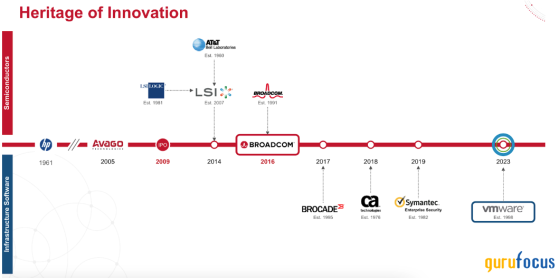

Founded in 1991 with a focus on broadband communications, Broadcom Inc. (NASDAQ:AVGO) has transformed itself into a dominant player in the semiconductor and industrial software sectors through a series of strategic mergers, acquisitions and spinoffs.

Initially a leader in the 5G chip market, the company expanded its technological base to become a significant force in artificial intelligence. Key acquisitions, including CA Technologies, Symantec (NASDAQ:GEN)'s Enterprise Security business and VMware, have broadened its exposure to five critical areas: networking, wireless, storage, broadband and industrial. Broadcom's products are essential for building data centers, which are increasingly in demand due to the widespread adoption of AI-powered applications, particularly in the enterprise market.

Source: Broadcom

This year, Broadcom's stock has significantly outperformed the broader market, with shares up around 30% year to date compared to a nearly 15% gain for the S&P 500.

AVGO Data by GuruFocus

In the recent quarter, AI demand and VMware's hybrid computing solutions were the company's key growth drivers, making it an appealing investment prospect. As a semiconductor bellwether, Broadcom has exposure to multiple industries and various growth vectors. It is highly profitable, with margins significantly surpassing the tech sector median. The current interest in Broadcom is largely fueled by its involvement in AI products. Broadcom is on a positive trajectory with improving fundamentals, such as revenue growth and high gross margins. While the company's valuation seems high based on its earnings, I believe this is warranted given its strong prospects.

Expanding AI revenue amid declining legacy businessWhile the market is enthusiastic about Broadcom's AI-driven business, it is crucial to understand it is still ramping up its revenue share from these products. By the end of fiscal 2024, the company anticipates 25% of its semiconductor solutions segment revenue will come from AI products, up from previous years. This surge is expected to be driven by a booming demand, evident by revenue reaching $3.10 billion in the second quarter, marking remarkable growth of 280% year over year. The primary driver is AI networking products, achieved through strategic partnerships with major networking vendors. However, it is essential to note that 75% of Broadcom's revenue still comes from its legacy business lines, which saw a decline from $7.90 billion in the second quarter of 2023 to $6.60 billion in the second quarter of 2024, a 15.70% decrease.

This contrast highlights the importance of Broadcom's strategic decision to pivot toward a steadier subscription business like VMware and increase its focus on AI. Broadcom and other semiconductor-focused companies are investing heavily to support AI applications. With the demand for AI chips surging due to investments in large language models, the company is experiencing significant top-line growth. Its main clients are large blue-chip companies, which offer a relatively stable revenue and earnings profile. I expect this focus on blue-chip clients to solidify Broadcom's role in the AI chip market, with Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) being a significant customer.

Broadcom's significant investments in AI and the resulting top-line growth is undeniably exciting, as evident by AI revenue reaching $3.10 billion in the second quarter, which was driven by its networking products and strategic partnerships. However, the legacy business' revenue decline and the high valuation of its shares pose risks. While the current enthusiasm for AI-related stocks, including Broadcom, is understandable, it has led to a stretched valuation. I believe the recent share price rally is driven by fear of missing out on Broadcom's AI exposure, which has inflated the stock price. Despite the impressive revenue growth, the valuation gains seen by Broadcom, whose AI exposure is only at about 25%, may pose risks as it still leaves a substantial portion of the business reliant on its legacy operations.

VMware acquisition and hybrid cloud strategyThe company completed its acquisition of VMware in November 2023, a strategic move aimed at expanding its capabilities in private and hybrid cloud solutions. Hybrid clouds allow companies to use different clouds based on their specific needs, which has led to their growing popularity. Since the acquisition, Broadcom has streamlined VMware's offerings from 8,000 products to four core offerings, strengthened the sales force and eliminated channel conflicts. This transition includes shifting VMware's business model from licensing to subscription, a move expected to drive down costs and improve operating margins to align with Broadcom's software portfolio by 2025.

Source: Broadcom

Broadcom has been aggressive in cutting costs post-acquisition, with operating expenses decreasing 9% from $5.30 billion in the first quarter of 2024 to $4.80 billion year over year. The company is leveraging its extensive customer base to sell VMware's offerings, signing up close to 3,000 of its largest 10,000 customers to build self-service virtual private clouds on-premises. While the shift from a perpetual licensing model to a subscription could present renewal risks for VMware's existing customers, I believe that in the long term, it will drive significant revenue growth and profits for Broadcom. This growth will be especially notable if VMware's products complement Broadcom's existing networking, storage solutions and AI chips.

Financial performance and outlookThe tech company's financial results for the second quarter, released on June 13, exceeded Wall Street's expectations for both revenue and earnings. Broadcom reported sales of approximately $12.50 billion, marking a 43% year-over-year increase (excluding VMware, the increase was 12% year over year as the acquisition began impacting first-quarter results). The adjusted earnings per share were $10.96, also beating estimates.

Source: Broadcom

This strong performance was driven by a surge in demand for AI products, leading to a post-earnings share price rally of 12%. The company increased its full-year sales guidance to $51 billion, surpassing the consensus estimate of $50.30 billion. Broadcom's semiconductor solutions segment accounted for 58% of sales in the quarter, reaching $7.20 billion, while the infrastructure software segment brought in $5.30 billion, leading to total net revenue of $12.50 billion. Despite this, the GAAP gross margin declined year over year to 63.70% due to short-term acquisition-related amortization costs.

In fiscal 2023, Broadcom generated $4.20 billion in AI revenue, which increased to $3.10 billion in the most recent quarter. Given the current run rate, it is likely the company can achieve $10 billion to $12 billion in AI revenue in 2024, assuming the rapid growth in AI persists. Looking beyond 2024, I expect the AI-related business to grow by at least 25%, in line with the overall AI computing market growth. The VMware business is critical to Broadcom's future, potentially reaching a run rate of $11 billion to $12 billion in fiscal 2024. The transition toward a subscription model could result in a higher recurring business model, though some customer loss is expected due to the change.

Broadcom's legacy business is anticipated to continue experiencing structural decline. However, as the product mix shifts toward software and subscription solutions, its margins and multiples are expected to improve. In the short term, non-cash charges for the merger, including impairments and RSU expenses, will negatively impact earnings. Margin expansion is expected to come from operating leverage within its cost of goods sold. The gross margin for its semiconductor business is significantly lower than its software business, so a fast-growing AI segment will initially pressure gross margins.

The company also announced a 10-for-1 stock split to make its shares more accessible to investors. Trading on a split-adjusted basis started on July 15. The stock split, prompted by a 257% price increase over the last three years, aims to reduce the high price tag of $1,679 per share, potentially making it easier for more investors to build exposure to the company and improving liquidity.

Broadcom also stands out in the semiconductor sector due to its significant cash flow distributions to shareholders. In 2024, the company increased its full-year dividend by 14.30% to an annualized payout of $21 per share. Over the last decade, it has consistently outpaced other chip-focused hardware companies in terms of dividend growth, making it a top choice for income-focused investors.

Source: Broadcom

Assessing Broadcom's valuationBroadcom's current success is undeniably driven by its strong fundamentals, including robust revenue growth and high gross margins. However, the stock's valuation appears stretched when considered in the context of earnings. Much of the recent rally can be attributed to investor enthusiasm for its AI exposure, which has driven the company's valuation to elevated levels.

Source: Alpha Spread

Historically, Broadcom has maintained an average price-earnings ratio of 36.90 over the past five years. However, it currently trades at nearly twice this historical average, with a price-earnings ratio of 68.80. Even looking at forward price-earnings, Broadcom stands at 21.30, higher than the peer average of 19.60. This indicates its shares may not offer enough of a safety margin to justify a buy at this time, especially since there are more attractive alternatives in the market with better risk-return profiles at current price levels.

For example, Broadcom's forward price-earnings ratio is similar to that of Advanced Micro Devices (NASDAQ:AMD), despite the latter's earnings growth projections being significantly higher in the long term. This comparison suggests AMD could be a more attractive option for investors seeking AI exposure, given its aggressive expansion into the AI chip market. Given Broadcom's impressive dividend growth and increasing revenues, it could reasonably trade closer to the peer average. While Broadcom is undoubtedly a strong company, its current price levels imply other companies might offer cheaper alternatives or better growth profiles based on relative valuation.

Source: Alpha Spread

A discounted cash flow analysis using an 11% discount rate, a terminal growth rate of 5% after an initial five-year growth phase and a 13% compound annual growth rate for the initial growth phase suggests a fair value of around $139 per share. This indicates the stock is overvalued by about 8% and does not offer a sufficient margin of safety for investment at current prices.

Although Broadcom is a strong business with significant growth potential, I believe it may not be the best option for long-term investors at this price point. There are other companies with similar or greater growth prospects available at more attractive valuations. Additionally, the high probability of consolidation in the stock in the coming months raises concerns. After its impressive rally in recent years, it might need more time to achieve further growth. Therefore, I advise caution and suggest waiting for a significant price dip before investing. Based on current valuations, I am rating the stock as a hold.

ConclusionBroadcom has successfully transformed itself into a powerhouse in the semiconductor and industrial software sectors, driven by strategic acquisitions and a strong focus on AI innovations. While the company's financial performance and growth prospects are undeniably impressive, the current valuation raises concerns and potential investors may find better opportunities with companies offering similar or greater growth prospects at more attractive valuations. I recommend holding off on taking on any new positions in Broadcom until a significant dip offers a more favorable entry point.

This content was originally published on Gurufocus.com

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI