at.

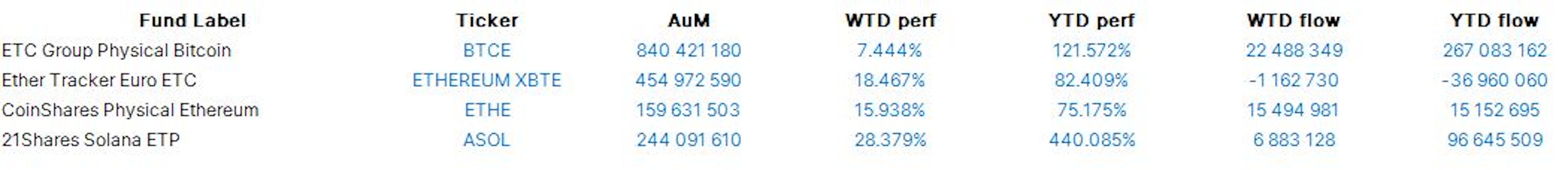

While Bitcoin's remarkable rise is certainly capturing everyone's attention, it would appear that Ether is outpacing it. Over the week, Ether saw a remarkable surge of 9.13%, nearly reaching the symbolically significant $2,000 milestone during Friday's trading activity. Reflecting the trend, the ETC Group Physical Bitcoin (BTCE) gained +7.44% last week, while the Ether Tracker Euro ETC (ETHEREUM XBTE) rose by +18.47% over the same period.