Whirlpool slides after both Q2, full-year EPS guide miss

In the realm of investing, maximizing one’s return is the instinctual objective, however, finding avenues to mitigate one’s losses can be of equal, if not greater importance, as investors find losses to be much more distressing than missing out on potential gains. To that end, BMO (TSX:BMO) ETFs is gradually expanding its suite of buffer ETF offerings, with the recent launch of the BMO US Equity Buffer Hedged to CAD ETF – January (Ticker: ZJAN). This article will expound on the value proposition this solution provides and how investors can benefit from using it.

Buffer ETFs Explained

Buffer ETFs are funds that seek to provide investors with the upside of an asset’s returns, generally up to a capped percentage, while also providing downside protection on the first predetermined percentage of losses. Simply put, investors trade in some upside for additional downside protection. However, buffer ETFs have an outcome period embedded within their investment strategy, normally one year, meaning that the stated caps and buffers apply only to investors who purchase on the rebalance date and hold the ETF throughout the entire outcome period. Investors who purchase after the rebalance date will receive different caps and buffers based on the performance of the referenced index between the rebalance date and when they purchased the fund.

The value proposition of Buffer ETFs

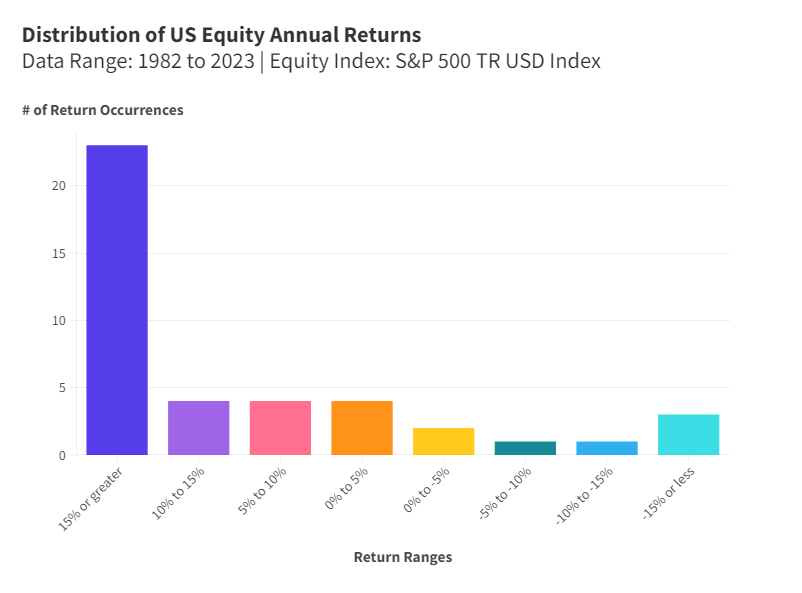

As generally understood by investors, losses do occur over a long investment period, however, buffer ETFs provide a modified investment experience for investors by implementing a systematic approach to risk management. By using options strategies, buffer ETFs offer a predefined risk-reward profile. Investors know upfront the range within which the fund's returns are expected to fall. This transparency can be attractive to investors who want to manage their risk exposure more precisely and have a clearer understanding of potential outcomes. As a result, investors are able to have a smoother investment journey and the peace of mind to know their loss exposure is greatly reduced.

BMO’s growing buffer ETF line-up

In launching the BMO US Equity Buffer Hedged to CAD ETF – January (Ticker: ZJAN), BMO ETFs is providing investors with exposure to the large-cap segment of the US equity market, namely the S&P 500 Hedged to Canadian Dollars Index, while providing a buffer against the first 15% of a decrease in the market price of the Index, over a period of approximately one year. Given that late last year, the firm brought to market the BMO US Equity Buffer Hedged to CAD ETF – October (Ticker: ZOCT), it can be surmised that a suite of buffer ETF offerings is being gradually built over time; reflecting BMO’s belief in the investment philosophy and impact these solutions can have in the portfolio of investors.

Against the backdrop of a market environment that currently has elevated interest rates and has exhibited a strong equity market performance, at the end of 2023 and thus far in 2024, the primary value proposition of the BMO US Equity Buffer Hedged to CAD ETF – January (Ticker: ZJAN) is its ability to provide a measure of safety, while also allowing for some equity-market upside participation. Though investors are knowingly giving up some returns, the ability to avoid large losses within one’s portfolio is a truly compelling attribute of this investment solution.

For investors interested in learning more about BMO’s buffer ETF offerings, their dedicated website provides an in-depth overview.

This content was originally published by our partners at the Canadian ETF Marketplace.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI