Shareholders in Bank of America (NYSE:BAC) have enjoyed robust returns so far in 2021. BAC shares are up about 32% year-to-date, and hit a multi-year high in early June. But since then the stock has lost about 8% of its value.

BAC stock's 52-week range has been $22.95 - $43.49. The current price of $40.45 at time of writing supports a dividend yield of 2.1%.

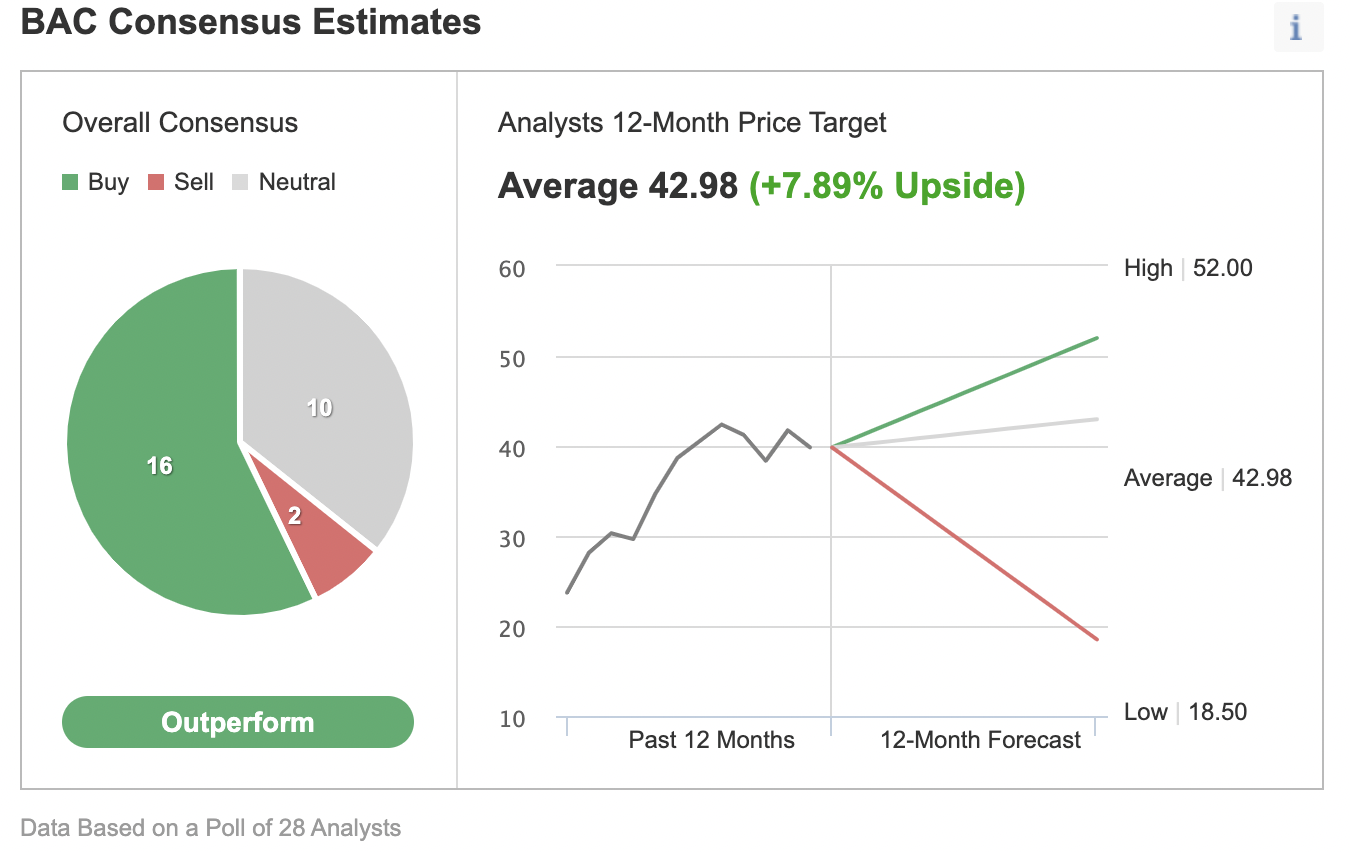

Despite the recent decline in price, Wall Street is still bullish on the company in the long run. According to 28 analysts polled by Investing.com, the 12-month median price forecast is $42.98, implying a return of over 7%.

So today, we look at how bullish investors might consider selling cash-secured put options on BAC stock. Such a trade could especially appeal to those who want to receive premiums (from put selling) or to possibly own Bank of America shares for less than their current market price of $39.90.

We previously discussed the detailed mechanics of cash-secured put selling using Exxon Mobil (NYSE:XOM) stock. Readers who are new to put selling may want to consider reviewing that article.

How Q2 Earnings Fared

Back of America issued lackluster Q2 results in mid-July. Net income of $9.2 billion translated into $1.03 per diluted share.

The group reports revenue in four main segments: Consumer banking; global wealth and investment management; global banking; and global markets.

In other words, Bank of America has a hybrid business model that helps generate revenue from:

- interest-bearing activities, namely deposit-taking and granting of loans, which show us a bank’s net interest income, NII, by deducting interest paid from the total interest earned; and

- non-interest bearing activities, including fees from brokerage and investment services, banking-related service charges, credit card fees, own trading profit and losses, mortgage-related activities as well as fees from mobile banking operations.

Total revenue declined by 4% year-over-year. Management highlighted the 6% drop in net interest income due to lower interest rates.

The low interest rate environment has meant that revenue generated by the trading desk (especially equities) was crucial for Bank of America. However, revenue from fixed income trading operations was well below expectations.

On the results, CEO Brian Moynihan said:

“We delivered solid earnings and returned more capital to shareholders during the quarter…. Consumer spending has significantly surpassed pre-pandemic levels, deposit growth is strong and loan levels have begun to grow.”

In the days following the release of the results, BAC shares initially fell below $37. Then, the stock rallied and came shy of $43 on Aug. 26. Now, it is once again below $40.

The trailing P/E ratio for BAC shares stands at 13.7x. The shares are also trading at 4.07x sales. The next earnings release will be on Oct. 14.

As Bank of America is a rate-sensitive bank, it would benefit from a potential interest-rate hike in the coming months, which could provide tailwinds for BAC stock. However, there could still be short-term volatility in the share price.

Selling Cash-Secured Puts On BAC Stock

Investors who write cash-secured puts are typically bullish on a stock during the timeframe that extends to the option expiry date. They generally want one of two things. Either to:

- Generate income (through the premium received by selling the put); or

- Own a particular stock, in spite of finding the current market price per share (i.e., $40.45 for BAC now) higher than what they would like to pay.

A put option contract on Bank of America stock is the option to sell 100 shares. Cash-secured means the investor has enough money in their brokerage account to purchase the security if the stock price falls and the option is assigned. This cash reserve must remain in the account until the option position is closed, expires, or the option is assigned, which means ownership has been transferred.

Let's assume an investor wants to buy BAC stock, but does not want to pay the full price of $40.45 per share. Instead, the investor would prefer buying the shares at a discount within the next several months.

One possibility would be to wait for Bank of America stock to fall further, which it might or might not do. The other possibility is to sell one contract of a cash-secured BAC put option.

So the trader would typically write an at-the-money (ATM) or an out-of-the-money (OTM) put option and simultaneously set aside enough cash to buy 100 shares of the stock.

Let's assume the trader is putting in this trade until the option expiry date of Dec. 17. As the stock is currently $40.45 at time of writing, an OTM put option would have a strike of 39.00. So the seller would have to buy 100 shares of Bank of America at the strike at $39.00 if the option buyer were to exercise the option to assign it to the seller.

The BAC Dec. 17, 2021, 39-strike put option is currently offered at a price (or premium) of $1.62.

An option buyer would have to pay $1.62 X 100, or $162, in premium to the option seller. This premium amount belongs to the option seller no matter what happens in the future. This put option will stop trading on Friday, Dec. 17.

Risk/Reward Profile For Unmonitored Cash-Secured Put Selling

Assuming a trader would enter this cash-secured put option trade at $40.45, at expiration on Dec. 17, the maximum return for the seller would be $162, excluding trading commissions and costs.

The seller's maximum gain is this premium amount if BAC stock closes above the strike price of $39.00. Should that happen, the option expires worthless.

If the put option is in the money (meaning the market price of Bank of America stock is lower than the strike price of $39.00) any time before or at expiration on Dec. 17, this put option can be assigned. The seller would then be obligated to buy 100 shares of BAC stock at the put option's strike price of $39.00 (i.e., at a total of $3,900).

The break-even point for our example is the strike price ($39.00) less the option premium received ($1.62), i.e., $37.38. This is the price at which the seller would start to incur a loss.

On a final note, the calculation of the maximum loss assumes the put seller was assigned the option and purchased 100 shares of Bank of America at the strike price of $39.00. Then, in theory, the stock could fall to zero.

If the put seller gets assigned the option, the maximum risk is similar to that of stock ownership but partially offset by the premium (of $162) received.

Bottom Line

Cash-secured put selling is a moderately more conservative strategy than buying shares of a company outright at the current market price. This strategy can be a way to capitalize on the choppiness in BAC stock in the coming weeks.

Investors who end up owning Bank of America shares as a result of selling puts could further consider setting up covered calls to increase the potential returns on their shares.

In other words, selling cash-secured puts could be regarded as the first step in stock ownership.