Broadcom (NASDAQ:AVGO) Inc. (Broadcom) is a leading designer, developer, manufacturer, and global supplier of a variety of semiconductor and infrastructure software products. The company is perfectly positioned to take advantage of the current AI revolution, with its portfolio of products that is optimized for AI. While there is still a decent level of demand for AI-optimized hardware products, it's clear that the triple-digit growth rates seen in previous periods aren't sustainable, with the Nvidia (NASDAQ:NVDA) CEO Jensen Huang guiding 79.3% YoY revenue growth for Q3 2025. Although a growth slowdown in the broader industry is expected, Broadcom continues to show accelerating growth in its AI revenue, maintaining strong pace throughout Q3. The recent integration with VMware has also strengthened the company's AI-related enterprise software and cybersecurity capabilities which has been driving growth in its infrastructure software segment. However, non-AI revenue continues to hold back Broadcom's overall performance as sales in those areas remain relatively sluggish. Despite this, Broadcom's CEO Hock Tan stated during the earnings call that the slowdown in non-AI revenue has now bottomed out.

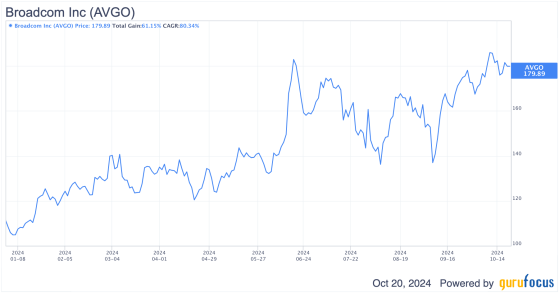

AVGO Data by GuruFocus

Shares of Broadcom dropped 10% after its earnings release (has recovered these lost gains as of now), even though the company reported better-than-expected results for Q3. Revenue jumped 47% YoY, driven largely by the AI boom and VMware's contribution. Still, this positive report coincided with weak macroeconomic data, particularly in a week marked by poor labor market data. This led to investors panicking and thus the sell-off.

Broadcom has a large exposure to non-AI revenue, which is more cyclical and sensitive to macroeconomic dynamics. This cyclicality and sensitivity to macro pressures might have amplified the effects of the sell-off as well. Despite this, I view Broadcom as a buy opportunity. The company continues to maintain high gross margins and generate substantial free cash flow. In my opinion, the more compelling aspect of the recent earnings was the progress in VMware's integration, which aligned with Hock Tan's guidance and reflects his successful history of strategic acquisitions.

Broadcom's Growth Driven by VMware IntegrationBroadcom's top-line growth continues to be driven by the VMware acquisition. In Q3 FY24, the company outperformed both revenue and non-GAAP EPS expectations, with its Infrastructure Software (ETR:SOWGn) segment showing an impressive 200% YoY growthup from 175% the previous quarter. However, this YoY growth comparison isn't directly comparable, as VMware's revenue wasn't included in last year's results. During the earnings call, management noted that VMware generated $3.8 billion in revenue for the quarter, with QoQ growth accelerating to 40.7%, up from 28.6% in Q2.

VMware Cloud Foundation (VCF) was a standout, with its annualized booking value reaching $2.5 billion in Q3, reflecting a 32% QoQ increase. On the flip side, excluding VMware, Broadcom's core software business saw a significant QoQ slowdown. While the overall company revenue grew 47.3% YoY in Q3 FY24, without VMware, the core business growth was just 4% YoYdown from 4.9% growth in Q3 FY23. Management acknowledged the slowdown but was quite optimistic over the outlook, stating that non-VMware software revenue has now stabilized and is expected to grow at a mid-single-digit rate moving forward.

Mixed Performances in the Semiconductor Solutions SegmentBroadcom's Semiconductor Solutions segment continues to experience challenges. After showing the first signs of recovery in Q2, the segment's revenue declined 4.8% YoY in Q3, totaling $7.3 billion. However, the AI-driven demand from hyperscalers for Broadcom's networking and custom AI chip products was a bright spot, with the Networking product segment growing by 43% YoY. Despite this strength, the rest of the Semiconductor Solutions segmentparticularly non-AI networking, server storage, and wireless productsunderperformed, with relatively flat growth. According to management's outlook, this weakness is expected to persist over the next few quarters. Nonetheless, CEO Hock Tan emphasized multiple times during the earnings call that the deceleration in non-AI revenue has likely reached its lowest point.

Strong Margin Expansion One of Broadcom's key strengths lies in its margin performance, especially following the VMware integration. In Q3, the company posted gross margins of $8.4 billion, marking a 36% YoY growth. Gross margin percentage rose to 64% from 62% in the previous quarter, driven by strong demand for AI-related products. GAAP operating margins also expanded to 32.4%. The Infrastructure Solutions segment saw a 700bps sequential margin improvement, while Semiconductor Solutions margins improved by 80bps. Non-GAAP gross margins, which adjust for amortized intangible assets and other expenses, reached 77%, up from 75% a year ago. These expanding margins are one of the main reasons for my bullish view on Broadcom at the current price levels as well.

AVGO Data by GuruFocus

Impressive Free Cash Flow GenerationBesides its strong margin performance, Broadcom's free cash flow generation is another reason for my bullish view. The company generated $4.8 billion in free cash flow in Q3, a 4% YoY increase with a robust free cash flow margin of 37%, up 1 percentage point QoQ. This strong cash generation offsets any material risks for Broadcom, in my opinion, and provides the company with flexibility to return more value to shareholders through dividends or stock buybacks.

Healthy Balance Sheet and Debt ManagementBroadcom ended Q3 with $10 billion in cash and $72 billion in debt, which incurred an annual interest expense of roughly $4 billion. Given management's Q4 estimates for EBITDA margins at 64%, I estimate Broadcom's leverage ratio to be around 2.3x on an adjusted basis, which is a relatively safe level. It's worth noting that credit rating agencies have recognized Broadcom's solid capital structure, with Fitch upgrading its credit rating in August and S&P doing so in November 2023, following the VMware acquisition.

AI Growth MomentumBroadcom's AI-related revenue continues to grow, with the company reporting $3.1 billion in AI revenue for Q3 FY24 and guiding to $3.5 billion for Q4 FY24. However, the full-year AI revenue forecast of $12 billionup from the previous guidance of $11 billionfell short of market expectations, raising concerns about a potential normalization of growth in the next fiscal year. This cautious outlook is reminiscent of Nvidia's recent earnings, which also hinted at tempered growth expectations in the AI sector. Despite these concerns, I believe the AI investment theme remains strong, as tech companies continue to upgrade their infrastructure to remain competitive.

Non-AI Revenue StabilizationManagement has expressed optimism regarding the stabilization of Broadcom's non-AI revenue, pointing to a 20% YoY increase in non-AI bookings. This growth, along with management's guidance that the cyclical downturn in non-AI revenue has "passed the bottom," should provide investors with some better confidence in the company moving forward. As the company navigates the market's evolving expectations around AI revenue, I believe Broadcom's competitive advantagesparticularly in networking solutionswill continue to drive its success in the AI space, while non-AI segments gradually recover.

Valuation Perspective Broadcom's current valuation appears more attractive than it did several months ago, when enthusiasm for AI hardware makers such as NVIDIA and AMD (NASDAQ:AMD) was at its peak. With management's upgraded forecasts for Q4, Broadcom is on track to achieve approximately 44% revenue growth, bringing its total revenue to around $52 billion for the year. This strong performance, along with the potential for further margin expansion following the solid results from Q3, suggests that a forward P/E multiple higher than 35x is justified.

AVGO Data by GuruFocus

At present, Broadcom is trading at a forward P/E of about 29x, which represents a discount compared to its AI-centric peers, who are trading relatively higher in the 30x-35x range. Given Broadcom's exposure to the AI market, its ability to generate consistent free cash flow, and its year-over-year gross margin expansion, I believe a P/E multiple of 33x is attainable. Under this scenario, the stock would be valued at around $205 per share, implying an upside potential of roughly 15%.

Source: Alpha Spread

Looking at the valuation from a DCF perspective, based on Wall Street estimates, the model points to an even bigger upside of approximately 25%, with an intrinsic value of $240 per share. This DCF model assumes a discount rate of 8% and a terminal growth rate of 3% after the forecast period. It also factors in strong top-line growth, with revenue expected to increase from $60 billion in Year 1 to $136 billion by Year 5. Alongside this, net margins are projected to grow from 41% in Year 1 to 503% at the end of the forecast period. While these assumptions are optimistic, they effectively capture the significant potential upside for Broadcom at its current valuation levels.

Final ThoughtsI strongly recommend considering Broadcom, as the company has consistently demonstrated its ability to grow both sales and profits. Despite a 29x forward P/E multiple that may initially appear expensive, Broadcom's profit growth trajectory of 20-30% annually makes it a compelling investment. The company is exceptionally well-positioned to capitalize on the AI revolution, with increasing global spending on AI-focused hardware being a potentially multi-decade opportunity. Broadcom's recent financial performance, driven by its strong AI exposure and the successful integration of VMware, supports this thesis. With management guiding to even higher AI-related revenues and margin expansion, the outlook remains strong. Additionally, its undervaluation compared to AI peers, combined with consistent free cash flow generation, further strengthens the case for owning Broadcom at these levels. Analysts currently anticipate an almost 30% YoY jump in profits next year, and with a robust pipeline in AI networking solutions, I believe the company's future growth is far from being fully realized. For a company that delivers such consistent earnings growth and substantial cash returns to shareholders, Broadcom remains an attractive buy at its current valuation.

This content was originally published on Gurufocus.com

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI