“Every cloud has a silver lining”, a phrase meant to assure that even in the worst situations, there is a positive angle to be found. Well, some bond holders are searching for that silver lining currently, as bond markets have been experiencing a sizable drawdown. So, what is the bright side of bonds that would incentivize investors to continue holding them?

The case for buying bonds

The precipitous climb in interest rates over the past three years, approximately, has set the stage for the environment we are currently in. While many investors and savers have become enamored with the yields being quoted on U.S. Treasury instruments, in truth, there is no certainty they will remain at this or a similar level for the next 5 to 10 years. Conversely, if investors were to buy bonds now – they would be able to lock in this level of yield generation for a much longer period.

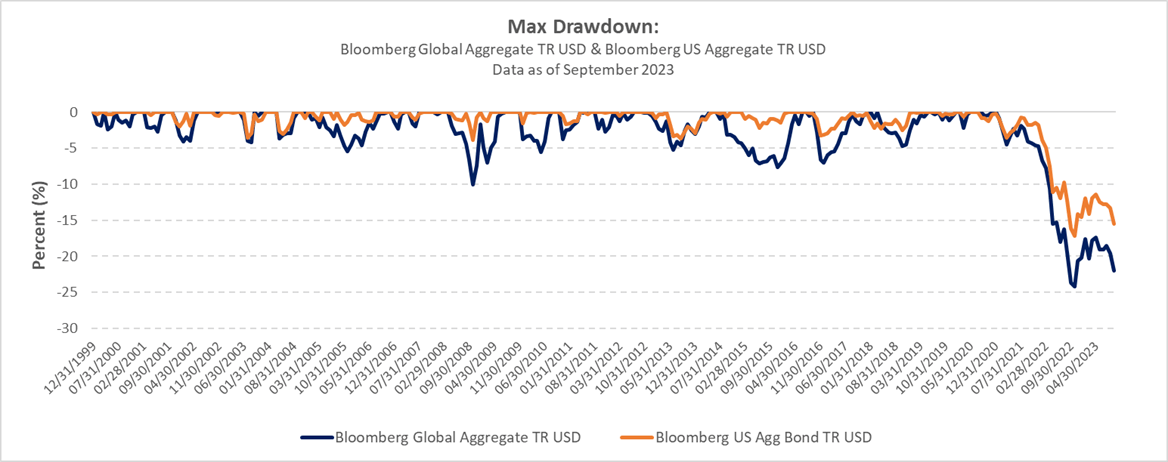

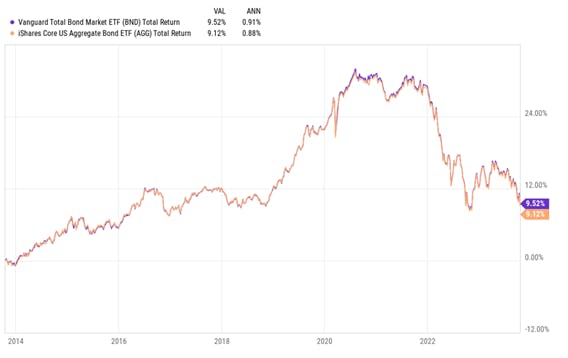

While locking in a high yield is one rationale, the other consideration is capital appreciation. Given the inverse relationship between bond yields and price, buying bonds now could be highly profitable, particularly if we see interest rate cuts and/or a recession. As observed from the following charts, the rise in rates coincides with the price declines of fixed income solutions, which is to be expected.

Using the Vanguard Total Return Bond Market ETF (Ticker: BND) and iShares Core US Aggregate Bond ETF (Ticker: AGG) as examples, the yield to maturity for both solutions are 5.3% and 5.6% respectively, as of October 17th, 2023. However, as evidenced from the following chart – there has been a material decline in performance after 2020, due to interest rate changes. Though we are currently in a ‘higher for longer’ interest rate environment – the Federal Reserve and Central Banks globally will eventually reduce rates in the future; when that does occur bond holders will begin to see price appreciation with their investments.

Getting paid for patience and rewarded in the long run

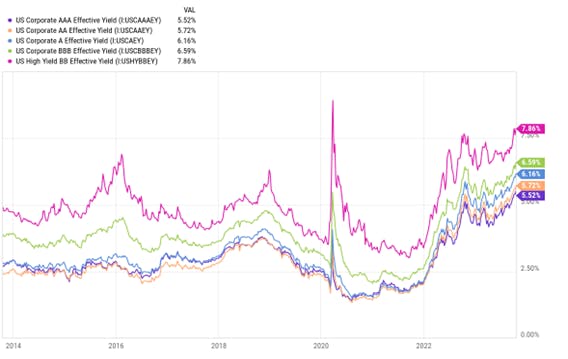

The true silvering of fixed income at this immediate juncture is being rewarded for one’s patience. With the yield on high-quality portfolios being above five percent, the income represented by these yields can provide the foundation for meaningful future returns and a ballast against current price weakness. With bond yields being at or near their highest level in almost a decade, long-term investors may expect improved future returns on their fixed income investments.

Though investors need to exercise patience at this juncture of the economic cycle, high-quality fixed income will continue to offer a compelling yield should rates remain as they currently are or higher; however if the economy improves and rates decline, investors will benefit from this change.

This content was originally published by our partners at ETF Central.