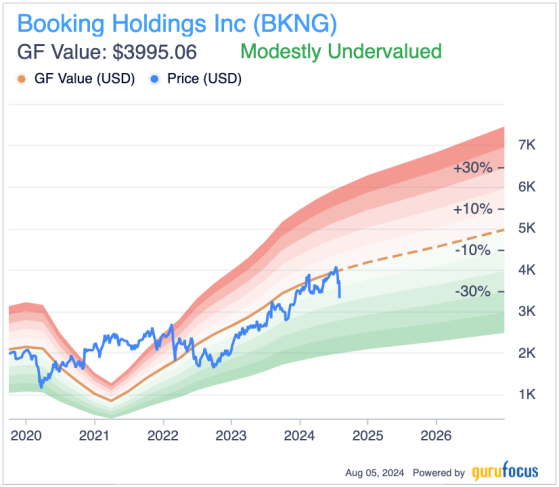

Booking (NASDAQ:BKNG) Holdings Inc. (NASDAQ:BKNG) is arguably the world's most extensive online travel company. It has robust momentum from high fundamentals following the pandemic that is expected to continue steadily throughout the next two years. The GF Value chart indicates the stock is moderately undervalued, and based on my risk analysis of the company and its industry, I consider the stock a buy with a 20%-plus 12-month price return possible.

Market leadership, subsidiaries, offerings and AI integrationsOperating in over 220 countries and territories, it is one of the most globally extensive online travel companies. As a result of this breadth of operations, it can serve a diverse customer base and remain competitive around the globe due to brand strength.

It also has several subsidiary companies, including Booking.com, Priceline, Agoda, KAYAK and OpenTable. Most of these names are considered flagships in their own right, so consolidation under one umbrella creates an incredibly strong holding company. Booking.com, in particular, is a market leader in online accommodation bookings and has been the most downloaded travel app globally. Programs like Genius on Booking.com, which offers exclusive discounts and perks, help to encourage repeat business, bolstering revenue stability. Further, the company's business-to-business segment, particularly through Booking.com for Business, has shown great growth. It caters to small and medium-sized enterprises and offers tailored travel solutions.

I am most excited about Booking's artificiail intelligence integrations, which include Booking.com's trip planner and Priceline's generative travel assistant, Penny, which uses the technology to offer tailored travel suggestions and streamline the booking process. Its AI integration is also helping to improve business efficiency by automating various processes, including customer service, pricing strategies and inventory management. This should help the company expand its margins across its subsidiaries with guidance and direction from the board.

Additionally, Booking Holdings is advancing its Connected Trip vision, which seeks to integrate various travel services into a unified experience. It will leverage AI to connect accommodations, flights, car rentals and activities for a travel experience that is simplified and focuses on utility.

Second-quarter results, valuation analysis and price targetTotal revenue for the second quarter, which was reported on Aug. 1, represented a 7% year-over-year increase. Net income grew 18%. In addition, the company achieved a 7% rise in total room nights booked and a 4% increase in gross travel bookings.

Interestingly, Booking reported stable growth in the U.S. and accelerating growth in Asia, with room night growth in the mid-teens in Asia. This signifies part of a broader shift in growth toward China across industries, which continues to be a pressing narrative. The company is well positioned as it also operates in China.

Further, the company reported a staggering 28% increase in air ticket bookings, which bodes very well for its enhanced trip planning initiatives, as more users are seeking its offerings for a unified and seamless full travel experience.

According to the GF Value Line, Booking Holdings is modestly undervalued, indicating that now may be an opportune time to buy. This is especially true as earnings per share and revenue estimates continue to be strong, with the future three-year growth rate for earnings at 25% and at 8.80% for revenue.

Booking Holdings has a price-earnings ratio of 25, which is substantially lower than its 10-year median of 30. Furthermore, its price-sales ratio is 5.30, lower than its 10-year median of 7.20. The company has been experiencing exponential growth in both the top and bottom lines, and it has fully recovered from Covid-19, which makes me very bullish on the stock moving forward.

In my opinion, the stock is a buy. Wall Street agrees as it has an average price target for the stock that indicates 22% upside in 12 months.

Balance sheet weakness, travel industry sensitivity and competition risksBooking Holdings currently has negative equity, which I consider one of its biggest weaknesses. It has an equity-to-asset ratio of -0.15, which is a big detraction from its 10-year median of 0.28. Further, its debt-to-equity ratio, including lease obligations, is -4.05. Partly this has been contributed to by significant share buybacks, which have reduced its cash reserves and equity. Negative equity is a new occurrence for the company, but it started to show a significant contraction in its equity-to-asset ratio from 2021 to 2022. Therefore, it is also likely that the pandemic had a big impact on this. Unfortunately, it does mean the company has less flexibility in its capital allocation strategy due to financing capacity.

The travel industry is highly sensitive to economic fluctuations and, as we saw during the pandemic, Booking Holdings can be significantly impacted as a result of these occurrences. Further external shocks, including escalations in current wars, could significantly impact the travel and real estate markets in some of its core regions of operation. For example, the Middle East and Southeast Asia are pockets where demand could drop and travel could become restricted.

Further, there is intense competition with players like Expedia (NASDAQ:EXPE), Airbnb (NASDAQ:ABNB) and TripAdvisor (NASDAQ:TRIP) showing resilience and strong market expansion strategies. Booking Holdings is currently the leader, but newer entrants like Airbnb are proving to be fierce, with evolutions such as luxury experiences capturing a significant portion of the market.

In addition, data breaches are a growing concern. For companies that are heavily digitally reliant like Booking, it is of paramount importance that strong cybersecurity measures are put in place to protect it. Choosing the right cybersecurity providers is paramount as issues such as the outage with CrowdStrike's (NASDAQ:CRWD) recent update could cause significant revenue contraction.

ConclusionBooking Holdings is the world's leading online travel conglomerate, based on my research. I consider it moderately undervalued right now, in line with the GF Value chart's indication, and I believe that a 20%-plus compound annual growth rate over the next 12 months is possible. Despite this favorable outlook, the company is exposed to escalations in wars in the Middle East and Southeast Asia, as prime examples, potentially affecting its growth, as well as growing cybersecurity risks. As a result of my analysis, I rate the stock a buy.

This content was originally published on Gurufocus.com