Blockchain funds enjoyed significant growth last week following a U.S court ruling supportive of Grayscale Investments' application for a spot Bitcoin ETF. This first victory marks an important shift as it comes after the Securities and Exchange Commission (SEC) had previously rejected the landmark application. Funds tracking the Blockchain theme gained +3.79% over the week.

Grayscale, one of the largest digital asset managers globally, last year submitted a proposal to launch an exchange-traded fund that would directly track Bitcoin prices. However, the application was denied by the SEC, with the regulator’s decision not only shaking Grayscale’s stock but causing further uncertainty in cryptocurrency markets worldwide.

Yet last week’s ruling by a federal appeals court says the SEC was wrong to reject the innovative product offering suggesting that the regulator did not duly consider all the factors involved, such as market volatility or sufficient investor protection mechanisms, before deliberately terminating discussions around a bitcoin-based ETF introduction on US exchanges.

Post-verdict reaction was strong among blockchain funds, triggering a substantial resurgence and boosting morale within cryptocurrency circles after many months of regulatory setbacks. Observers noted enhanced liquidity and increased trading volumes across various platforms as the potential impact of this favourable judicial intervention was processed.

While the ruling doesn’t necessarily mean Grayscale’s spot bitcoin ETF will be approved, this development will no doubt serve to encourage other fintech firms. As a clearer path appears ahead, many companies recognise the potential for launching bitcoin-oriented financial instruments into mainstream investment channels with appropriate levels of legal and compliance oversight helping foster crypto-economy globalization efforts and encouraging greater institutional participation going forward.

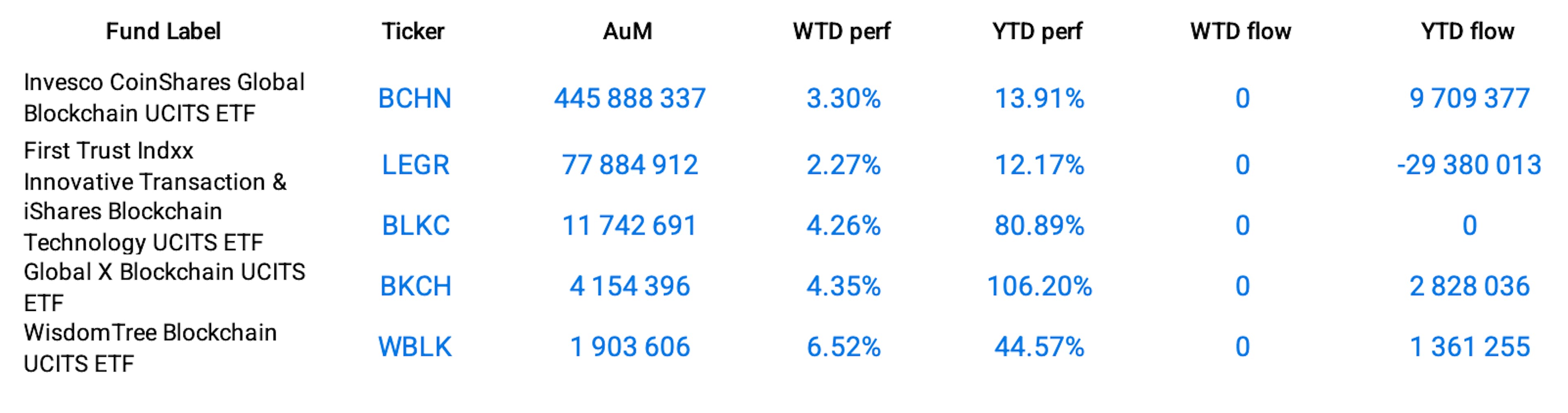

Off the back of last week’s news, the Invesco CoinShares Global Blockchain UCITS ETF (BCHN) and iShares Blockchain Technology UCITS ETF (BLKC) gained respectively 3.30% and 4.26% over the week.

Group Data: Blockchain

Funds Specific Data: BCHN, LEGR, BLKC, BKCH, WBLK