The launch of these two new actively managed ETFs reflects the firm’s intention to expand the breadth of its product shelf. In this article we’ll look at each product, examining their individual investment objectives and value proposition to investors.

BlackRock (NYSE:BLK) Large Cap Value ETF | Ticker: BLCV | Expense Ratio: 0.55%

BLVC is an actively managed, US equity focused solution that will invest in companies thought to be undervalued. The fund will have a traditional large value focus, focusing on equity securities that have a market capitalization within the range of companies included in the Russell 1000® Value Index. The fund will have high conviction in nature, having between 50 to 60 holdings.

As highlighted in a previous article, value investing in the context of large market capitalization (large-cap) equities, focuses on identifying, and investing in, well-established companies with substantial market capitalizations that are trading at prices below their perceived intrinsic value. Large-cap companies are typically well-known and have a significant market presence; this is reflected in the Russell 1000 Value Index’s fact sheet, as the average market capitalization of companies considered to be ‘Value, Large Cap’ is $166.293 Billion. In the context of large-cap equities, value investors may focus on companies that have temporarily fallen out of favor with the market due to factors such as a poor earnings report, industry-specific challenges, or general market pessimism. These investors believe that such companies can rebound and offer attractive long-term returns when the market eventually recognizes their true value.

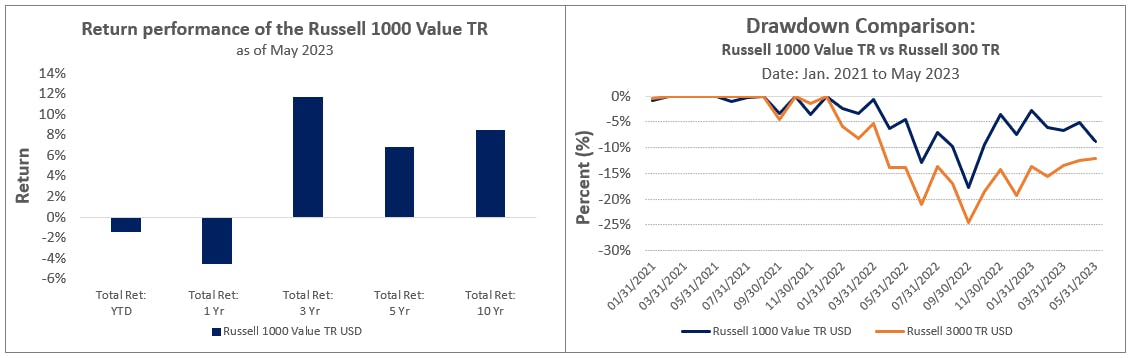

Simply put, the investment strategy seeks to acquire valuable assets when they are momentarily undervalued and hold them until they reflect their fully realized potential. In the present, while the year to date and 1-year trailing performance of the Russell 1000 Value Index, as of May 2023, has been disappointing - over longer investment time frames, performance has been much more compelling. Furthermore, when looking at the recent market drawdown performance of the Russell 1000 Value Index, it has been less than that of the broader market, as reflected by the Russell 3000 TR Index, indicative of the safety investors may find in these established firms.

BlackRock Flexible Income ETF | Ticker: BINC | Expense Ratio: 0.50%

BINC is an actively managed fixed income solution that seeks to maximize long-term income by utilizing a multi-sector approach to provide enhanced yield generation and gain access to diverse fixed income types.

With access to a broad opportunity set across the fixed income landscape, the fund not only has the potential to offer the diversification needed to mitigate risk, but the flexibility to take advantage of opportunistic gains throughout the market cycle – a truly tactical fund.

In the current ‘higher for longer’ interest rate environment, as market interest rates remain elevated, a low fixed coupon rate may no longer be attractive, resulting in a price adjustment to make its yield more in line with market interest rates. But current market conditions require diversification beyond the traditional fixed income offerings, as non-traditional bonds can help enhance portfolio yield.

For investors interested in a tactical fixed income solution focused on yield generation, BlackRock’s ability to tap into multiple sources of yield around the globe is the cornerstone value proposition of this fund. As central banks globally signal their intention to continue increasing interest rates, BlackRock’s ability to allocate across fixed income sectors enables them to actively manage interest rate risk exposure within the fund, which can help to mitigate risk and capture opportunities in any interest-rate environment.

This content was originally published by our partners at ETF Central.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.