Nvidia's year-long dominance dimmed over the past week as Broadcom (NASDAQ:AVGO) took center stage, with its share price soaring over 21% (as of Dec. 19) following the announcement of its Q4 2024 earnings on Dec.12, that surpassed analysts' expectations.

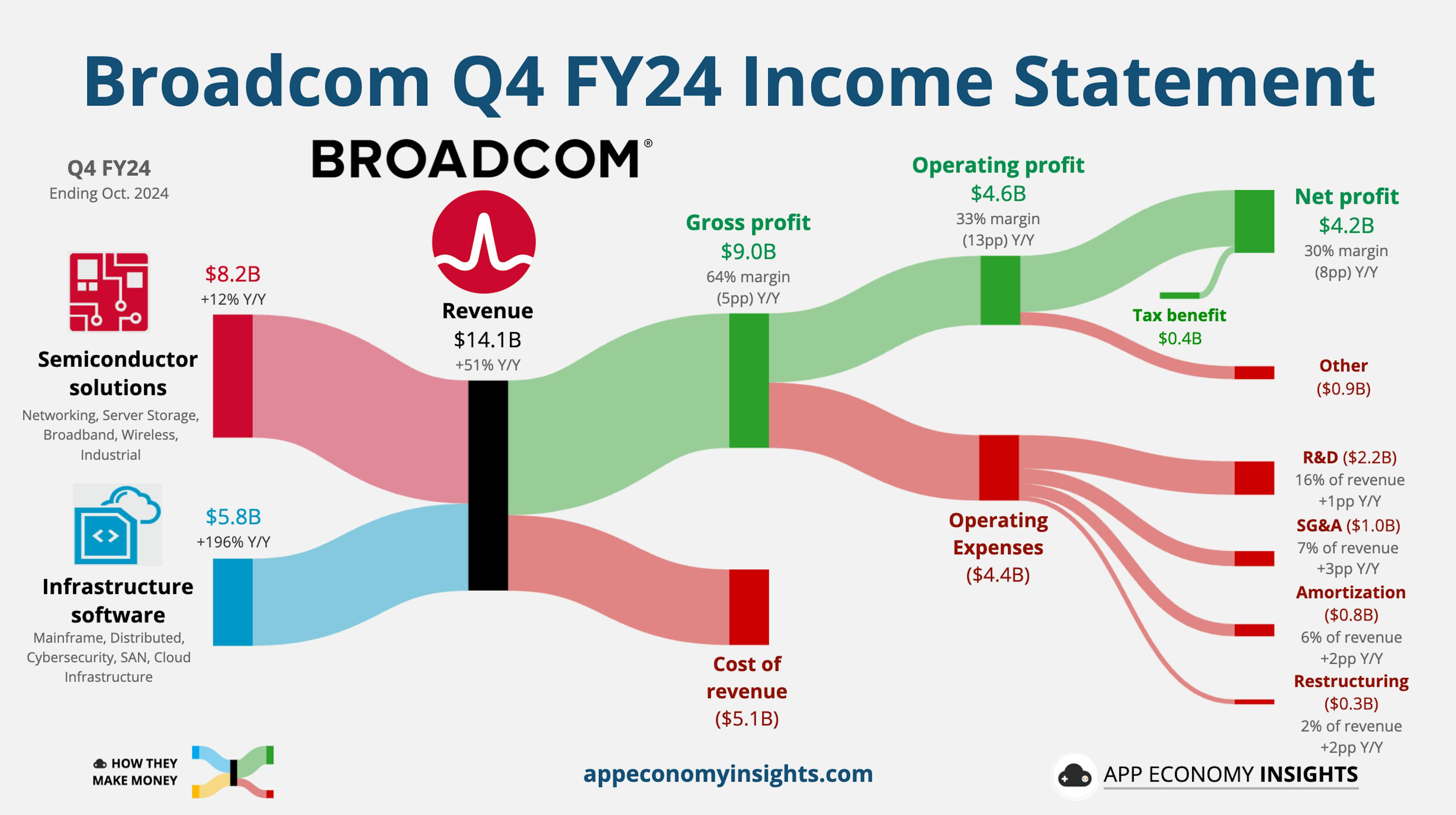

Broadcom reported an impressive 51% year-over-year revenue growth, fueled by a more than threefold increase in AI-related revenue for the fiscal year. The successful integration of VMware also played a key role, driving fiscal 2024 revenue to a record $51.6 billion, including $21.5 billion in infrastructure software revenue.

Broadcom's optimistic forecast for Q1 2025 revenue of $14.6 billion further solidified investor confidence.

Can the rally continue? If so, here are several ways to gain exposure to Broadcom. But first...

What does Broadcom (AVGO) do?

Broadcom is a leading force in technology, providing innovative semiconductor and infrastructure software solutions that drive critical systems worldwide. Its Semiconductor Solutions segment delivers advanced technologies for data centers, broadband, telecommunications, and wireless communications, while its Infrastructure Software (ETR:SOWGn) segment focuses on enterprise mainframe systems and cybersecurity.

With a broad portfolio supporting smartphones, servers, and networking equipment, Broadcom plays an integral role in industries ranging from consumer electronics to data centers. Through strategic acquisitions, the company continues to expand its software capabilities, ensuring it remains at the forefront of technological innovation and excellence.

Broadcom (AVGO) vs. Nvidia (NVDA)

Nvidia (NASDAQ:NVDA) has been a dominant force in the semiconductor industry, leading the AI revolution. But what sets Broadcom apart from Nvidia?

In essence, Broadcom specializes in connectivity, networking, and infrastructure software, catering to diverse sectors such as telecommunications and enterprise. Meanwhile, Nvidia focuses on GPUs for gaming, AI, and data centers, excelling in high-performance computing and AI-driven innovations.

Should you Invest in Broadcom (AVGO)

Deciding whether to invest in Broadcom shares can take time and effort. You need to look at its past financial performance, growth, and strengths in the fast-changing world of Artificial Intelligence. Luckily, Broadcom is a popular stock, and there are plenty of research reports available to help you understand if it’s a good investment.

Another option is to invest through ETFs. Many ETFs include Broadcom, giving you exposure to the company while also spreading your risk by investing in a variety of other stocks.

Semiconductor ETFs with Broadcom (AVGO) Exposure

Unsurprisingly, the results reveal that the top holders of Broadcom are predominantly semiconductor ETFs. These funds provide investors with a diversified portfolio of companies engaged in the design, manufacturing, and distribution of semiconductors and related technology.

For U.S. investors, the semiconductor ETFs list includes the Invesco PHLX Semiconductor ETF (NASDAQ:SOXQ), the First Trust Nasdaq Semiconductor ETF (NASDAQ:FTXL), the iShares Semiconductor ETF (NASDAQ:SOXX), the VanEck Semiconductor ETF (NASDAQ:SMH), and the Invesco Semiconductors ETF (NYSE:PSI), among others.

European investors can consider the Amundi MSCI Semiconductors ESG Screened UCITS ETF (SIX:SEMDM) or (CHIP), the VanEck Semiconductor UCITS ETF (LON:SMGB), the HSBC NASDAQ Global Semiconductor UCITS ETF (LON:HNSC), or the iShares MSCI Global Semiconductors UCITS ETF USD (LON:SEMI), among others.

Investing in semiconductor ETFs offers an opportunity to capitalize on the potential growth driven by increasing demand for chips. This demand has surged in recent years, fueled by advancements in technology, gaming, defense, electric vehicles (EVs), and, most recently, the Artificial Intelligence revolution, which heavily relies on these products.

Technology ETFs with Broadcom (AVGO) Exposure

Investors may also consider broader technology ETFs, which typically cover a wide range of technology-related industries. These funds are generally more diversified, with a larger number of holdings, potentially reducing risk compared to pure semiconductor ETFs. However, their exposure to Broadcom may be lower, depending on whether the ETFs are market-cap-weighted or equally weighted. The list shared above provides a variety of ETFs you can explore.

Single Stock Broadcom (AVGO) ETFs

Over the past few years, single-stock ETFs have emerged, offering exposure to, as the name suggests, a single stock. You might wonder, why buy an ETF for just one stock instead of purchasing the stock directly?

These single-stock ETFs serve a distinct purpose:

They provide leveraged exposure (e.g., 2x or 3x) to the daily returns of the stock. For example, if Broadcom's price increases by 5%, a 2x leveraged ETF would rise by approximately 10%, while a 3x leveraged ETF would increase by around 15%.

Example of these ETFs include:

- Direxion Daily AVGO Bull 2X Shares (NASDAQ:AVL)

- Defiance Daily Target (NYSE:TGT) 2X Long AVGO ETF (NASDAQ:AVGX)

Note that these two ETFs are available for U.S. investors only.

Another use case is inverse exposure (e.g., -1x, -2x, -3x), which means they are designed to deliver the opposite of the stock's daily performance. For example, if Broadcom's price falls by 5%, a -1x inverse ETF would rise by approximately 5%, while a -2x or -3x inverse ETF would increase by 10% or 15%, respectively. This makes them useful tools for investors looking to profit from or hedge against a stock's decline.

The only U.S.-listed inverse Broadcom ETF in the U.S. today is the Direxion Daily AVGO Bear 1X Shares (NASDAQ:AVS)

However, it’s important to note that these ETFs are generally intended for short-term use due to the compounding effects of daily rebalancing, which can lead to significant deviations from expected returns over longer periods.