Nvidia, Warner Bros Discovery and CVS Health rise premarket; Toll Brothers falls

- Broadcom stock is in a dynamic rebound phase.

- Markets seem optimistic ahead of the earnings release.

- Let's take a deep dive into what to expect from the report.

- Get the AI-powered list of stock picks that smashed the S&P 500 in 2024 for half price as part of our FLASH SALE.

Until the end of last year, Broadcom (NASDAQ:AVGO)'s stock price, despite a few significant corrections, maintained a steady upward trajectory, driven by the booming AI bull market. However, at the start of 2025, a noticeable correction emerged due to concerns over potential restrictions on chip exports used in AI development.

The market also reacted negatively to reports suggesting that Intel (NASDAQ:INTC) may take over as Broadcom's chip manufacturer, replacing its current partner, Taiwan Semiconductor Manufacturing.

A potential catalyst for a turnaround could be today’s quarterly earnings report, which investors view positively given the high number of upward revisions. If the market consensus is exceeded, it could signal a continuation of Broadcom’s impressive multi-year rally, with the only exception being the revenue results published for Q3 2024.

Broadcom and Intel to Strengthen Their Partnership?

For Intel, 2024 has largely been a year of setbacks, as reflected in its stock performance. Recently, intriguing reports surfaced suggesting that Broadcom might be interested in using Intel’s chip manufacturing services. However, investors may have valid concerns, given the ongoing technological challenges that have delayed the mass production of Intel’s 18A process until next year. If this collaboration moves forward, it could also lead to delays for Broadcom. At present, these reports remain unofficial, meaning the market will be closely watching for any confirmation.

This potential shift in a key partnership may also be linked to Broadcom’s attempt to secure a U.S.-based manufacturer in response to possible export restrictions imposed by the new administration. If these reports are confirmed and Intel successfully implements its new manufacturing process, both companies stand to benefit from this partnership in the long run—despite potential initial delays.

Impressive Number of Broadcom Performance Revisions

If the market consensus holds, Broadcom is expected to report strong quarter-on-quarter growth in both earnings per share and revenue.

Source: InvestingPro

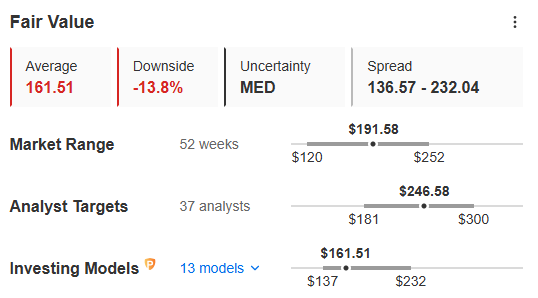

Notably, there have been 21 upward revisions and only two downward ones, highlighting investors' exceptionally high expectations for today’s earnings report. However, if Broadcom fails to significantly outperform the consensus, there is a risk of continued downward movement, as indicated by the InvestingPro fair value index.

Source: InvestingPro

Declines Slow Just Before Earnings Release

Broadcom's stock price has recently accelerated its downward momentum, slipping below the $200 per share mark and reaching a support zone around $185 per share. Currently, sellers have been halted at this level, as the market awaits today’s earnings figures.

If the earnings report disappoints, the next target will be the local demand zone around $160 per share. Conversely, a return to an uptrend would require a breakout above the local downtrend line, potentially paving the way for an attack on $225 per share.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.